-

Craig Phillips, a top aide to Treasury Secretary Steven Mnuchin, said his department "broadly" agrees with the FHFA plan, which would return Fannie Mae and Freddie Mac to the private market and provide them an explicit government guarantee.

January 18 -

FHFA Director Mel Watt said Fannie Mae and Freddie Mac should be reincorporated as private entities and the government must provide an explicit guarantee for catastrophic losses in the secondary mortgage market.

January 17 -

Housing regulators should not adopt an alternative credit scoring model until the banking industry is on board.

January 16

-

Readers react to the Federal Housing Finance Agency considering changing its credit scoring policy, slam the possibility of enforcing mandatory penalties for data breaches at credit reporting agencies, weigh the possible nomination of a credit union regulator to the CFPB, and more.

January 11 -

The GSEs are on their way to paying back the money they owed the government under the original bailout deal made at the height of the financial crisis, making 2018 an opportune time for an overhaul of the housing finance market.

December 29

-

The announcement Thursday that Treasury Secretary Steven Mnuchin and Federal Housing Finance Agency Director Mel Watt agreed to let Fannie Mae and Freddie Mac each build a $3 billion capital buffer avoided a potential crisis.

December 21 -

Fannie Mae and Freddie Mac will be allowed to build capital buffers to protect against losses under an agreement between the Treasury Department and the Federal Housing Finance Agency announced on Thursday.

December 21 -

The two government-sponsored enterprises have relied on the “classic” FICO credit scoring model for the past 12 years. But the Federal Housing Finance Agency is weighing whether the GSEs should upgrade to more recent scoring alternatives.

December 20 -

The maximum loan amount for Federal Housing Administration mortgages will go up in more than 3,000 counties for 2018.

December 7 -

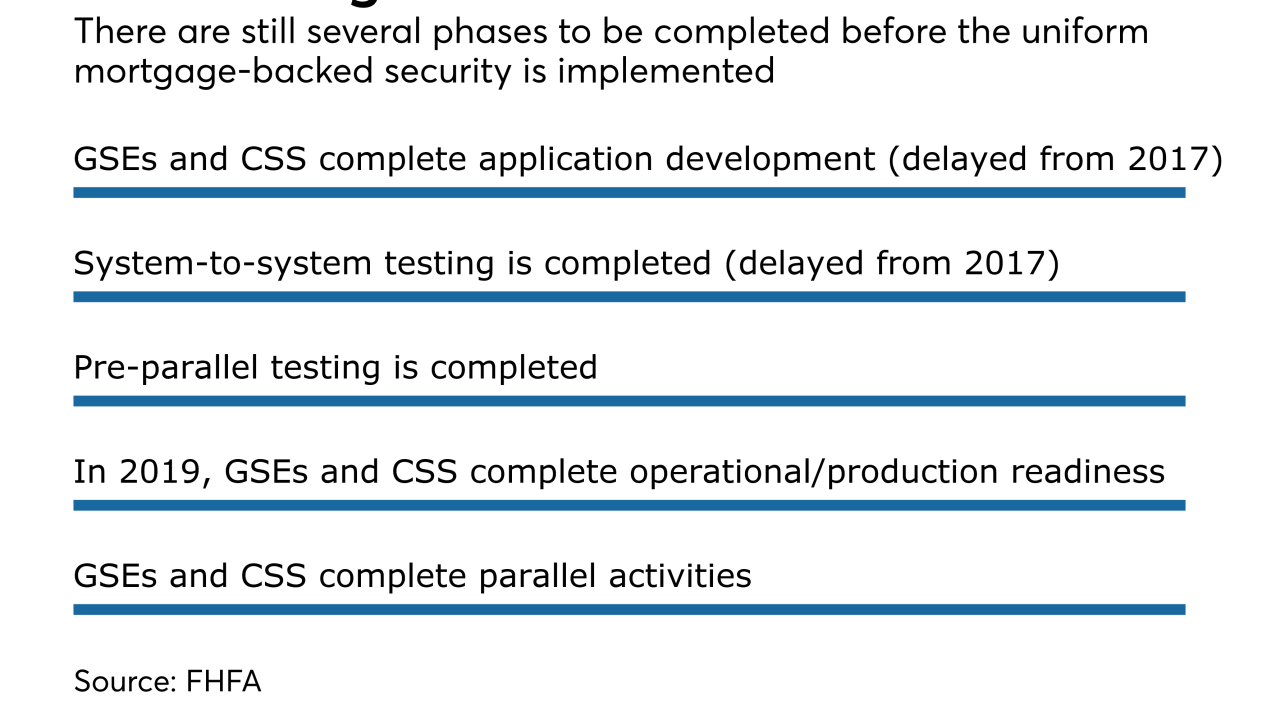

Testing of the common securitization platform is taking longer than expected, but the Federal Housing Finance Agency said it won't delay the 2019 launch of Fannie Mae and Freddie Mac's new single "uniform mortgage-backed security."

December 4 -

Conforming loan limits for mortgages bought by Fannie Mae and Freddie Mac will increase for the second consecutive year in response to the rapid rise in home prices, the Federal Housing Finance Agency said.

November 28 -

The Federal Housing Finance Agency must set fees equal to the cost of capital that private banks hold against similar risk, not just the amount of capital that Fannie and Freddie think are right for themselves.

November 3

-

Federal Housing Finance Agency Director Mel Watt said the agency is poised to examine alternatives to how a Fannie Mae and Freddie Mac assess creditworthiness of home buyers, including seeking public comment on the issue later this fall.

October 23 -

In a moment of rare unity, the Independent Community Bankers of America and National Association of Federally-Insured Credit Unions sent a joint letter to FHFA arguing to stop the GSEs' profit sweep.

October 19 -

Fannie Mae and Freddie Mac were not affected by a hacking incident against the accounting giant Deloitte, the companies said Tuesday, after a British newspaper alleged a server containing emails from government agencies was compromised.

October 10 -

Though FHFA Director Mel Watt stopped short of saying he would break with a Treasury agreement that forces all profits of the GSEs to go to the government, he emphasized that it couldn’t continue indefinitely.

October 3 -

Despite a direct request by six Democratic senators that Fannie Mae and Freddie Mac be allowed to rebuild capital, Treasury Secretary Steven Mnuchin did little to clarify the administration's thinking.

September 14 -

The mortgage finance giants Fannie Mae and Freddie Mac could need nearly $100 billion in bailout money in the event of a new economic crisis, according to stress test results released Monday by their regulator.

August 7 -

FHFA Director Mel Watt said Fannie Mae and Freddie Mac cannot use alternative credit models until other issues are resolved first.

August 1 -

A bipartisan duo of lawmakers is set Tuesday to introduce a bill designed to increase homeownership opportunities for “credit invisible” consumers.

August 1