Fifth Third Bancorp

Fifth Third Bancorp

Fifth Third Bancorp is a diversified financial-services company headquartered in Cincinnati. The company has over $200 billion in assets and operates numerous full-service banking centers and ATMs throughout Ohio, Kentucky, Indiana, Michigan, Illinois, Florida, Tennessee, West Virginia, Georgia, and North Carolina.

-

The new products, along a 2% cash-back credit card, are aimed at helping customers build savings and reduce debt.

August 5 -

Building off the popularity of its personal financial management tool, HelloWallet, the Cleveland bank is now offering in-person financial checkups as a way to deepen customer relationships.

July 30 -

KeyCorp, Regions Financial and others have sacrificed short-term profits to avoid being crushed by an anticipated decline in interest rates.

July 23 -

Earnings at the Cincinnati company fell 25% from the same period last year, largely due to $109 million in expenses tied to its March acquisition of MB Financial.

July 23 -

Joel Kashuba, Fifth Third's head of innovation and design, explains to Digital Banking 2019 how understanding four major aspects of human experience — cognitive, perceptual, physical and emotional — is integral to each aspect of customer engagement.

July 1 -

The banking industry has some work to do to improve its overall reputation, but the good news is that most customers have positive feelings about their own banks. Here are 10 banks that made big strides.

June 30 -

Challenger banks promote the concept of empathy in banking, which sometimes means forgoing revenue to build up customer goodwill.

June 26 -

Banks are increasingly turning to outsiders like Nikki Katz, a former Disney executive now at Bank of America, and Joel Kashuba, formerly of Procter & Gamble and now at Fifth Third, to help build their digital experiences.

June 21 -

Kashuba, who heads design and innovation at Fifth Third Bank, says looks matter even to the common credit card.

June 18 -

CEO Greg Carmichael said Wednesday that online-only banks "aren't relationship-based" and that Fifth Third would stick to its plan of attracting new depositors by selectively expanding into new markets.

June 12 -

The Cincinnati bank wants to convert from a state charter as it expands in the Southeast and beefs up digital banking operations.

May 31 -

Jury's out on whether BB&T-SunTrust will serve the community or Wall Street; 'we were willing to shock historical norms,' says Otting on OCC's makeover; is it too late for Congress to stop CECL?; and more from this week's most-read stories.

May 24 -

Regions Financial said Thursday that it will not renew its contract with GreenSky — a move analysts say could prompt other banks to re-examine their lending arrangements with the fintech.

May 16 -

As chief operational risk officer, Carrie Lichter played a key role in bringing to life Fifth Third's high-tech war room, also known as the cyber fusion center.

May 1 -

Democratic lawmakers made clear at a hearing Wednesday that they do not intend to abandon the issue following the GOP's repeal of regulatory guidance last year.

May 1 -

Now that the Cincinnati company recently completed its first bank acquisition in over a decade, CEO Greg Carmichael is pushing ahead on tech hires and expansion outside its Midwestern core.

April 23 -

Fifth Third bought MB Financial in the quarter and benefited from increases in corporate banking revenues and a slight improvement in credit quality.

April 23 -

The bank is investing more in its digital capabilities, according to The Cincinnati Enquirer.

April 22 -

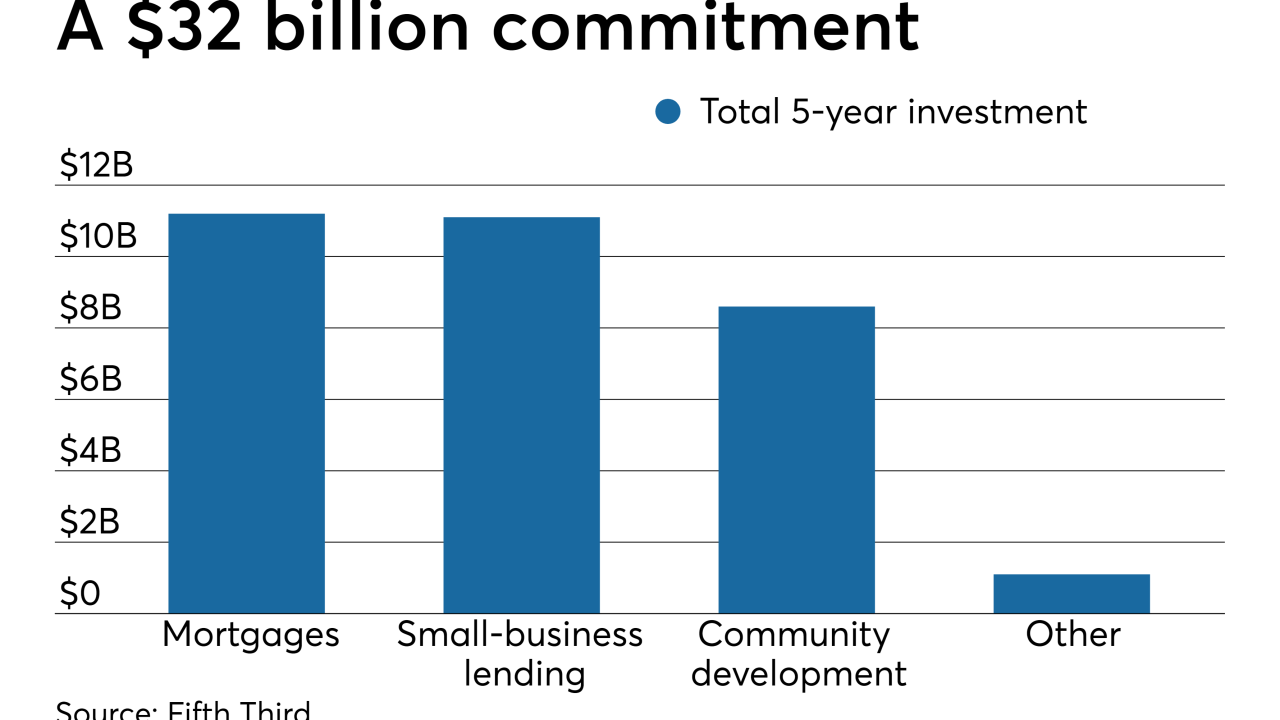

The bank is pledging to lend another $2 billion in a market where it has invested $3.6 billion in various community development initiatives since 2016. Most of the new funds will be used to make loans to small businesses that operate in low- and moderate-income neighborhoods.

April 5 -

Two of three hires announced by the agency come from the Ohio bank, where the FDIC chairman formerly served as a top executive.

March 26