-

FIS’s $43 billion agreement to acquire Worldpay and Fiserv’s $22 billion deal to buy First Data are largely closing the gaps between financial technology and merchant acquiring. But these mergers are only the first of many steps.

April 3 -

Bank technology giants FIS and Fiserv are spending nearly $66 billion between them in just the past few weeks to add a broad swath of payments technology — including a few key nuggets that will help them go toe to toe with fintechs.

March 18 -

First Data’s transformation over the past few years has involved much more than transaction automation, and has relied heavily on the creativity and ingenuity of executives such as Mia Shernoff.

March 12 -

Alipay is a force to be reckoned with outside of China, but it has taken a strategic approach to foreign markets that downplays its potential as a threat to local payment systems.

February 15 -

As major vendors consolidate, financial institutions should be looking to adopt emerging technologies, rather than relying solely on legacy firms to provide services.

February 11 CCG Catalyst

CCG Catalyst -

TotalHousehold Pro, a website platform for home improvement contractors to manage their businesses, is partnering with CardConnect to launch a mobile app to allow contractors to accept payments in the field.

February 6 -

As major vendors consolidate, financial institutions should be looking to adopt emerging technologies, rather than relying solely on legacy firms to provide services.

February 6 CCG Catalyst

CCG Catalyst -

Fiserv’s $22 billion deal to acquire First Data creates pressure to scale core banking and payment processing that may force further industry consolidation.

January 25 -

While the transaction will lower the cost of servicing First Data’s massive debt, the fintech and processing giant will be more complex and ponderous, writes Eric Grover, a principal at Intrepid Ventures.

January 24

-

CFPB to scrap key underwriting portion of payday rule; Fiserv-First Data — why small banks fear big fintech; banks, credit unions help federal workers hurt by shutdown; and more from this week's most-read stories.

January 18 -

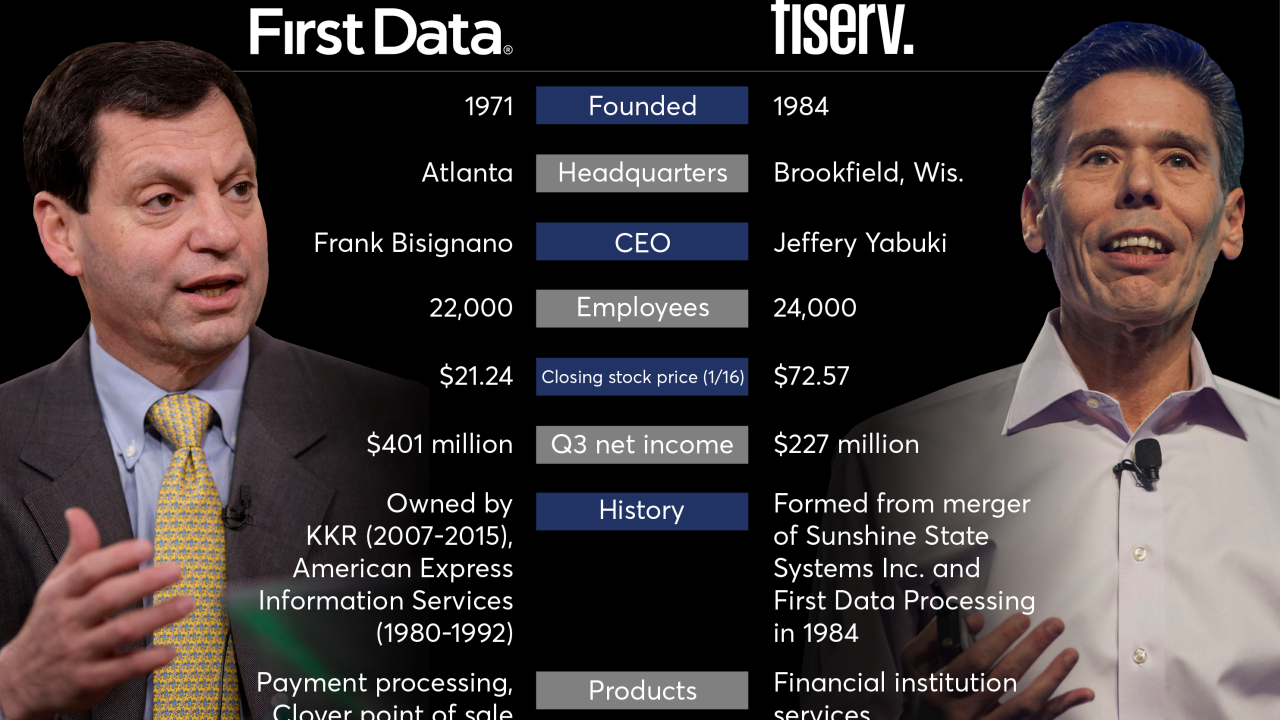

The Fiserv-First Data deal, valued at about $22 billion, will combine two of the financial services industry's largest technology and processing companies.

January 16 -

The large core banking software vendors are already criticized as large and slow-moving. Consolidations like these are only likely to make them more so.

January 16 American Banker

American Banker -

The large core banking software vendors are already criticized as large and slow-moving. Consolidations like these are only likely to make them more so.

January 16 American Banker

American Banker -

The numbers behind Fiserv's deal to acquire First Data are huge, particularly considering each company's existing tonnage still makes consolidation the best play when faced with nimble fintechs and mobile startups.

January 16 -

Fiserv will acquire First Data in an all-stock deal with a value of about $22 billion that will combine two of the financial services industry's largest technology and processing companies.

January 16 -

The deal, valued near $22 billion, will combine two of the financial services industry's largest tech and processing firms; both banks top expectations.

January 16 -

Credit and debit cards often overshadow prepaid gift cards, but the tables get turned during holidays, particularly as people get gift cards for themselves.

December 11 -

First Data is adding BlueSnap's e-commerce tools to consolidate the expanding menu of payment options that acquirers and financial institutions must juggle.

October 10 -

FirstSense's technology is designed to spot and prevent fraud as it happens. It will operate with First Data's fraud protection and transaction authorization engine, helping financial institutions identify payment cards at risk.

September 26 -

Two payments startups, PayStand and Quadpay, are collaborating with Silicon Valley Bank and First Data during a four-month accelerator program to explore mutual product development opportunities.

July 24