-

Credit unions won't have to comply with the controversial rule until at least 2020, but a forthcoming proposal on alternative capital could raise the ire of banking groups.

October 18 -

Trade groups say the National Credit Union Administration hasn't adequately explained how it plans to reduce its budget at the same time it asks Congress for increased oversight powers.

October 17 -

The worldwide week-long celebration of credit unions will include two NCUA board meetings focused on issues that have impacted the last five years and could set the stage for the remainder of the decade.

October 15 -

With its CEO planning retirement, tiny Coast-Tel Federal Credit Union is seeking approval to merge into Bay FCU.

October 11 -

Currently running for a fourth term in Congress, former credit union employee Denny Heck is a vocal proponent of changes to NCUA's risk-based capital rule and other industry priorities.

October 11 -

The storm could impact as many as 57,000 homes and cause more than $13 billion in damages, according to one estimate.

October 10 -

The late-filing credit unions will pay a total of about $4,100 to the U.S. Treasury.

October 9 -

Credit unions in the Great Lakes State continued to add members in Q2 while a variety of loan types saw double-digit growth.

October 9 -

Analysts are split on whether cyber threats have evolved enough for lawmakers to finally grant the National Credit Union Administration third-party vendor oversight.

October 9 -

National Credit Union Administration Chairman Mark McWatters called on lawmakers to further expand field-of-membership options for CUs and to permit the regulator to oversee third-party vendors, including fintech partners.

October 2 -

As NCUA Chairman Mark McWatters heads to Capitol Hill, credit unions are facing new threats at the ATM and CU trade groups are writing big checks in advance of midterm elections.

October 1 -

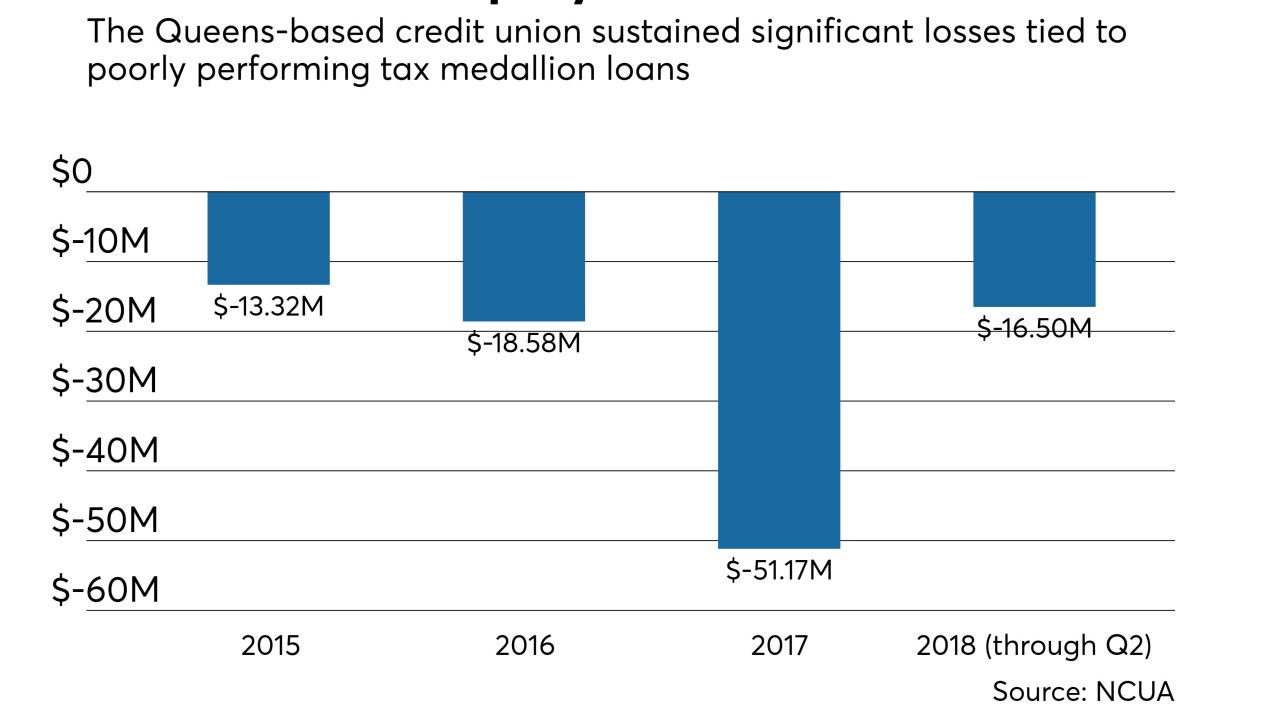

NCUA liquidated LOMTO Federal Credit Union following years of significant losses due to poorly performing taxi medallion loans.

October 1 -

At least six Trump administration picks to fill financial posts are still pending, but the bitterly partisan divide over Judge Brett Kavanaugh has taken up most of the energy in Congress.

September 28 -

In September, the National Credit Union Administration barred five people from the industry, including one individual who was accused of working to embezzle more than $1 million.

September 28 -

Analysts say the proposal will hurt more than help, and while it isn't expected to gain traction soon, that could change if Democrats retake the Senate.

September 27 -

The National Credit Union Administration is eyeing a 1.1 percent funding increase for 2019 for a total of $334.8 million

September 26 -

The House of Representatives passed two bills that would tie appraisal waivers for Small Business Administration loans to bank rules for commercial real estate loans, despite objections from the Appraisal Institute about its members being cut out of transactions.

September 26 -

The Mass.-based credit union is the latest to drop its federal charter in favor of state oversight.

September 26 -

Congress is considering additional tax reform, while the NCUA board is taking comments on a proposed rule to ease appraisal limits and more.

September 24 -

CUs with low-income designations can apply for funds to repair property and equipment or rebuild network systems.

September 24