-

Many in the industry support the National Credit Union Administration’s attempts to streamline regulations governing corporate credit unions, but critics claimed some elements could make it tougher to compete with fintechs.

July 30 -

A proposal to expand credit unions’ access to subordinated debt drew plenty of fire from bankers, but there are also concerns the regulation could be problematic for the institutions it aims to help.

July 27 -

The National Credit Union Administration will also discuss the current expected credit losses standard, which trade groups have argued that the industry should be exempt from.

July 27 -

The credit union regulator can accomplish so much more when board members work in a good-faith, fair-minded manner.

July 23 National Credit Union Administration

National Credit Union Administration -

A letter from the National Taxpayers Union requested changes, such as requiring federal credit unions to fill out a certain IRS form for non-profits, before lawmakers considered easing member business lending limits.

July 22 -

Kyle Hauptman pledged to focus on capital reform and expanding access for the underserved if confirmed to the credit union regulator's board, but one senator questioned whether the nominee was even qualified to serve.

July 21 -

The credit union regulator can accomplish so much more when board members work in a good-faith, fair-minded manner. It needs to renew that attitude.

July 21 National Credit Union Administration

National Credit Union Administration -

The latest nominee to the National Credit Union Administration board is set to appear before a Senate committee while a new forecast indicates the economy could take longer to turn around than expected.

July 20 -

The credit union regulator revised its summary of what examiners will focus on to reflect legal and regulatory changes that have taken place since the COVID-19 outbreak began.

July 15 -

The Senate will consider Kyle Hauptman’s nomination to the NCUA board on July 21, while new data from the SBA details credit unions’ participation in the Paycheck Protection Program

July 13 -

The National Credit Union Administration's first-quarter look at credit union performance by state includes several metrics where the industry did not fare well.

July 10 -

Working together, credit unions can help build a culture of tolerance and inclusion that in time may aid in healing some of the nation's oldest wounds.

July 9 National Credit Union Administration

National Credit Union Administration -

Jim Nussle, CEO of the Credit Union National Association, recently argued that Congress should do away entirely with FOM requirements. Such a move would further favor credit unions over banks.

July 9 Sound Financial

Sound Financial -

A report from the trade group shows that state-chartered credit unions saw greater first-quarter membership gains than their federal counterparts and posted lower rates of consolidation.

July 8 -

Jim Nussle, CEO of the Credit Union National Association, recently argued that Congress should do away entirely with FOM requirements. Such a move would further favor credit unions over banks.

July 8 Sound Financial

Sound Financial -

More than 70% of the industry now has access to the emergency liquidity source, according to the regulator.

July 6 -

The credit union regulator has not yet announced an agenda, but the meeting could potentially include mattes related to field of membership and risk-based net worth.

July 1 -

The regulator banned a former CU employee from working in financial services on the basis of allegations that he misused funds when working at an Indiana credit union.

June 30 -

Credit unions won the day as the Supreme Court rejected an appeal that would have limited consumers' access to financial services. Now Congress must act to remove those field-of-membership restrictions entirely.

June 30 America's Credit Unions

America's Credit Unions -

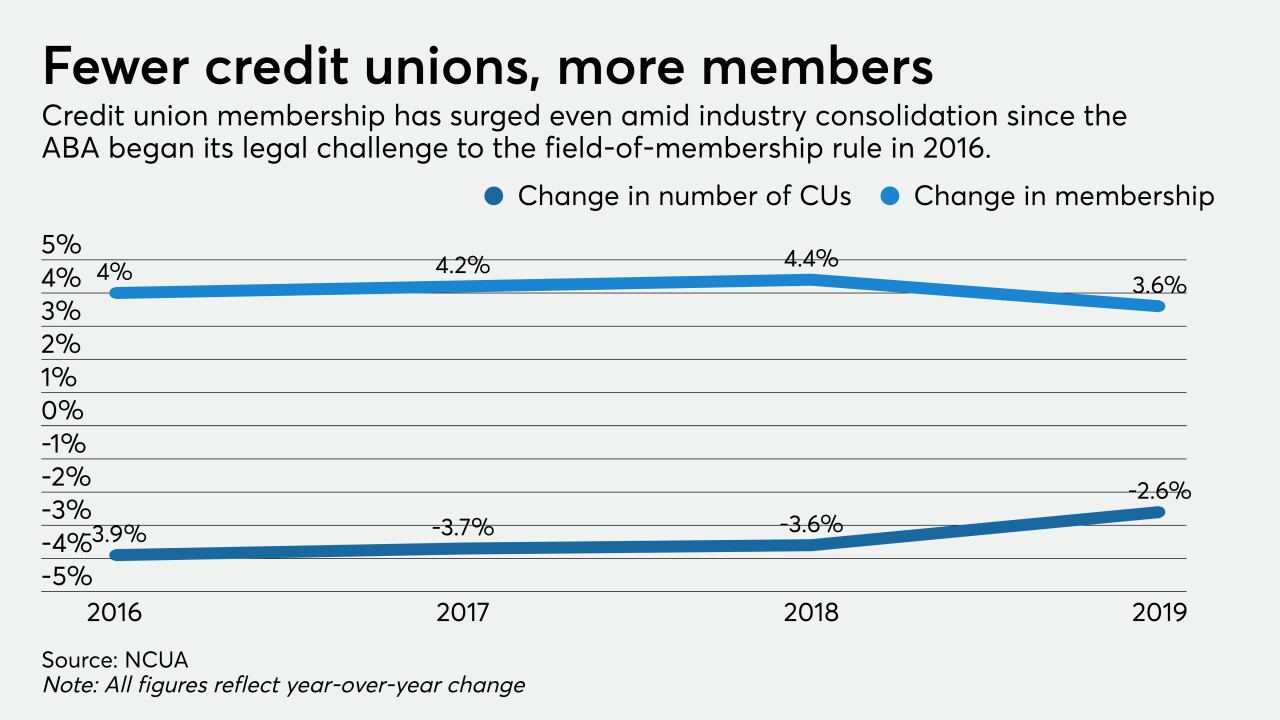

The industry claimed victory over banks as the Supreme Court elected not to hear a challenge to a controversial 2016 rule, but the landscape has shifted dramatically since NCUA approved the measure.

June 30