-

The National Credit Union Administration took steps to increase hires of women, minorities and people with disabilities in 2021, making its staff more representative of the general population.

April 25 -

The regulatory agency issued two new prohibition orders, bringing the yearly total to 10.

July 30 -

The organizations that received charters this year emphasize digital access and remote work, and aim to address the economic disparities highlighted by the pandemic and the nationwide wave of racial justice protests.

July 14 -

The National Credit Union Administration issued three prohibition orders in June, barring those people working for any federally insured financial institution.

July 1 -

The National Credit Union Administration closed the New Jersey credit union after determining it engaged in unsafe and unsound practices.

July 1 -

The National Credit Union Administration will distribute the funds to 1,800 credit unions to resolve the failure of three corporate credit unions in the wake of the financial crisis. It is the third such payment the regulator has made within the past year.

June 29 -

MDI credit unions added about 400,000 members, assets of $10.6 billion and six new credit unions in 2020, according to the National Credit Union Administration.

June 28 -

The National Credit Union Administration granted approval to expand its charter and membership to Baltimore City and the counties of Baltimore, Carroll, and Harford, Maryland.

June 14 -

The retiring head of the National Association of State Credit Union Supervisors spent years working to rein in a contentious funding mechanism used by the National Credit Union Administration that drew money from the Share Insurance Fund.

June 9 -

The National Credit Union Administration placed the New Jersey credit union into conservatorship Monday, citing its "unsafe and unsound practices."

May 24 -

The National Credit Union Administration changed course late last year and proposed changes that would in effect give members more time to resolve overdrafts. However, consumer activists and even some credit unions say the proposal falls short.

May 20 -

The National Credit Union Administration issued only one prohibition order in April.

May 10 -

Most executives are comfortable crossing over $1 billion of assets, where more frequent exams are the biggest supervisory change. But few are eager to take on the compliance burdens that accompany the jump above $10 billion.

May 5 -

The National Credit Union Administration approved the creation of Maun Federal Credit Union, which will serve members of the state's Islamic community.

May 5 -

Regulators recently eased field-of-membership rules to promote growth of federal credit unions. A handful of institutions are taking advantage of the changes to recruit more members, but some may find the process too cumbersome.

April 22 -

The agency will hold an exercise this summer related to emerging fraud risks and one board member suggested Congress should once again consider allowing the NCUA to oversee third-party vendors — a measure that would cost the regulator roughly $2 million a year.

April 22 -

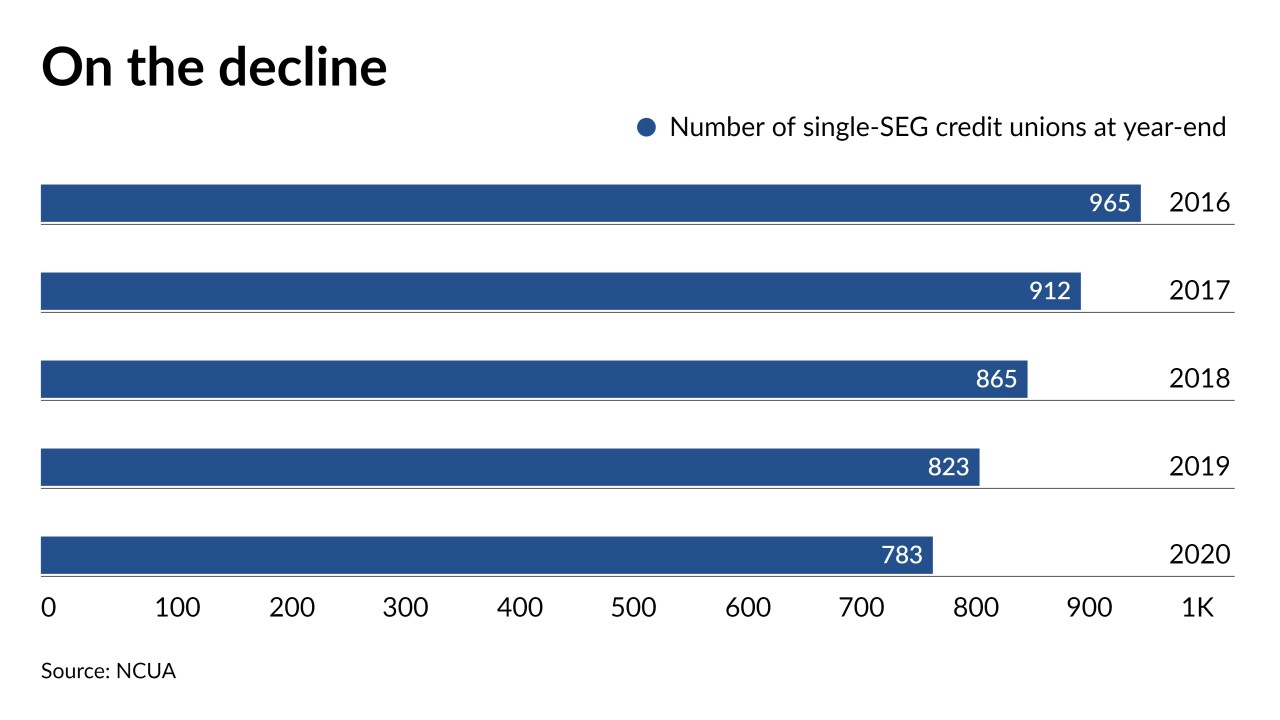

Cal Poly Federal Credit Union's recent merger into SchoolsFirst highlights the difficult choice many small institutions face: diversify your field of membership or risk going out of business.

April 21 -

Key legislation to protect banks and credit unions serving the legal marijuana industry looks set to move forward in the House this week.

April 19 -

A report to Congress from the National Credit Union Administration says the regulator has made "steady strides" toward greater diversity in its workforce and operations, but that progress is "just the beginning."

April 16 -

Too many Americans lack a sound grounding in personal financial management, which limits their opportunity to build long-term financial independence.

April 9