-

The National Credit Union Administration changed course late last year and proposed changes that would in effect give members more time to resolve overdrafts. However, consumer activists and even some credit unions say the proposal falls short.

May 20 -

The National Credit Union Administration issued only one prohibition order in April.

May 10 -

Most executives are comfortable crossing over $1 billion of assets, where more frequent exams are the biggest supervisory change. But few are eager to take on the compliance burdens that accompany the jump above $10 billion.

May 5 -

The National Credit Union Administration approved the creation of Maun Federal Credit Union, which will serve members of the state's Islamic community.

May 5 -

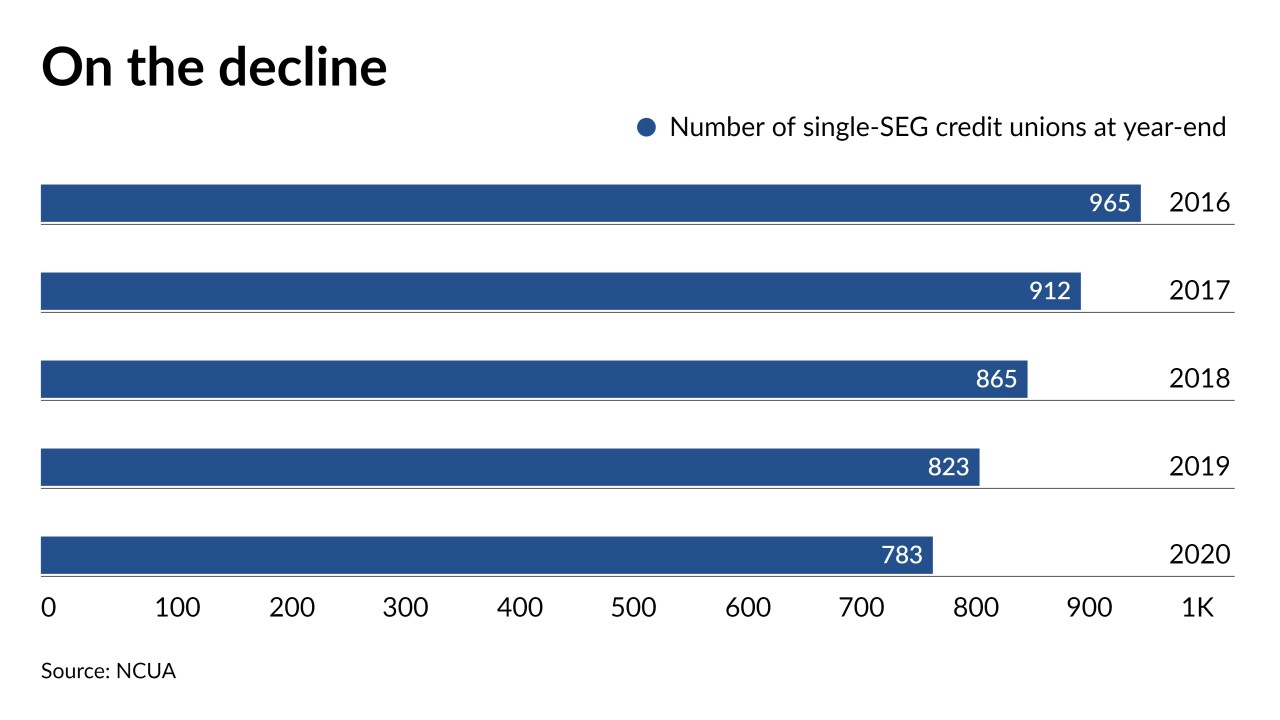

Regulators recently eased field-of-membership rules to promote growth of federal credit unions. A handful of institutions are taking advantage of the changes to recruit more members, but some may find the process too cumbersome.

April 22 -

The agency will hold an exercise this summer related to emerging fraud risks and one board member suggested Congress should once again consider allowing the NCUA to oversee third-party vendors — a measure that would cost the regulator roughly $2 million a year.

April 22 -

Cal Poly Federal Credit Union's recent merger into SchoolsFirst highlights the difficult choice many small institutions face: diversify your field of membership or risk going out of business.

April 21 -

Key legislation to protect banks and credit unions serving the legal marijuana industry looks set to move forward in the House this week.

April 19 -

A report to Congress from the National Credit Union Administration says the regulator has made "steady strides" toward greater diversity in its workforce and operations, but that progress is "just the beginning."

April 16 -

Too many Americans lack a sound grounding in personal financial management, which limits their opportunity to build long-term financial independence.

April 9

-

Harper is only the third member of the National Credit Union Administration board to chair the council. Blake Paulson, acting comptroller of the currency, has been appointed vice chairman.

April 1 -

The $6.4 million-asset institution was placed in conservatorship in January and is the first credit union to be liquidated this year.

March 31 -

The National Credit Union Administration issued only one prohibition order in March, barring a former branch manager of Greater Iowa Credit Union in Ames from working in the financial services industry.

March 31 -

The Texas-based institution is the third credit union to be taken over by regulators this year.

March 26 -

Changes to CDFI Fund regulations could make it significantly easier to raise the capital required to get a new institution off the ground.

March 22 Archer+Rosenthal

Archer+Rosenthal -

NCUA Chairman Todd Harper has reiterated his call for CUs not to garnish members' econimic impact payments, while the industry's largest PAC has resumed campaign contributions after a brief pause.

March 22 -

About 2,000 credit unions will receive a disbursement in connection with the failure of three corporates during the financial crisis, but the agency indicated nearly $2 billion in additional payments could be coming.

March 18 -

A new report from the regulator shows slower growth in membership and lending, as well as a decline in the number of credit unions reporting profits.

March 18 -

Lawmakers this week will continue to discuss extending the Paycheck Protection Program, and the National Credit Union Administration is scheduled to hold its monthly board meeting.

March 15 -

Unify Financial is sponsoring a $300M securitization of prime auto loans. The $3.3 billion-asset institution is only the second CU to sell securities backed by auto loans since the NCUA gave the green light for credit union securitizations nearly four years ago.

March 12