-

Saule Omarova is scheduled to appear before the Banking Committee as progressives cheer her potential appointment to lead the Office of the Comptroller of the Currency and critics describe her views as too radical. Her confirmation would rely on the support of every Democrat in the chamber.

November 11 -

Directors can urge executives to move more quickly in gauging their institutions’ vulnerability to extreme weather events, said acting Comptroller of the Currency Michael Hsu. He offered a list of five questions every board member should ask senior leaders about their progress.

November 8 -

The agency said the risk management program for Cenlar FSB, which performs servicing functions for financial institution clients, was inadequate for the bank's size.

October 26 -

The Office of the Comptroller of the Currency made good on a promise to rescind Community Reinvestment Act reforms finalized by ex-Comptroller Joseph Otting as part of talks with other regulators on an interagency overhaul of the law.

September 8 -

The Office of the Comptroller of the Currency is seeking nearly $19 million from David Julian, Claudia Russ Anderson and Paul McLinko. The trial before an administrative judge is scheduled to begin in South Dakota on Sept. 13.

September 1 -

Five years into scandals that have already cost Wells Fargo more than $5 billion in fines and legal settlements, regulators are privately signaling they’re still not satisfied with the bank’s progress in compensating victims and shoring up controls.

August 31 -

Nearly eight months of the Biden administration have gone by without a word from the White House on a nominee to lead the Office of the Comptroller of the Currency. Here are some of the candidates who have been in (and in some cases fallen out of) the running.

August 16 -

The Federal Financial Institutions Examination Council says bank accounts and information systems have become more vulnerable as mobile and other technologies have expanded. It issued guidelines on detailed steps financial institutions should take to heighten security.

August 11 -

The Boston-based cryptocurrency firm says it would welcome the tough oversight that comes with being a bank. Yet Biden-era regulators have shown apprehension about granting approvals to digital-asset firms.

August 10 -

Sen. Patrick Toomey, the top Republican on the Banking Committee, criticized acting Comptroller of the Currency Michael Hsu and others in the Biden administration for advancing “social goals that are unrelated to banking.”

August 3 -

In late July, the Justice Department notified the Houston bank of a potential lawsuit alleging violations between 2013 and 2017, according to a securities filing. Cadence said that its prospective merger partner, BancorpSouth, supports the settlement discussions.

August 2 -

The Office of the Comptroller of the Currency’s pledge to rescind Trump-era Community Reinvestment Act reforms and work with other regulators suggests that an interagency agreement is within reach. But outstanding issues remain, particularly around the treatment of online banking activities.

July 30 -

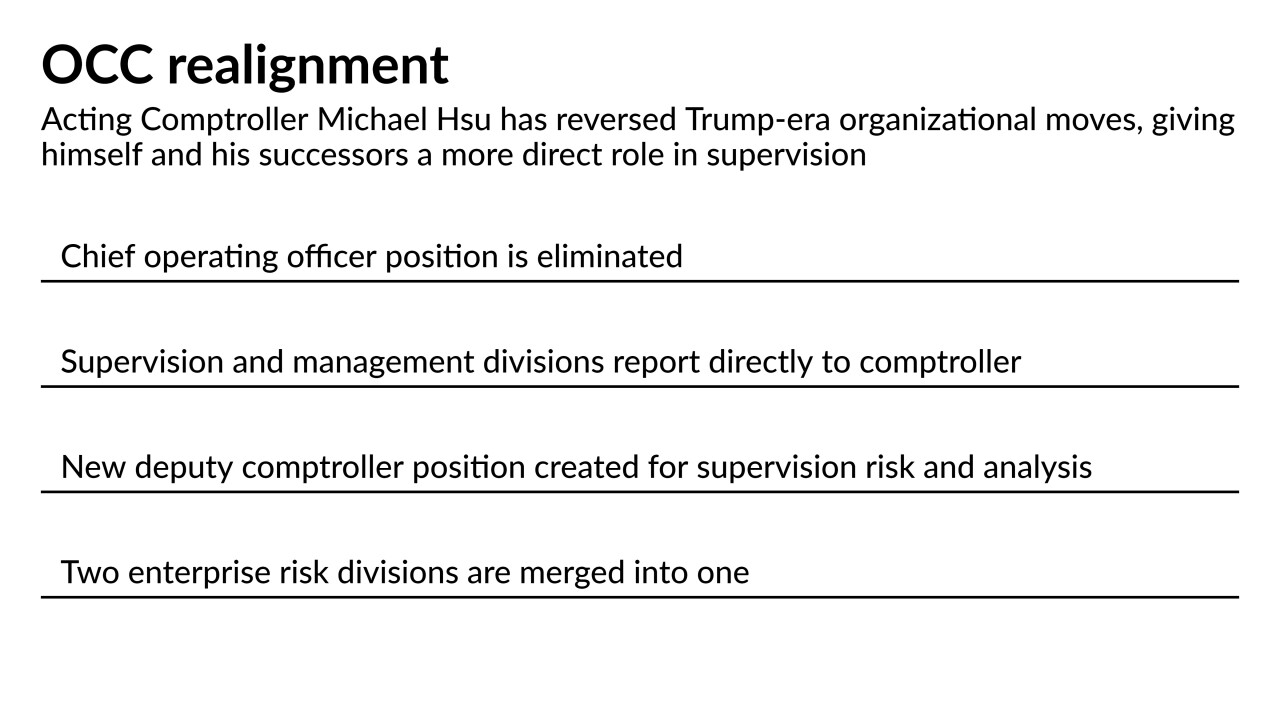

Michael Hsu is reorganizing the Office of the Comptroller of the Currency so that he directly oversees staffers who develop examination strategy. Some analysts suggest the move could result in more aggressive oversight by an agency long accused of being too cozy with national banks.

July 21 -

Recent delays may be frustrating, but the Office of the Comptroller of the Currency isn't closing the door on financial technology companies. However, applicants will have to be patient, forthright about their business plans and willing to actively engage any state or federal regulatory agencies that the OCC consults.

July 16 Klaros Group

Klaros Group -

The Federal Housing Finance Agency recently became the third agency along with the Office of the Comptroller of the Currency and Consumer Financial Protection Bureau without a Senate-confirmed leader. But analysts say the appointment of interim chiefs gives the administration even more control over regulatory initiatives.

July 9 -

The chief operating officer now oversees numerous divisions at the Office of the Comptroller of the Currency. But as part of a reorganization, the COO’s position is being eliminated and several units will come under the direct authority of the comptroller.

July 6 -

A congressional resolution that invalidates the regulation issued last fall by the Office of the Comptroller of the Currency would help regulators crack down on so-called rent-a-bank schemes that promote predatory lending, the president said before signing the measure.

July 1 -

A 2017 investigation into the fake-accounts scandal — conducted by the board of directors with a major assist from the law firm Shearman & Sterling — was billed as independent and objective. Was it?

June 21 -

A state regulator group has agreed to pause its lawsuit challenging Figure Technologies’ application as the federal agency reviews chartering policies. But analysts caution that the underlying conflict over nontraditional firms seeking banking powers is far from resolved.

June 18 -

The appointments of former senior leaders from a rival regulator could force the Office of the Comptroller of the Currency to embrace interagency cooperation after taking a go-it-alone approach during the Trump administration, some observers say. Others worry about another extreme: the Federal Reserve having outsize influence over financial policy.

June 11