-

The jockeying over who President Biden should appoint to head the Office of the Comptroller of the Currency has focused attention on how to regulate the fintech sector, but the discussion has glossed over flaws in the agency's funding structure that have persisted across administrations.

February 10 American Banker

American Banker -

The next administration must halt the practice of allowing new entrants into the banking system to forgo a full Community Reinvestment Act exam.

February 9 K.H. Thomas Associates

K.H. Thomas Associates -

The Biden administration’s yet-to-be-named comptroller of the currency is widely expected to invalidate the GOP-backed measure that bars banks from shunning gun makers, fossil-fuel producers and the like. But another option is to recast it to promote investment in underserved communities.

February 8 -

Protego Trust Bank in Seattle will focus on providing custody services for investors that hold digital assets. The OCC decision comes weeks after the agency granted permission to a South Dakota trust company to offer crypto-related services.

February 5 -

A federal judge denied the Office of the Comptroller of the Currency's motion to have the case thrown out, saying concerns about the agency's rulemaking process to reform the Community Reinvestment Act have merit.

February 1 -

Several financial tech companies that applied to become national banks are seeking exemptions from many provisions of the Community Reinvestment Act. A consumer advocacy group and the American Bankers Association say the OCC mustn't allow this.

January 29 American Bankers Association

American Bankers Association -

The rule, finalized in the waning days of the Trump administration and scheduled to take effect in April, would have punished banks for denying services to certain firms without documented reasons for doing so.

January 28 -

The most likely picks for comptroller of the currency have pushed tech-driven approaches to financial inclusion and anti-money-laundering, and would bring new perspective to regulating cryptocurrencies.

January 27 -

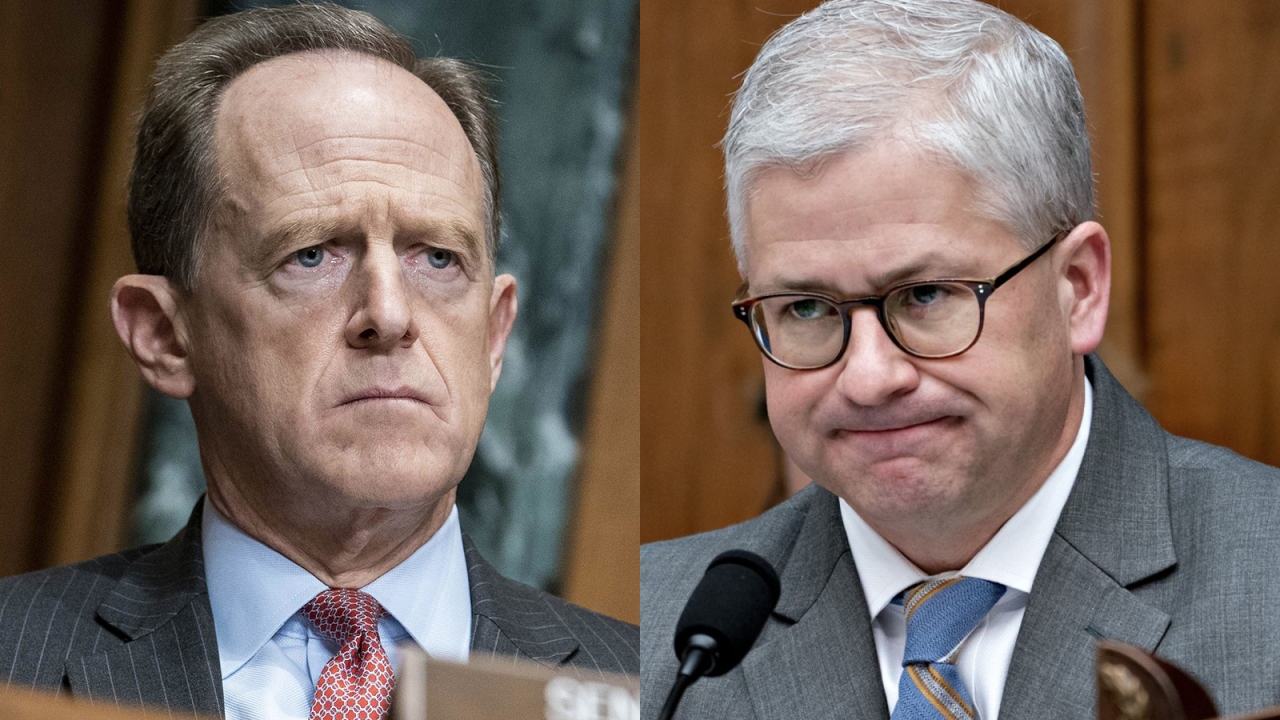

The Senate’s confirmation of Treasury Secretary Janet Yellen was notably bipartisan. But experts say congressional Republicans are poised to give nominees for the federal banking agencies heavier scrutiny.

January 27 -

The most likely picks for comptroller of the currency have pushed tech-driven approaches to financial inclusion and anti-money-laundering, and would bring new perspective to regulating cryptocurrencies.

January 27 -

It would force national banks to make loans to high-risk industries that often pose dangers to vulnerable communities. The next comptroller of the currency should instead promote equal credit availability for consumers who need it most.

January 22 Beneficial State Bank

Beneficial State Bank -

The new administration is wasting no time assembling a team of regulatory appointees and urging agencies to pause pending rules.

January 21 -

Michael Barr helped write the 2010 Dodd-Frank Act while serving under Treasury Secretary Timothy Geithner.

January 21 -

The administration faces a slew of immediate financial policy tasks, such as passing a new round of small-business aid, charting a course for Fannie Mae and Freddie Mac and filling vacant agency leadership posts.

January 20 -

The OCC had hit James Strother and other executives with civil charges a year ago in connection with the bank's phony-accounts scandal. His monetary penalty is lower than what the agency had first floated.

January 15 -

Issued in the final days of the Trump administration, the regulation has united banks, gun-control advocates and environmentalists in opposition. It could be blocked by Congress or a comptroller chosen by the new president.

January 14 -

The Office of the Comptroller of the Currency finalized a rulemaking Thursday morning opposed by the industry that forces the largest banks to provide services to gun businesses and other sectors to which banks have curtailed lending.

January 14 -

Brian Brooks may be remembered as one of the most controversial interim regulatory chiefs in recent memory, taking positions on the pandemic response, fintechs’ banking ambitions and other issues that won him supporters and critics alike.

January 13 -

A co-founder of Anchorage Trust Co. said its digital bank, which will not take insured deposits, will enable the company to strengthen partnerships with financial institutions that offer custody services for clients’ cryptocurrency assets.

January 13 -

Several financial tech companies that applied to become national banks are seeking exemptions from many provisions of the Community Reinvestment Act. A consumer advocacy group and the American Bankers Association say the OCC mustn't allow this.

January 13 American Bankers Association

American Bankers Association