-

The agencies issued a rule to better enable banks to participate in two of the Federal Reserve’s lending facilities and “support the flow of credit to households and businesses.”

May 5 -

The Conference of State Bank Supervisors says parts of the plan are an overreach, while the agency should think twice about developing the proposal during the coronavirus pandemic.

May 5 -

Banking regulators restored the scandal-plagued bank's score three years after assigning it the lowest possible rating under the Community Reinvestment Act.

May 4 -

The joint statement on the risks of cloud computing summarizes years of guidance and rules as industry reliance on third-party platforms has become more ubiquitous.

May 1 -

Federal regulators are now conducting nearly all supervision off-site as a result of the pandemic. The temporary measures are stoking a debate about whether they should be permanent.

May 1 -

Organizers of Rockpoint Bank still need to raise $30 million before opening.

May 1 -

Regulators need to revamp their proposal to overhaul the Community Reinvestment Act now that the coronavirus outbreak has created unforeseen financial needs.

May 1 Buckley LLP

Buckley LLP -

Minorities are often hit harder financially during a crisis, but if regulators move forward on revamping the Community Reinvestment Act, they’ll only make matters worse.

April 20 D-N.Y.

D-N.Y. -

Community advocates would like to see changes to the 1977 Community Reinvestment Act, but say regulators should suspend such efforts until the coronavirus pandemic has passed.

April 8

-

Lenders and community groups say it's a mistake for the banking agencies to move forward during a national crisis. But Comptroller of the Currency Joseph Otting says updated Community Reinvestment Act rules would speed relief to neighborhoods and small businesses.

April 8 -

The OCC and FDIC are holding off on easing debt limits in response to the coronavirus pandemic, leaving billions of dollars locked up at banking subsidiaries that could be used for lending amid the deepening economic crisis.

April 7 -

After Congress temporarily lowered the leverage ratio used by smaller institutions, the federal agencies said they would allow a one-year transition before banks have to comply again with the regular standard.

April 6 -

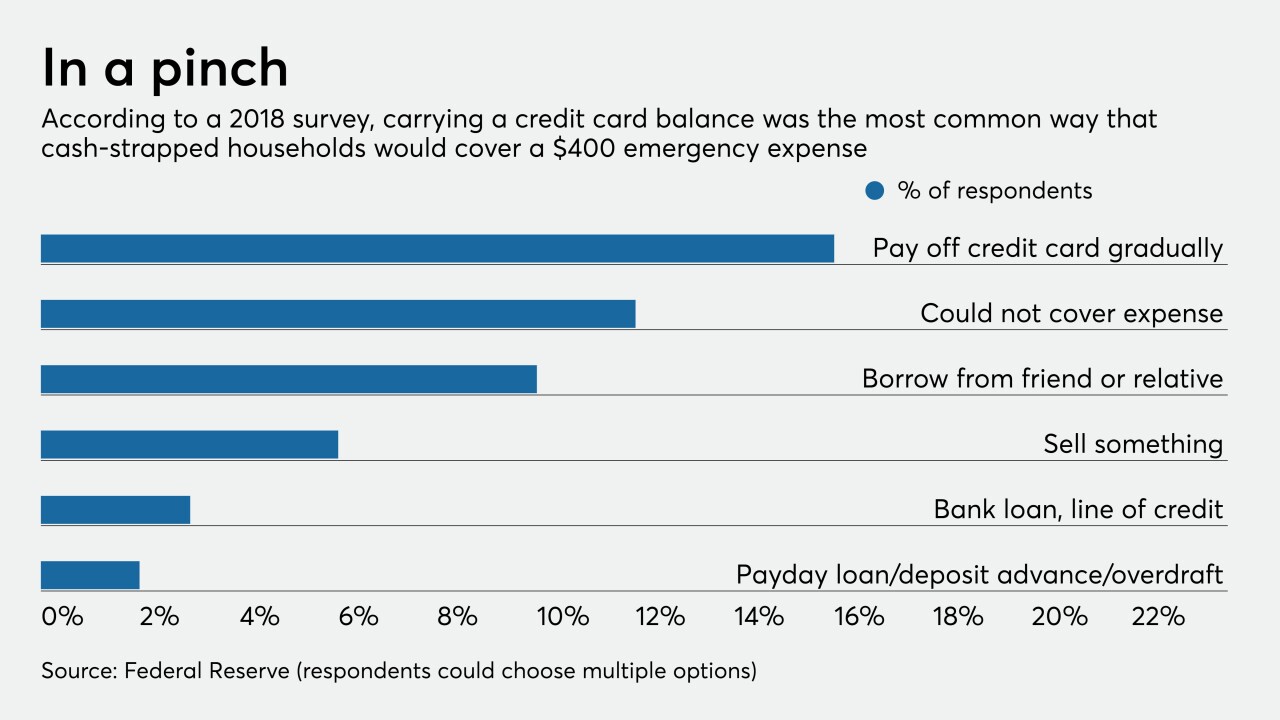

Regulators point to traditional financial institutions as well-positioned to meet short-term credit needs during the coronavirus pandemic, but there are still a host of questions about whether the industry should try to compete with high-cost lenders.

April 2 -

The agencies will give the industry another month to submit feedback on the so-called covered fund portion of the rule "in light of potential disruptions resulting from the coronavirus.”

April 2 -

The ICBA chief’s plea for a six-month halt to regulations not related to the pandemic followed similar calls by community groups and a key Senate Democrat.

March 31 -

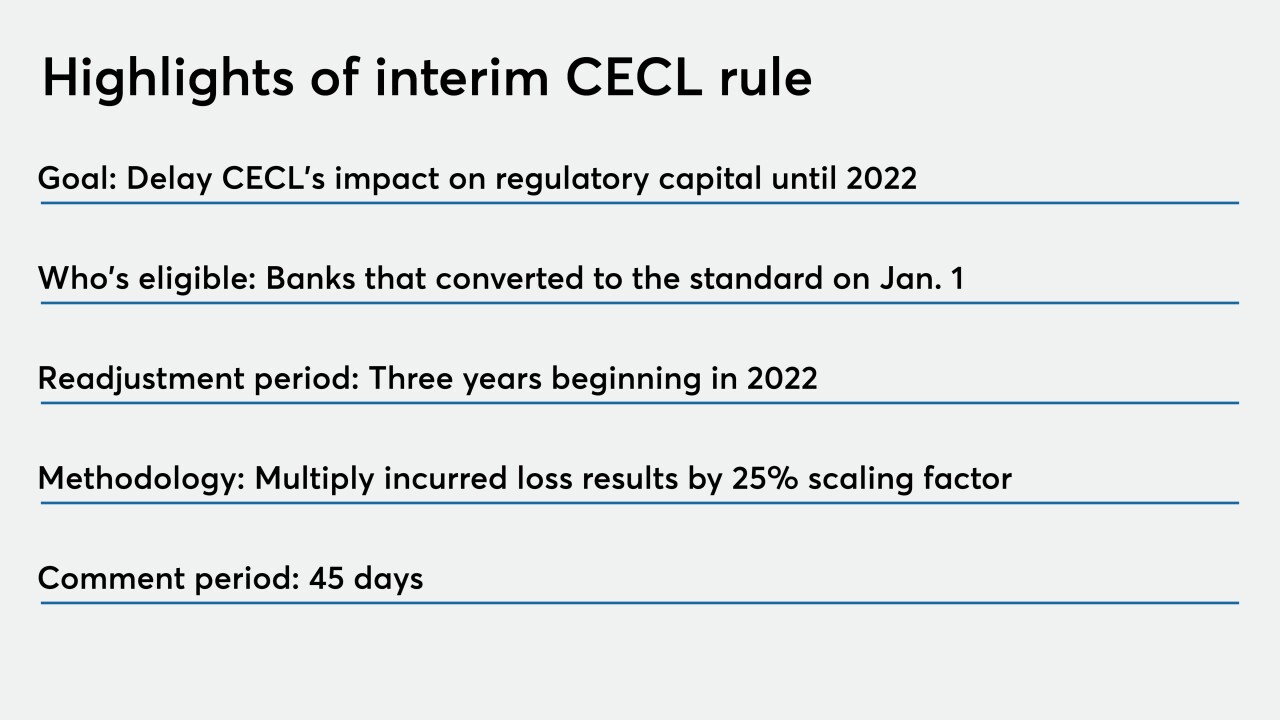

Lawmakers and regulators opted to delay compliance for banks that have implemented the credit loss standard, sparing them near-term capital hits.

March 27 -

Regulators are allowing banks that implemented the loan-loss standard to forestall any capital hits until 2022.

March 27 -

The joint statement said examiners will not impede banks and credit unions’ responsible efforts to offer open lines of credit, closed-installment loans or other products to borrowers dealing with fallout from the pandemic.

March 26 -

The joint statement said examiners will not impede banks’ responsible efforts to offer open lines of credit, closed-installment loans or other products to borrowers dealing with fallout from the pandemic.

March 26 -

Accommodations for borrowers affected by the coronavirus pandemic, such as payment delays and fee waivers, are "positive and proactive actions that can manage or mitigate adverse impacts," several banking agencies said.

March 23