PNC Financial Services Group

PNC Financial Services Group

PNC Financial Services Group is a diversified financial services company offering retail banking, corporate and institutional banking, asset management, and residential mortgage banking across the United States.

-

More than 250 wholesale clients signed up with the Pittsburgh bank in the past year to use real-time payments for payroll, billing and supply chain management.

May 25 -

The investment, tied to PNC's deal to acquire BBVA USA, was always going to be large but seemed to grow as CEO Bill Demchak got intimately involved in the discussions and the needs of communities and businesses hit hard by the coronavirus pandemic became more apparent.

April 28 -

Large banks like Chase, PNC and U.S. Bank were seen as having more resources to devote to customer relief and upgrade digital channels that consumers came to rely on, according to a J.D. Power survey.

April 27 -

PNC Financial Services Group Chief Executive Bill Demchak said he wants to position the bank to perform in a sector in which smaller firms are disappearing amid a wave of consolidation.

April 14 -

The company will give retail account holders 24 hours to cancel upcoming payments that would put them in the red. The move addresses customers’ top gripe and will have benefits that offset the lost income, executives say.

April 13 -

The Cities for Financial Empowerment Fund, a nonprofit that seeks to improve financial stability of low- and moderate-income households, validated the account under its Bank On initiative.

March 29 -

The Pittsburgh company intends to continue adding commercial offices and retail branches in markets it had been eyeing before agreeing to buy BBVA USA for $11.6 billion.

January 15 -

The Pittsburgh bank says the data aggregator deceptively uses PNC's logo in obtaining bank customers' login credentials.

December 23 -

BBVA USA was one of the first U.S. banks to deploy a real-time core system and to purchase a neobank. Here's what PNC may keep, and what it may jettison, after it acquires the U.S. unit of the Spanish banking giant.

November 30 -

The Pittsburgh company is using its BlackRock windfall to execute a familiar script: buy an underperforming bank, cut costs and strengthen ties with commercial clients.

November 16 -

The deal would rank among the biggest bank combinations since the financial crisis, creating a coast-to-coast franchise with about $563 billion of assets and branch presence in 29 of the nation’s 30 largest markets.

November 16 -

The Pittsburgh company has reservations about the business model and staying power of online-only banks.

October 14 -

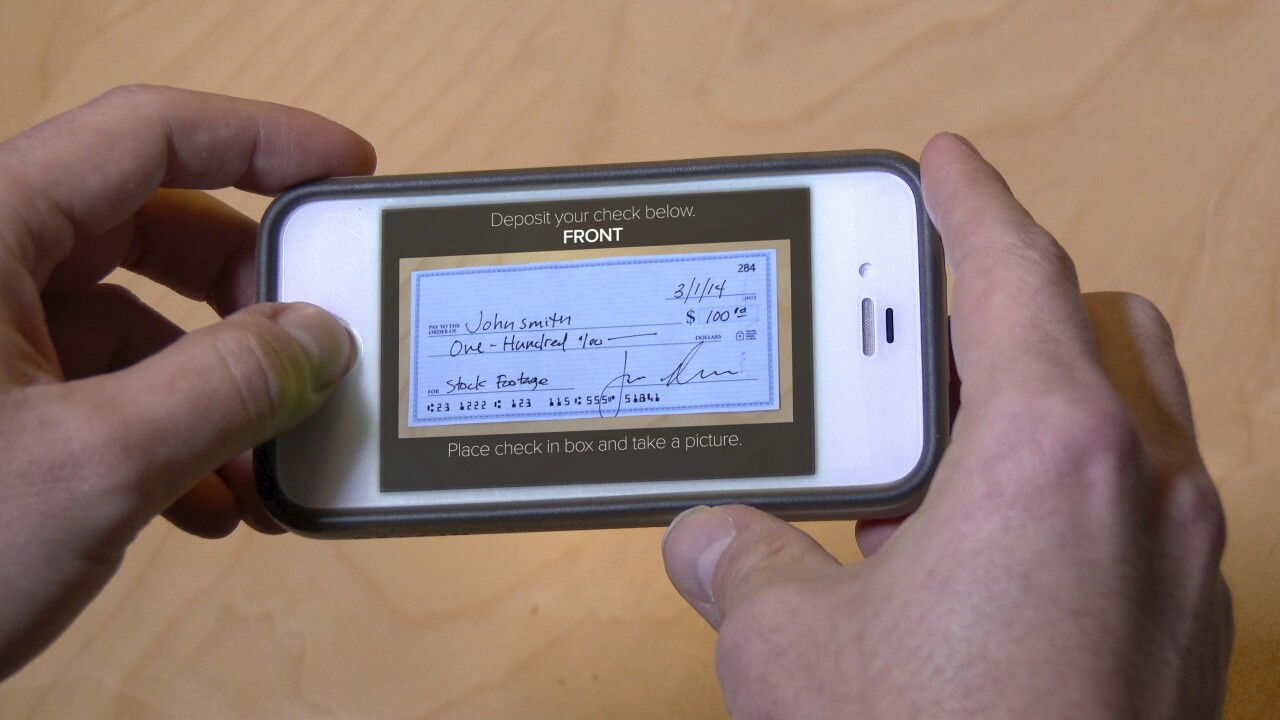

The lawsuit follows two successful USAA suits against Wells Fargo that claimed infringement of patents.

October 2 -

“What COVID has done for us is it has showed us where to prioritize investments,” William Demchak said at an industry conference in discussing the Pittsburgh company's plans to speed up the shift to digital banking.

September 15 -

The move is part of the effort by banks and other companies to promote racial equity and be more sensitive to the stresses on front-line employees.

September 2 -

As their employees continue to navigate the challenges of balancing work and home life during a pandemic, banks are pitching in to offer everything from child care reimbursement to nanny placement to tutoring services.

August 19 -

Institutions large and small are either creating new positions or elevating existing diversity heads to C-suite roles. Will the moves help banks improve equality within their ranks and better serve their communities?

August 9 -

Bank of America was the latest large bank to report a second-quarter drop in the key earnings metric after a March surge in credit line utilizations gave way to rapid payoffs in May and June.

July 16 -

The Pittsburgh bank says fewer borrowers are asking for help and that many borrowers who received assistance are making payments again. But with the coronavirus pandemic still raging in much of the country, CEO William Demchak and other bankers are tempering their optimism.

July 15 -

The Minneapolis company said 75% transactions have been handled online since the pandemic hit.

July 15