Santander

Santander

Banco Santander Rio SA is an Argentina-based financial institution (the Bank) principally engaged in the banking sector. The Bank's offer includes current and saving accounts, mortgage, consumer and commercial loans, fixed-term deposits, credit and debit cards, financial advisory, wealth management, banking guarantees, cash management, export and project financing, mergers and acquisition (M&A) transactions, custody, leasing, as well as securities brokerage, among others.

-

The hiring of Tim Wennes was one a series of leadership changes announced Wednesday by the holding company for the bank and the auto lender Santander Consumer.

July 24 -

The workers charged customers incorrect currency conversion rates; Santander plans to defend its decision not to hire Andrea Orcel if he sues.

July 24 -

Santander Bank and Santander Consumer USA have put many problems behind them in recent years under CEO Scott Powell, but he still has a Federal Reserve enforcement action to resolve and is negotiating with Fiat Chrysler to preserve a crucial auto lending relationship.

June 3 -

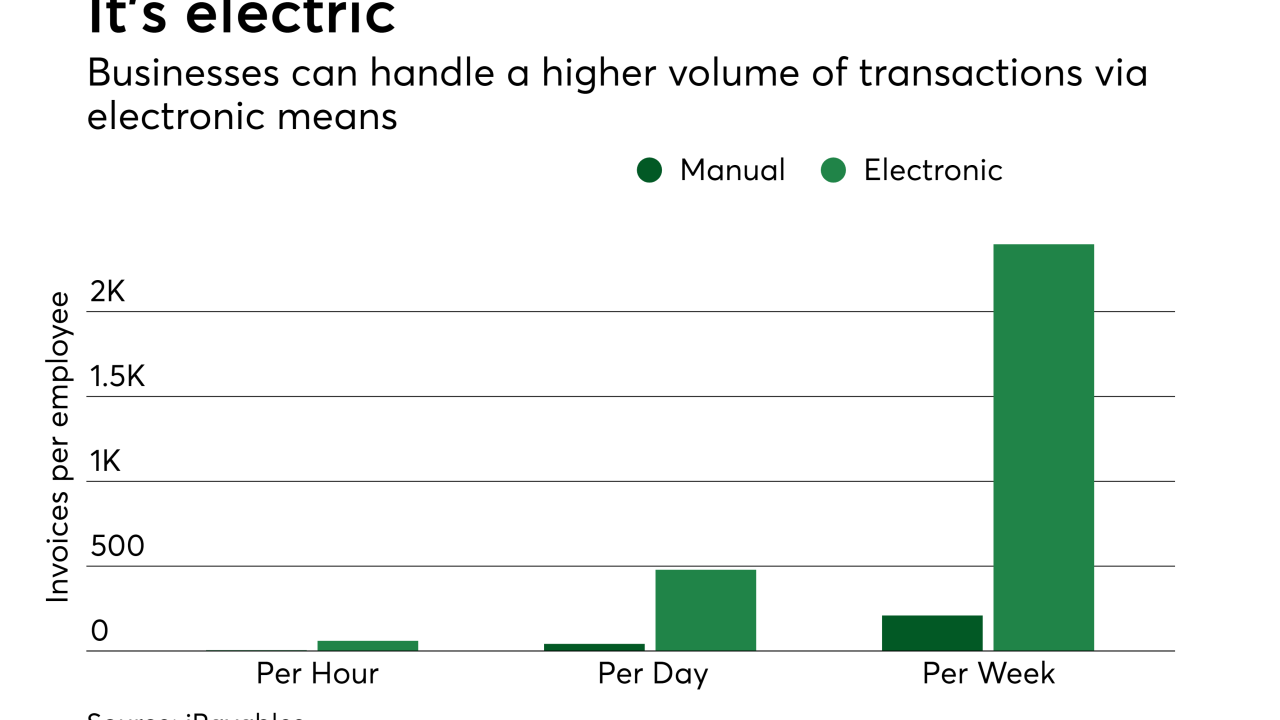

Cryptocurrencies will come and go but blockchain will flourish, because it has game-changing use cases that will fundamentally improve the way financial transactions get done, according to Vinay Pai, senior vice president of engineering at Bill.com.

April 9 -

Page views and sales results don't explain which customers do what, and why they do things (or don't do them), in online and mobile banking.

February 20 -

Solomon says he expects 2020 presidential aspirants to target banks; corporate human resources’ predictable revenue attracting investment banks’ attention.

February 13 -

The Fed vice chair says regulators need to be on the “cutting edge” at spotting vulnerabilities; firm looks to win over future millionaires.

February 11 -

The deal, valued near $22 billion, will combine two of the financial services industry's largest tech and processing firms; both banks top expectations.

January 16 -

Emily Vaughan Alexanderson will lead a group focused on education, nonprofit, technology and life sciences clients.

January 15 -

Santander taps JPMorgan Chase exec Colleen Canny to lead retail network; can Trump actually fire Fed's Powell?; will 2019 bring long-awaited reform of Fannie Mae, Freddie Mac?; and more from the past two week's most-read stories.

January 4 -

As head of Santander Bank’s retail network, Colleen Canny will be in charge of more than 600 branches and over 4,100 employees across eight states.

December 24 -

Several banks are seeing significant changes in leadership as the year comes to a close.

December 11 -

The agency alleges the subprime auto lender violated consumer finance laws by misrepresenting the level of guaranteed insurance protection.

November 20 -

The ploys vary widely—digital tracking, fee incentives and "coopetition"—but banks are turning up the volume on innovation to pry businesses away from checks and keep them from signing up with rival tech startups.

November 12 -

A group of large banks is using its considerable size and influence to build standards for trade finance, including agreements on payments processes, documentation and risk—giving the consortium its own ecosystem to counter the myriad forces in technology and e-commerce that threaten to upend traditional practices.

October 26 -

Sen. Warren proposes a bill that would extend the law to credit unions while stiffening penalties; the Spanish bank taps UBS’s Andrea Orcel.

September 26 -

Scott Powell, the CEO of Santander Holdings USA, has spent years contending with a host of regulatory problems. He outlined a long-range vision that includes a branch-focused retail push and possible acquisitions.

September 4 -

Santander Bank said Wednesday that the OCC had terminated a 2015 consent order related to an identity protection product. It is one of several regulatory headaches the bank and its parent company have resolved lately.

August 29 -

Thieves stole more than $13 million from an Indian bank just days after an FBI warning; Fed’s special oversight restrictions from 2015 lifted.

August 17 -

The Federal Reserve had ordered improvements in compliance, board oversight, risk management, capital planning and liquidity risk management that spanned multiple subsidiaries.

August 16