-

The Dallas bank has begun encouraging larger borrowers to seek forgiveness of Paycheck Protection Program loans first as it holds out for the government to streamline the process for loans below $150,000.

October 20 -

Wells Fargo fired more than 100 employees suspected of improperly collecting coronavirus relief funds, according to a person with knowledge of the situation.

October 15 -

Lenders welcomed the move as a helpful first step but are still urging policymakers to develop a broader, simpler process for expediting the approvals of loans extended to troubled small businesses under the Paycheck Protection Program.

October 9 -

The Small Business Administration has been covering six months of principal, interest and fees for loans that existed on Sept. 27. There are concerns the moves are masking weaknesses in lenders' 7(a) portfolios.

October 6 -

To date, the Small Business Administration hasn’t acted on tens of thousands of applications that lenders have submitted since early August. However, it will begin doing so by early next week, an official says.

October 1 -

More than 500 JPMorgan Chase employees got assistance from taxpayers aimed at helping businesses through the pandemic — and dozens of them shouldn't have, according to people with knowledge of the firm's internal investigation.

September 30 -

Lenders are disappointed with a low proposed cutoff for blanket forgiveness, but they said the proposal, which waives applications for some loans, is a good first step.

September 29 -

U.S. banks and credit unions reported skyrocketing levels of suspected business-loan fraud last month, a period that coincided with growing awareness of scams involving government small-business aid programs.

September 24 -

It's been six weeks since the Paycheck Protection Program expired and banks started filing forgiveness applications on behalf of borrowers. So why isn't the Small Business Administration responding?

September 22 -

The 57 charges involve $175 million allegedly stolen from the small-business loan program. Defendants are accused of lying on their applications and using funds to buy cars, jewelry and other luxury items.

September 10 -

More than $1 billion in coronavirus relief went to small businesses that received multiple loans and a congressional subcommittee analyzing the Paycheck Protection Program says it has seen evidence of fraud in thousands more loans.

September 1 -

The St. Louis company is gaining a sizable Small Business Administration platform and several niche deposit teams. Keeping those specialists in the fold will be key to the acquisition's success.

August 21 -

The company will pay $156 million for a bank with a large Small Business Administration lending platform.

August 20 -

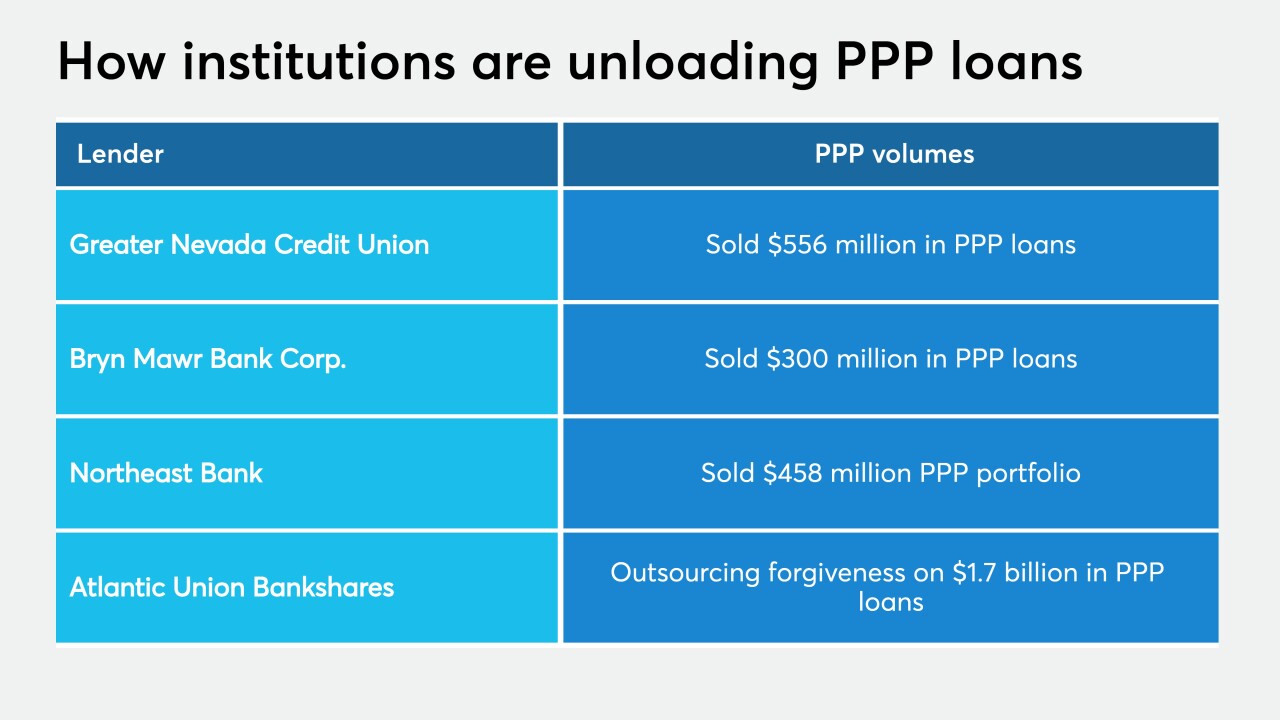

Many sellers are ditching the loans to avoid the cumbersome forgiveness process. For others, the Paycheck Protection Program was never a strategic fit.

August 5 -

Besides reauthorizing the Paycheck Protection Program, Congress should upgrade the loan forgiveness process, offer businesses the chance to take out a second loan and ensure the pricing satisfies lenders, bankers say.

August 4 -

Over 90% of loans from CUs in the Empire State are eligible for forgiveness using the $150,000 threshold.

August 4 -

The Senate Republicans' coronavirus relief package, known as the HEALS Act, would continue to make the loan program available to businesses, but any final bill would need to be negotiated with House Democrats.

July 28 -

The Senate Republicans' coronavirus relief package, known as the HEALS Act, would continue to make the loan program available to businesses, but any final bill would need to be negotiated with House Democrats.

July 27 -

Many bankers want to focus more on the forgiveness process, assessing the status of deferrals and pursuing traditional lending opportunities.

July 21 -

Greater Nevada Credit Union, like a number of community banks, agreed to sell its Paycheck Protection Program loans to avoid having to navigate the complicated forgiveness process.

July 15