Synovus Financial

Synovus Financial

Synovus Financial operates dozens of community banks throughout Georgia, Alabama, Florida, Tennessee, and South Carolina. Concentrating on commercial loans and commercial real estate, the bank uses its small-town image to establish strong relationships with its small-business customers.

-

The Tulsa, Okla., bank is adding Jim Thompson as director of senior housing investments.

June 13 -

Some of the biggest industry moves in May and early June were not executive promotions, but rather departures.

June 12 -

Jamie Gregory has worked for Regions for a decade and was named head of corporate financial strategy early this year, but he's jumping ship to Synovus in late June.

June 3 -

Regions Financial said Thursday that it will not renew its contract with GreenSky — a move analysts say could prompt other banks to re-examine their lending arrangements with the fintech.

May 16 -

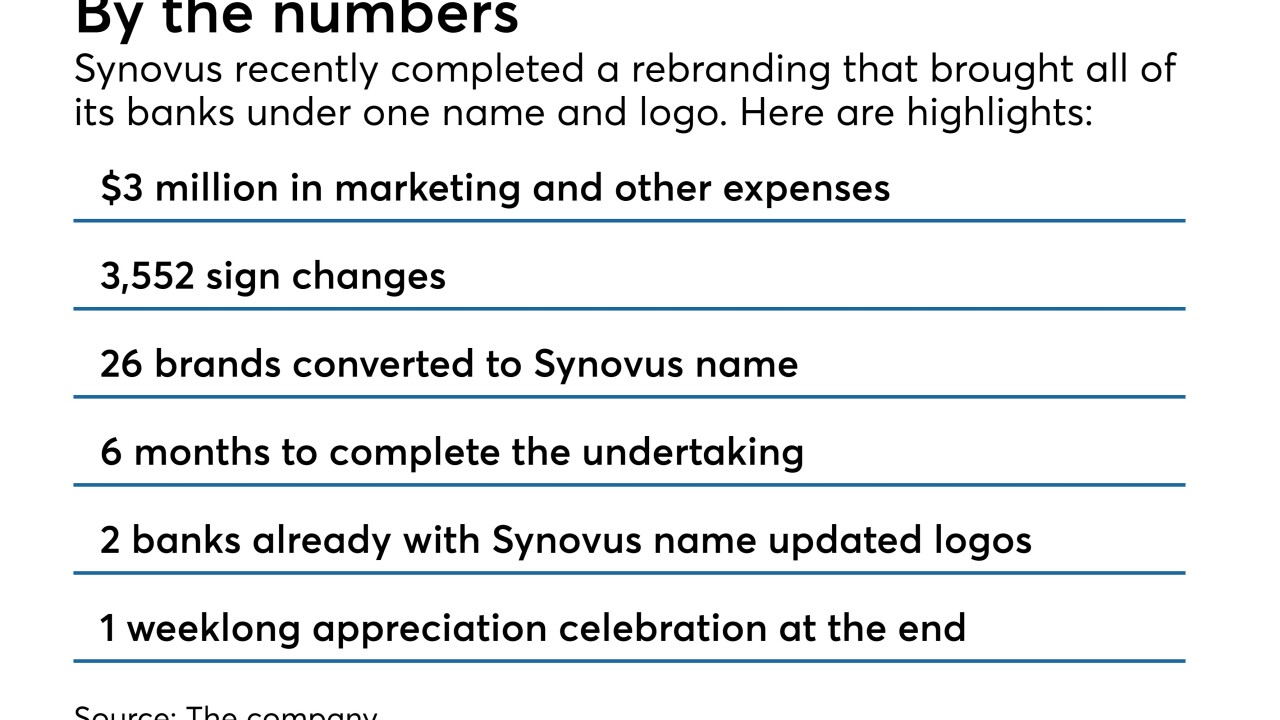

Synovus converted all 26 of its separately branded community banks to its own name over the past two years — a major undertaking that allowed Jennifer Upshaw, senior director of marketing, to shine.

May 2 -

Payments technology provider Total System Services has signed a multiyear contract with Synovus Financial Corp. to provide payment processing and also deliver two new customer service platforms to the financial institution.

April 16 -

The regulatory relief bill passed last year eliminated mandatory stress tests for dozens of regional and midsize banks, yet many banks continue running internal tests anyway. Here’s why.

April 9 -

The legendary Atlanta banking lawyer played a special, often behind-the-scenes role that was part diplomat, mentor and seer during his 50-year career. He died last week at 76.

March 11 -

The Atlanta company, which reported fourth-quarter results Tuesday, said that the lending partnership with American Express will launch in Atlanta, Chicago, Dallas, Los Angeles and Dallas within the next 60 days.

March 5 -

The Georgia company will abstain from acquisitions this year as it looks to make internal improvements.

January 15 -

Synovus has given CFO Kevin Blair the additional title of COO. He will oversee three business lines, plus tech, operations and product and treasury management.

December 12 -

Zack Bishop has experience in blending the systems of merged banks, according to Synovus, which this summer announced its first whole-bank deal in more than a decade.

November 26 -

The pressure is on for banks to lean more heavily on capital markets, wealth management and other nonmortgage sources of fee income. That could get tougher in upcoming quarters.

October 23 -

The Columbus, Ga., company ramped up its business and consumer lending even as it scaled back lending on construction and commercial real estate projects.

October 23 -

As Synovus brought all of its 28 banks under the same name and logo, management made sure employees were well informed and comfortable with the changes.

September 14 -

Federal bank regulators consider roughly a dozen new rules; firms tout tools to help financial institutions bank legal marijuana-related businesses; Mick Mulvaney defends CFPB enforcement powers; and more from this week's most-read stories.

July 27 -

Double-digit consumer-loan growth more than offset a decline in commercial real estate loan balances.

April 24 -

Banks are capitalizing on changing consumer habits - and satisfying a pressing need to diversify their loan portfolios - with a spate of instant point-of-sale loans for everything from iPhones to home improvements.

February 7 -

The Super Bowl reminds that firms often have one shot to make a good impression with their advertising. Here are some of the best and worst ads from financial companies.

February 4 -

Net interest income has surged thanks to rising rates, but noninterest income has lagged as trading revenue has weakened, refi demand has softened and fees from deposit service charges have barely budged. Is this the new normal?

January 24