-

When TD Bank launched an audio brand identity across its communication channels early this year, the new jingle triggered a surprising reaction from consumers using the firm's ATMs.

June 27 -

Executives at the Toronto-based bank said last year that they planned to add 150 branches in the United States. But when pressed on Thursday, they could not say how much they'll scale back their ambitions due to investigations over TD's anti-money laundering practices.

May 23 -

Executives at the Canadian bank, which recently took a major provision for potential fines, say they're working to shore up anti-money laundering controls. At the same time, they're preparing employees and investors for an expensive slog as they work to satisfy U.S. officials.

May 16 -

Toronto-Dominion disclosed last year that it was under investigation by the department. Canada's second-largest lender also faces probes by three U.S. regulators over its handling of suspicious customer transactions.

May 3 -

Toronto-Dominion Bank has taken an initial provision of $450 million in connection with U.S. investigations into its anti-money-laundering practices and said it expects additional penalties to come.

April 30 -

Analysts estimate the probe, which remains unresolved, could lead to a fine of between $500 million and $1 billion, and Toronto-Dominion has already said it is spending hundreds of millions of dollars to improve its risk and control infrastructure.

March 13 -

TD Bank is among the latest to support Tap to Pay, which allows clients to accept contactless payments on their personal smartphones. Through its investment in Autobooks, it enables others to do the same.

March 11 -

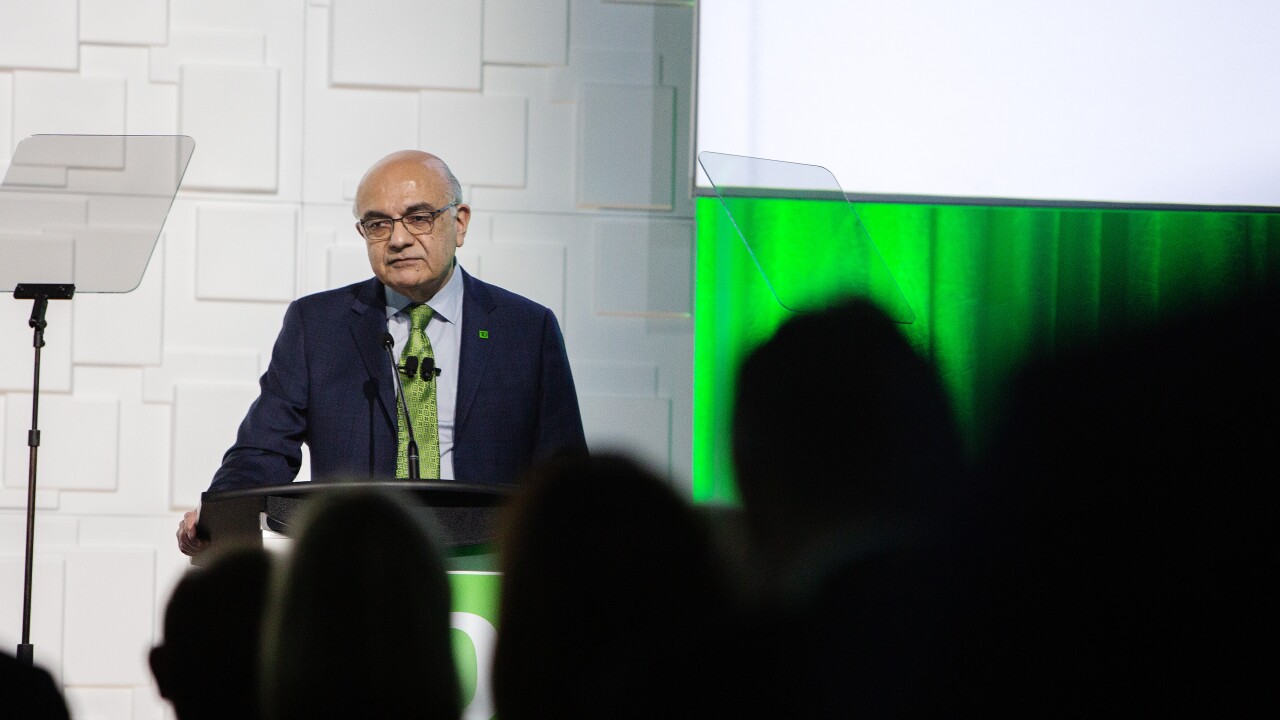

The Toronto bank has been under investigation by U.S. and Canadian supervisors for alleged shortcomings in anti-money-laundering compliance. CEO Bharat Masrani pledged "comprehensive enhancements" but declined to pinpoint the exact fixes and their costs.

February 29 -

Bharat Masrani has spent a decade as the Canadian bank's top executive and is pushing 70. But as the bank undergoes a U.S. Justice Department probe, it's unclear when he'll step down or who's next in line.

February 27 -

The New York bank's AI research group has published 400 papers, according to new research from Evident; TD Bank Group's Layer 6 unit published 14 last year. These groups work to solve real-life problems in the business units.

February 22 -

Here's what's happening around the world

December 20 -

Dan Sheehan, former CEO at Professional Bank in Coral Gables, said he's "putting the band back together" to spearhead his new, Texas-based employer's expansion plans in the Sunshine State.

August 16 -

Years of consolidation have damaged competition in the banking sector. Regulators should be more, not less, restrictive about approving mergers.

June 9 American Economic Liberties Project

American Economic Liberties Project -

Toronto-Dominion's Common Equity Tier 1 capital ratio was 15.5% as of Jan. 31, far in excess of the amount Canadian banks typically hold.

May 5 -

Merger arbitrage traders were expecting hiccups in Toronto-Dominion Bank's proposed takeover of First Horizon, but they were unprepared for its cancellation.

May 4 -

The companies cited an inability to secure regulatory approvals after postponing multiple times a closing that had been originally expected last fall.

May 4 -

The generative AI technology has been through a cycle of media buzz, disappointment and disillusionment.

March 6 -

A blueprint for a shared ledger for digital money would include central bank digital currencies, bank deposits and e-money from companies like PayPal — but not unsupervised cryptocurrencies.

November 28 -

Toronto-Dominion Bank's U.S. commercial lending chief sees loan demand growing even as the Federal Reserve aggressively hikes rates that are already at the highest since 2008.

October 20 -

TD Bank, the U.S. unit of the Canadian bank, has hired Christopher Fred as its new head of U.S. credit cards and unsecured lending. The bank's retail partners include Target and Nordstrom.

October 3