-

The political pendulum appears to be swinging toward significantly lower capital requirements, but that threatens to undo the gains banks made in the wake of the financial crisis.

October 30 Peterson Institute for International Economics

Peterson Institute for International Economics -

The term "shadow banking" is a pejorative, implying insufficient regulatory oversight, said Treasury in a report issued Thursday on asset management.

October 27 -

The Senate's repeal of the Consumer Financial Protection Bureau rule is arguably the industry's biggest policy victory since passage of Dodd-Frank. But is it the sign of a trend?

October 26 -

The Senate's repeal of the Consumer Financial Protection Bureau rule is arguably the industry's biggest policy victory since passage of Dodd-Frank. But is it the sign of a trend?

October 25 -

Consumer Financial Protection Bureau Director Richard Cordray pushed back against a Treasury Department report critical of the bureau's arbitration rule, saying it overlooked how class action lawsuits help consumers.

October 24 -

Treasury contests agency’s claims that ban on mandatory arbitration benefits consumers; former head of FX trading used client information to profit the bank.

October 24 -

With days ticking down for lawmakers to overturn the Consumer Financial Protection Bureau rule, some are now questioning the statistics used to challenge the bureau’s data.

October 23 -

The Treasury Department released an 18-page report saying the rule would “impose extraordinary costs” including legal fees mostly for lawyers that bring class-action lawsuits.

October 23 -

The CFPB's practice of "regulation by enforcement" forces mortgage companies to develop compliance standards based on the mistakes of their peers, rather than clear guidance from the enforcement agency, said David Motley, the new chairman of the Mortgage Bankers Association.

October 23 -

The Treasury Department will release a report early next year on opportunities and risks posed by fintech as part of administration efforts to reform the regulatory structure, Craig Phillips said.

October 18 -

Recent regulatory reform activity is a step in the right direction, but the changes envisioned in both a Treasury Department report and a suite of House bills are a mixed bag.

October 18 Cato Institute

Cato Institute -

Andreas Dombret, head of regulation at Germany’s central bank, fears entering “the next stage of … an eternal cycle” of crises as countries begin dialing back regulations.

October 13 -

The Treasury Department is expanding its calls for overhauling regulation of the financial services sector, this time focusing on changes to the most significant rules surrounding securitization and derivatives.

October 6 -

After the FSOC voted to rescind its systemic designation for AIG, it's unclear whether the interagency council will continue to appeal a court ruling overturning MetLife's SIFI designation.

October 2 -

In light of the recent disbursement of nearly $40 million in grants to credit unions from The Treasury Department’s Community Development Financial Institutions Fund, Credit Union Journal surveyed some credit unions which have received CDFI grants in the past to find out how these funds are being used.

September 26 -

EU-based banks are citing a U.S. Treasury Department report as reason to slow-walk international regulatory standards.

September 18 -

The Trump administration is prepping recommendations to address shortcomings in the capital markets in a report to be released next month, a top Treasury Department official said Monday.

September 18 -

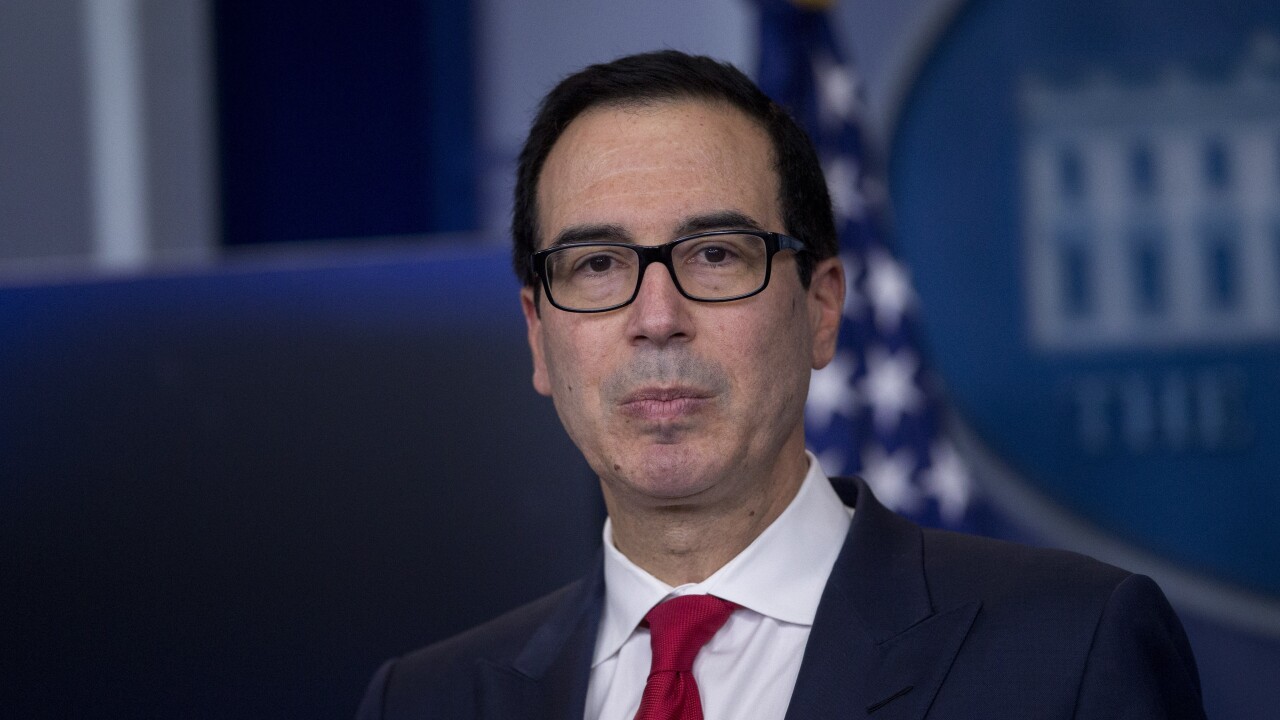

Despite a direct request by six Democratic senators that Fannie Mae and Freddie Mac be allowed to rebuild capital, Treasury Secretary Steven Mnuchin did little to clarify the administration's thinking.

September 14 -

Neglecting to appoint a full-time director could shortchange efforts to improve the bureau’s transparency and undertake other needed reforms.

September 7 MWWPR

MWWPR -

With the deadline for a federal-debt-limit renewal nearly a month away, bankers are dreading the prospect of higher funding costs, strained liquidity, weaker commercial loan demand and other ramifications if Washington does not act.

August 24