Wells Fargo

Wells Fargo

Wells Fargo is one of the largest banks in the United States, with approximately $1.9 trillion in balance sheet assets. The company is split into four primary segments: consumer banking, commercial banking, corporate and investment banking, and wealth and investment management.

-

Months after President Trump vowed that Wells Fargo would pay a severe penalty, the CFPB and OCC hit the bank with a $1 billion fine to settle claims it overcharged customers for auto insurance and home loans.

April 20 -

The bank’s latest punishment would settle charges by the CFPB and the OCC; Staley did not act without integrity in trying to unmask a whistleblower.

April 20 -

The latest fine from regulators was leveled against the bank on Friday. But it's far from the only penalty it has paid in recent years, and more may be on the way.

April 19 -

The CFPB and OCC are expected to assess a $1 billion fine against Wells Fargo for allegedly overcharging customers for auto insurance and home loans.

April 19 -

The bank revealed Friday that it is facing hefty regulatory penalties and will likely have to restate first-quarter earnings. Declines in loan balances and fee income and questions about upcoming stress tests are only adding to investors' worries.

April 13 -

Bankers hoped the tax overhaul would stimulate a boom in business borrowing, but several said this week that hasn’t happened yet. PNC’s Bill Demchak warned that the tax cuts could be encouraging lenders to underprice loans.

April 13 -

Banks should rethink even existing services, such as the branch experience, said top executives at the Oracle Industry Connect conference.

April 13 -

The firm warned Friday that it may take a charge of as much as $1 billion to settle a U.S. probe of its consumer business.

April 13 -

A $1 billion penalty being bandied about; Deutsche’s problems may be too big to eradicate.

April 10 -

According to the Reuters report, which cited unnamed sources, acting CFPB Director Mick Mulvaney is seeking a settlement with Wells over claims related to force-placed auto insurance and improper mortgage fees.

April 9 -

Retail banking chief Christian Sewing will become CEO immediately; higher deposit rates could trim lending margins as banks head into earnings season.

April 9 -

GSE reform a likely scratch from this year’s to-do list; banks’ difficulties in speaking emoji; reactions to Mick Mulvaney’s plans for the CFPB; and more.

April 6 -

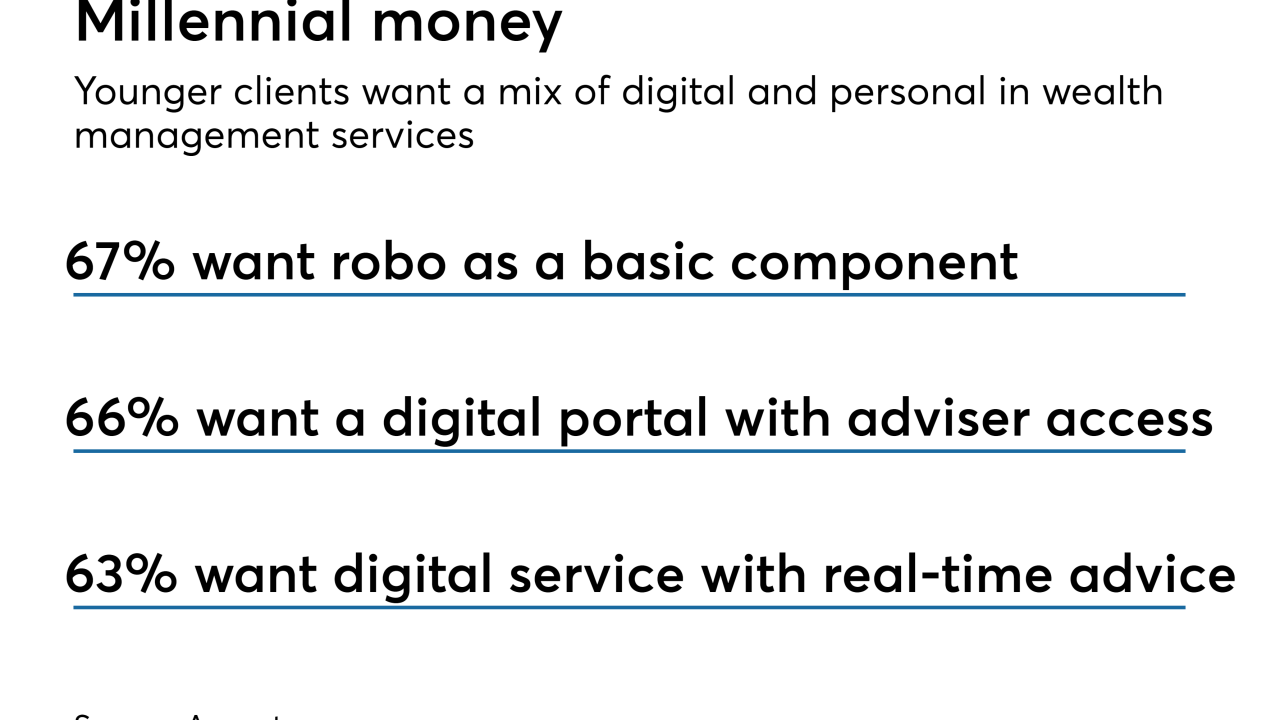

BMO Wealth Management aims to modernize its investment service and give advisers better equipment. Others offering automated advice solutions include UBS, Wells Fargo and JPMorgan.

April 6 -

KPMG has been the bank's auditor since 1931. Critics say it's time for a change.

April 5 -

Some clients of Wells Fargo's wealth management division were steered into investments that weren't always in the best interests of clients, according to several people familiar with the unit.

April 5 -

San Francisco Fed President John Williams is not suited to lead the most important of the regional Fed banks, given his inability to detect the phony-accounts problems at Wells Fargo. He also lacks Wall Street experience.

March 28 -

San Francisco Fed chief is reportedly leading candidate to replace Dudley in New York; four senior officers to retire as OCC readies penalties against the bank.

March 26 -

Wells Fargo announced changes to its risk-management leadership this week as some executives plan to retire, according to a person familiar with the situation.

March 23 -

Some top bank executives — at big and regional institutions alike — enjoy premium perks, including personal travel on corporate aircraft and minimal wait times for fancy medical exams. Here’s an overview of the special items disclosed to investors so far this year.

March 21 -

Many of the industry’s top executives — at big and regional banks alike — enjoy premium perks, including personal travel on corporate aircraft and minimal wait times for fancy medical exams. Here’s an overview of the special items disclosed to investors so far this year.

March 21