Wells Fargo

Wells Fargo

Wells Fargo is one of the largest banks in the United States, with approximately $1.9 trillion in balance sheet assets. The company is split into four primary segments: consumer banking, commercial banking, corporate and investment banking, and wealth and investment management.

-

The city's decision to drop a lawsuit alleging predatory ending by Wells Fargo, JPMorgan Chase, Bank of America and Citigroup highlights the challenges municipalities face in taking on deep-pocketed financial institutions.

February 3 -

Verdict on OCC’s supervision of Wells Fargo expected in late spring; TD Bank names Matt Boss its new consumer products chief; CenterState and South State plan $3.2B merger with operations stretching from Virginia to Florida; and more from this week’s most-read stories.

February 1 -

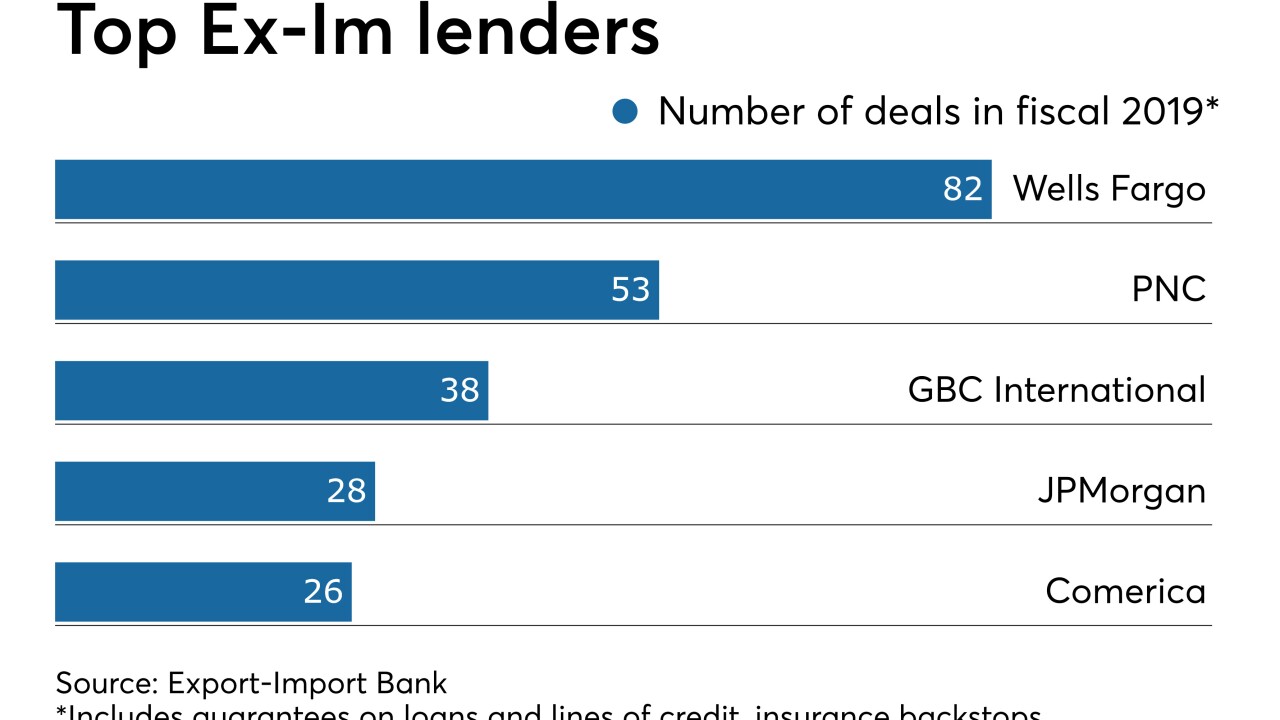

Lenders that depend on the Export-Import Bank to back loans to exporters are already seeing business borrowing pick up after Congress reauthorized the agency in December.

January 30 -

Critics of the OCC have long maintained that the agency was too close with the San Francisco bank. A watchdog's assessment of what transpired between 2009 and 2017 is expected to be completed late this spring.

January 28 -

The move by the European bank regulator is a policy shift as profitability at the region's banks continues to suffer from negative rates; the German bank paid $1.1 million to win business from a senior Saudi royal.

January 27 -

The changes will mean a bigger gap between the best and worst borrowers; the bank will require companies they take public to have a ‘diverse’ board member.

January 24 -

Documents released by the Office of the Comptroller of the Currency Thursday allege that senior leaders had reason to know that the wrongdoing was widespread but failed to act.

January 23 -

Former CEO John Stumpf agreed to pay a $17.5 million penalty while ex-community banking chief Carrie Tolstedt faces a potentially $25 million fine for sales-practices misconduct. Other former officials could face fines totaling $16 million.

January 23 -

An early warning system for bad bank loans is taking effect this year. Beware false alarms.

January 23 -

Wells Fargo's main regulator is preparing civil charges against former managers related to their roles in its retail banking scandals, people familiar with the matter said.

January 23 -

The Massachusetts senator and presidential contender sent a letter to eight of the biggest U.S. banks asking about how they assess climate-related risks to assets and how they plan to mitigate social and economic fallout.

January 22 -

Truist emphasizes high-touch, high-tech focus with new logo; Wells Fargo loses another patent lawsuit to USAA; what the Visa-Plaid merger means for banks, fintechs; and more from this week's most-read stories.

January 17 -

Savings for the top six U.S. banks from President Donald Trump's signature tax overhaul accelerated last year, now topping $32 billion as the lenders curbed new borrowing, pared jobs and ramped up payouts to shareholders.

January 16 -

Wells was ordered to pay USAA $102.8 million for infringing on its mobile deposit patents. It follows a separate lawsuit loss in November also related to patents.

January 15 -

JPM, Citi shrug off low rates as strong economy propels profits; digital currencies start year with gains as optimism about its future grows.

January 15 -

The Charlie Scharf era began with the company's lowest quarterly net income in more than nine years. Culprits included falling revenue, rising salaries and yet more financial fallout from the bank's sales scandal.

January 14 -

Wells Fargo & Co. may have a new leader, but the work of reinvigorating the firm after years of troubles is far from over.

January 14 -

Profits at big banks are expected to be up versus a year ago but down from the third quarter; add antiquated systems to the bank’s many problems.

January 13 -

Can Charlie Scharf fix what ails Wells Fargo? How will Kelly King and Bill Rogers manage the integration of the biggest bank merger since the early 2000s? And will New Jersey Gov. Phil Murphy be able to beat back opposition from the banking industry and make good on his promise to create a state-owned bank? Here are 11 leaders to keep an eye on in 2020.

January 12 -

Potential sources of industry upheaval, and how to adapt; former Wells Fargo execs may face criminal charges in coming weeks; why banks have such high turnover of chief compliance officers; and more from this week's most-read stories.

January 10