-

Venmo has more than 40 million active users, PayPal has revealed for the first time. This finally gives the market a sense of how popular Venmo is, and sheds a little light on how it compares to the bank-run Zelle service.

April 24 -

The largest U.S. banks got a head start in launching Zelle through their mobile apps about 18 months ago, working closely with Zelle’s owner Early Warning Services LLC. It’s taking longer for smaller institutions to get up and running, due to some technical complexity.

April 10 -

Banks of all sizes need to stick together to ward off threats from "unregulated" fintechs and other nonbanks, Bank of America Chairman and CEO Brian Moynihan said Tuesday.

April 2 -

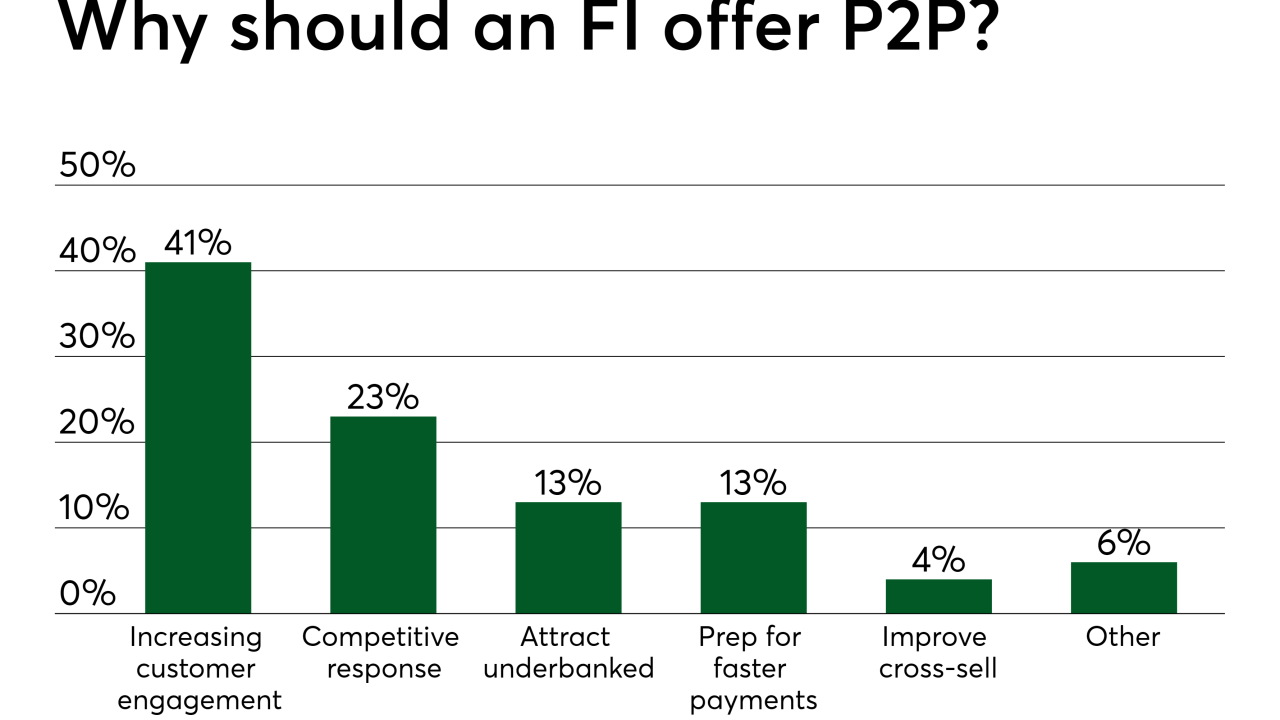

The market for P2P payments is finally taking off after years of false starts, but there are still many unanswered questions. The biggest one: How do banks get value out of offering this service free of charge?

March 22 -

The market for P2P payments is finally taking off after years of false starts, but there are still many unanswered questions. The biggest one: How do banks get value out of offering this service free of charge?

March 22 -

A man entered a SunTrust branch in Sebring, Fla., and shot and killed five women, four of whom were bank employees; 24 million mortgage documents exposed in data security lapse; the battle for deposits is like "a steel-cage" match; and more from this week's most-read stories.

January 25 -

Business pay has always lagged consumer innovation because of complexity. But new advancements in underlying business technology should change that, according to Rob Eberle, CEO of Bottomline Technologies.

December 28 Bottomline Technologies

Bottomline Technologies -

Proponents of real-time payments systems say banks must embrace them given consumer demand for more immediacy and transparency, even if criminals will try to exploit them.

November 28 -

A year after its launch, Zelle’s P2P payment volume has rapidly expanded through usage at the nation’s largest banks. But enabling smaller institutions to offer it to their customers is proving to be more challenging.

November 26 -

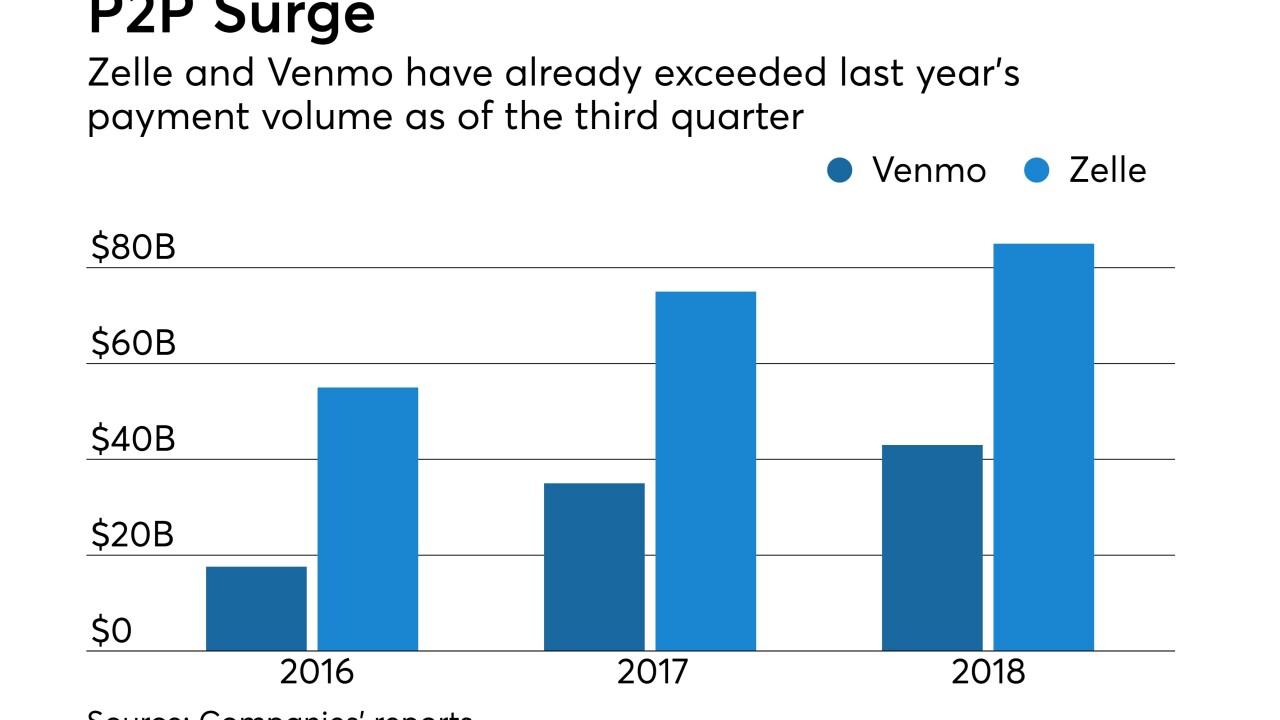

Zelle processed 116 million transactions during the third quarter as its payment volume jumped to $32 billion, while Venmo's volume increased 78% to nearly $17 billion.

October 23 -

Zelle processed 116 million transactions during the third quarter as its payment volume jumped to $32 billion, while Venmo's volume increased 78% to nearly $17 billion.

October 23 -

The Zelle network processed 116 million transactions during the July-September 2018 timeframe with a total value of $32 billion in payments.

October 23 -

As Venmo does battle with Zelle and Square for consumers' P2P payments, one thing is clear: Innovation is not cheap.

October 15 -

For bankers and network providers, it’s a given that moving to a real-time payment system like Zelle will lead to an increase in fraud attempts. Here's a look at the ways they're fighting back.

October 10 -

Zelle doesn't require a bank or credit union to participate in its network to allow it to receive funds; so even Zelle holdouts will see some activity on their accounts. This allows credit unions to compare members' demand to usage, and to determine whether signing up with Zelle is worth the trade-offs.

September 24 -

One expert says the U.S. lags behind other countries, but changes are coming soon – and fast.

August 17 -

Zelle is working on ways to ensure that customers can safely pay small businesses as well.

August 16 -

The person-to-person network also saw $28 billion in payments in the quarter and it added more bank members.

July 26 -

Zelle, the bank-owned P2P network operated by Early Warning, saw an 11% increase in payments volume during the second quarter from the previous quarter as it gradually adds financial institutions to its network.

July 26 -

"It was a difficult decision, but we’re at a good spot to do this,” Finch, 55, said in an interview.

May 17