-

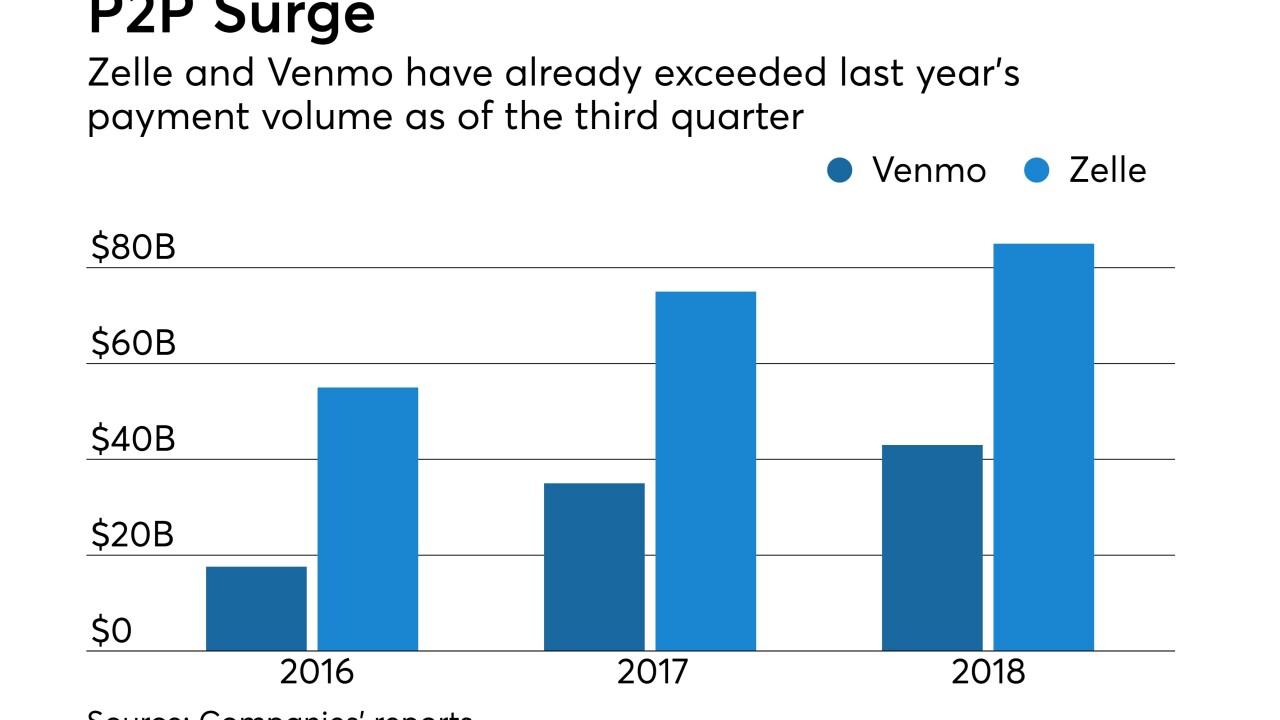

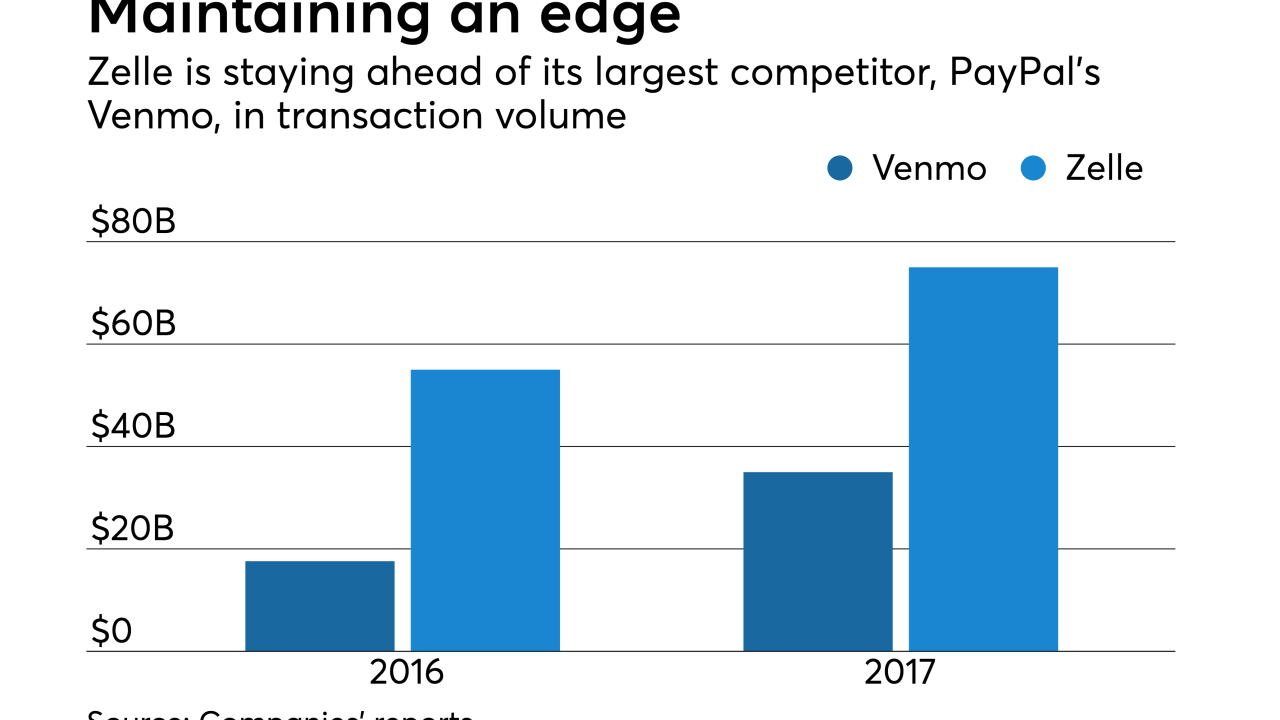

Zelle processed 116 million transactions during the third quarter as its payment volume jumped to $32 billion, while Venmo's volume increased 78% to nearly $17 billion.

October 23 -

The Zelle network processed 116 million transactions during the July-September 2018 timeframe with a total value of $32 billion in payments.

October 23 -

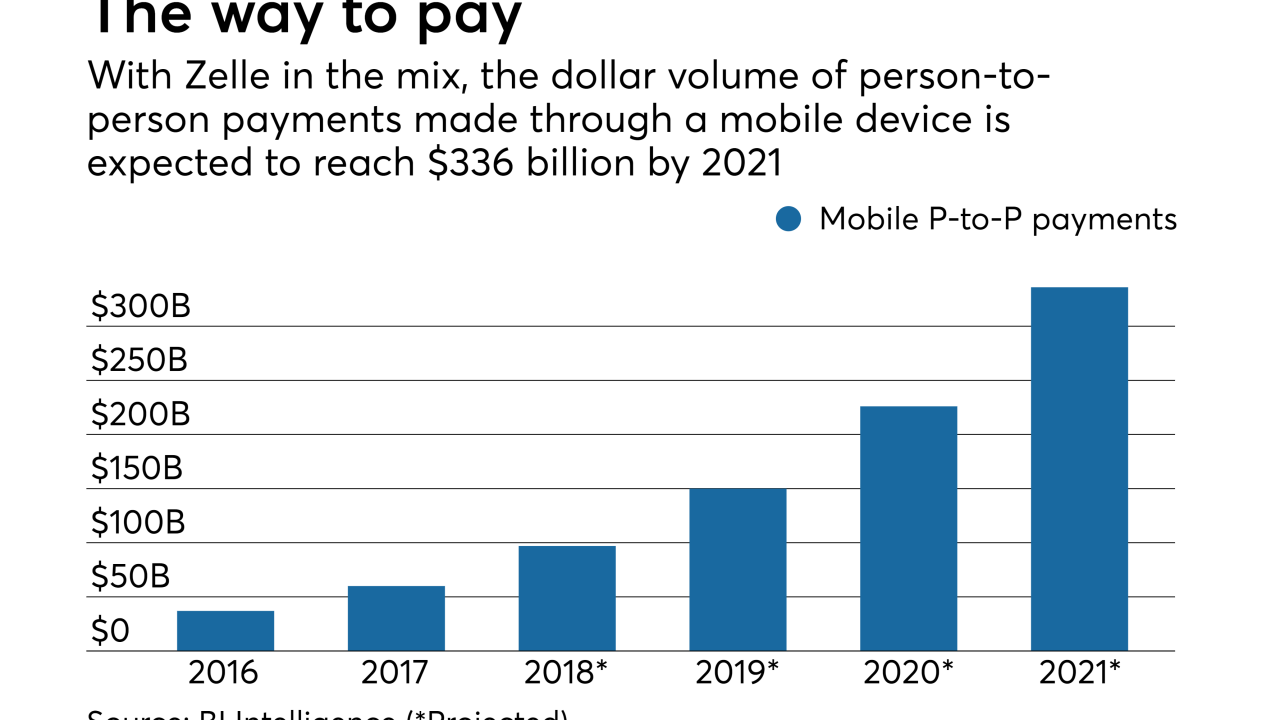

As Venmo does battle with Zelle and Square for consumers' P2P payments, one thing is clear: Innovation is not cheap.

October 15 -

For bankers and network providers, it’s a given that moving to a real-time payment system like Zelle will lead to an increase in fraud attempts. Here's a look at the ways they're fighting back.

October 10 -

Zelle doesn't require a bank or credit union to participate in its network to allow it to receive funds; so even Zelle holdouts will see some activity on their accounts. This allows credit unions to compare members' demand to usage, and to determine whether signing up with Zelle is worth the trade-offs.

September 24 -

One expert says the U.S. lags behind other countries, but changes are coming soon – and fast.

August 17 -

Zelle is working on ways to ensure that customers can safely pay small businesses as well.

August 16 -

The person-to-person network also saw $28 billion in payments in the quarter and it added more bank members.

July 26 -

Zelle, the bank-owned P2P network operated by Early Warning, saw an 11% increase in payments volume during the second quarter from the previous quarter as it gradually adds financial institutions to its network.

July 26 -

"It was a difficult decision, but we’re at a good spot to do this,” Finch, 55, said in an interview.

May 17 -

Regardless of which bank a consumer uses, the Zelle interface should look more or less the same. This is the part of the customer experience Zelle controls and sells to consumers, making it the best way to deliver its security message.

May 7 -

Banks using Zelle share the good, the bad and the indifferent of the person-to-person payment network.

April 25 -

There are lots of layers technology risk-mitigation features, and in addition, network-level mitigation is provided as well, writes Robb Gaynor, chief product officer at Malauzai.

April 24 Malauzai

Malauzai -

The bank faces June 15 AML compliance deadline; the features that make Zelle popular with customers entice thieves.

April 23 -

By adding direct deposit for payroll, Square is diversifying the Cash App as it competes in the P-to-P space with Venmo and Zelle.

March 7 -

As an industry, we owe it to our customers and end users to deliver banking and payments that function in real-time and meet their expectations, writes Paul Kobos, senior vice president of banking & payments for Gemalto.

February 12 Gemalto

Gemalto -

To pitch their payments system of the future, U.S. banks hired Daveed Diggs, an actor best known for playing Thomas Jefferson and Marquis de Lafayette in the Broadway musical "Hamilton."

February 2 -

For financial institutions to match Venmo and Apple Cash's power, they need an embedded, mobile and social payment strategy, write Richard Crone and Heidi Liebenguth of Crone Consulting.

February 2 Crone Consulting LLC

Crone Consulting LLC -

The P-to-P payments service promises to clear transactions in near-real time, but many consumers have complained that they have been unable access their money or even open accounts. Zelle has acknowledged the delays and says they are a result of its rigorous enrollment process.

January 17 -

Interac's e-transfer system has jumped in usage, and has become a gateway for myriad other services including a collaboration with MoneyGram.

December 15