-

It’s unusual for a seemingly healthy company’s website to implore its U.S. customers to seek out a competitor with less than a month's notice, but cross-border payment processor WorldFirst has done just that.

February 12 -

As another possible shutdown looms, concerns about furloughed workers’ credit histories have shifted the reform discussion away from data security.

February 11 -

A potential government shutdoown looms over a busy week in Washington that includes the National Credit Union Administration's monthly board meeting.

February 11 -

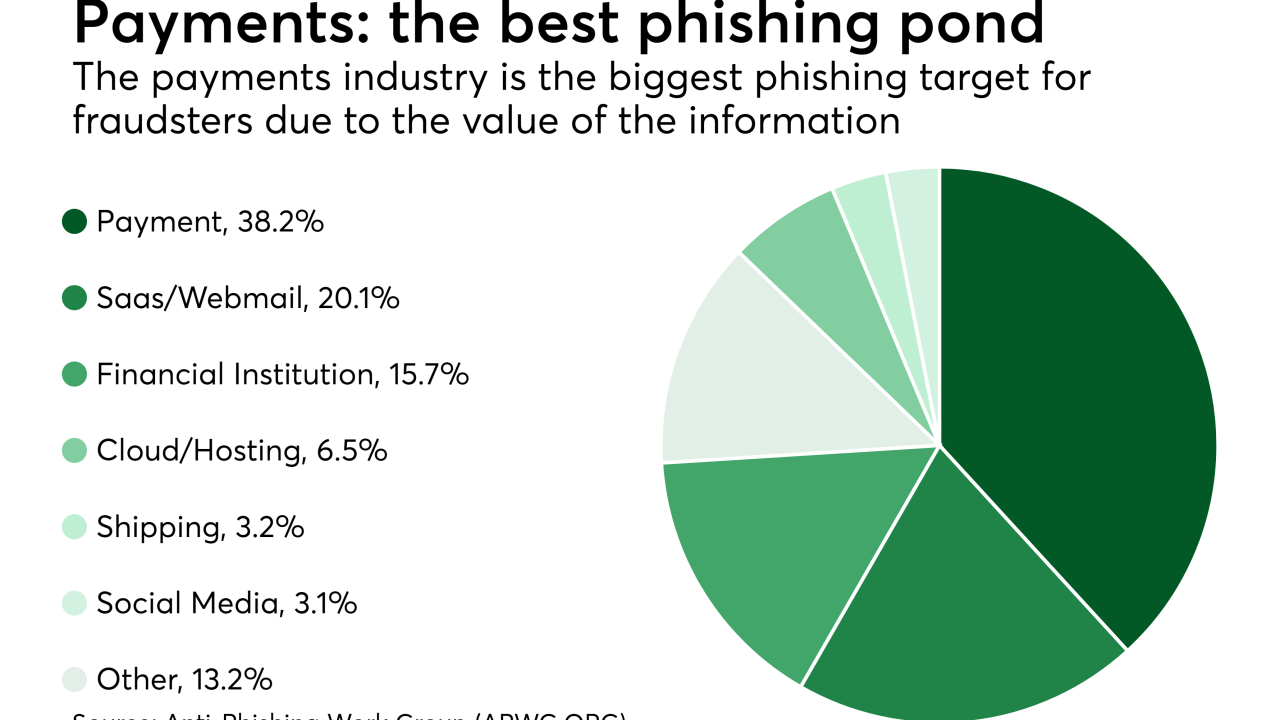

Today phishing scams have become so elaborate that they can take a variety of forms, including a phony job interview.

February 7 -

It’s past time for every organization handling sensitive data to lock down their security, and to stop relying personally identifiable information to verify users, writes Ryan Wilk, vice president of customer success for NuData Security.

February 7 NuData Security

NuData Security -

A former audit executive at Citi and Amex, Julie Scammahorn is replacing David Julian, who remains on administrative leave. She will join the bank in April.

February 6 -

After essentially failing its 2013 CRA exam, BBVA Compass embarked on an ambitious plan to achieve the highest possible CRA grade. Here’s how it succeeded.

February 6 -

The Feb. 13 hearing marks a turning point in long-running efforts in Washington to ease banks and credit unions' fears about serving the cannabis industry.

February 6 -

The Feb. 13 hearing marks a turning point in long-running efforts in Washington to ease bankers' fears about serving the cannabis industry.

February 6 -

The pushback on stores that don’t accept cash seems to be gaining momentum, with Philadelphia the latest municipality to consider a law that would ban cash-free shops.

February 6