-

A report from CO-OP Financial Services showed how credit union members' spending patterns adapted to social distancing during April.

May 14 -

With the pandemic's economic toll leading to elevated billing error notices, the consumer bureau said card companies will not be cited if they fail to meet the typical time frame for resolving disputes.

May 13 -

The Independent Community Bankers of America would not rule out legal action if Congress doesn't address the National Credit Union Administration's recent decision expanding the low-income designation.

May 13 -

Cross River Bank, a banking-as-a-service provider to fintechs, has signed Remitly to leverage its new push-to-card international payment service for near-real-time remittances.

May 13 -

The head of the U.S. central bank said its emergency credit programs were not designed to prop businesses up over the long term.

May 13 -

A negative Federal Reserve policy rate is still improbable, but if it were to happen it could be a net benefit, according to a note from JPMorgan Chase.

May 13 -

The move is the first time the bank has provided services to digital currency players; the Washington Post and four other heavy hitters want details on PPP and small business disaster loan programs.

May 13 -

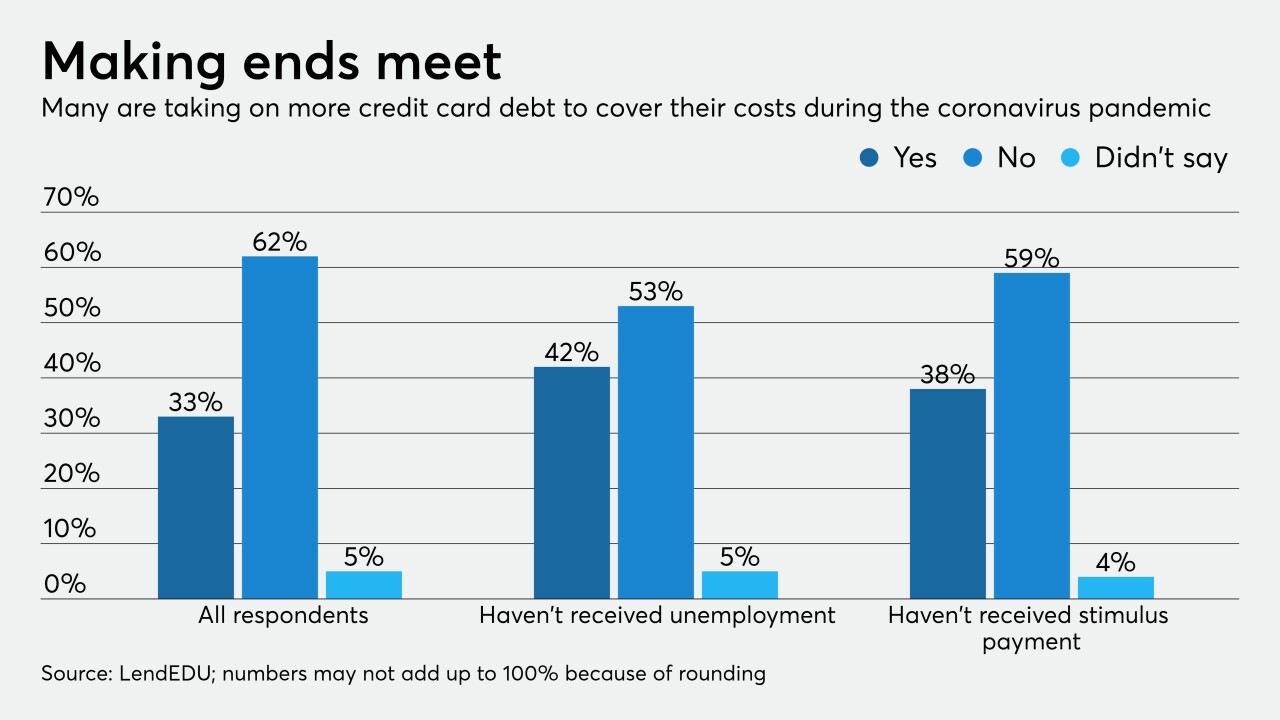

Despite some improvements, almost one-quarter of respondents to a LendEDU survey were still waiting on their relief checks and those consumers are more likely to take on additional credit card debt.

May 12 -

Cross-border payment fintech dLocal is partnering with Canadian e-commerce company Shopify to enable small businesses to offer local payment methods in more than 19 currencies in emerging markets.

May 12 -

The Georgia-based credit union hopes to gain more flexibility to widen its field of membership by switching from a federal charter.

May 12