-

Visa's growth beyond plastic cards relies heavily on tokenization, a strategy that should get a major boost from its planned acquisition of CardinalCommerce.

December 1 -

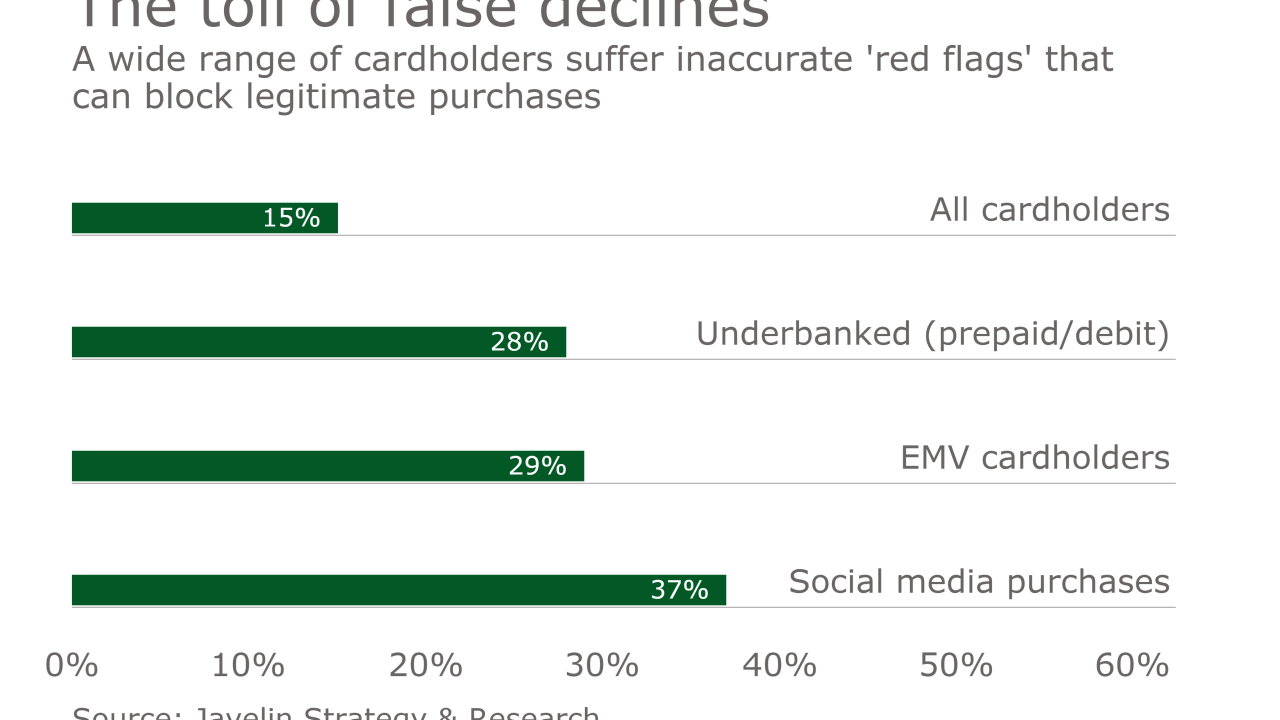

Inaccurate rejections of legitimate transactions aren't a new problem, and companies can't always use past transaction data to spot future risk on a large scale. Artificial intelligence can change the game.

December 1 -

Banks tend to respond to ATM and payment breach risks after an incident. They need to get more proactive.

December 1 CAST

CAST -

The bank consortium R3 CEV has released its Corda platform as open source to encourage innovation and interoperability in the industry's development of blockchain technology.

November 30 -

With access to financial transaction data under threat by hurdles imposed by certain financial institutions, it should be up to consumers to decide how their data is used to improve their financial well-being,

November 30Financial Data and Technology Association of North America -

Financial industry groups have rolled out a plan for keeping bank customers' data safe if a mega-disaster, like a massive attack or a natural disaster, strikes.

November 29 -

The growth of China’s fintech scene is providing a less developed financial market with much-needed updates. But those improvements also serve as a stepping stone to bring Chinese fintech players to Western markets.

November 29 -

As the holiday shopping season kicks off, retailers are preparing for an influx of payment volume from shoppers and scammers alike. Here are a few of the problems they face.

November 28 -

JPMorgan Chase seeks to reshape its business through technology, but there is a natural gap between the megabank and Silicon Valley startups. Larry Feinsmith's job is to bring the two together.

November 28 -

Stripe Inc. raised new financing that values the startup at about $9 billion, cementing its status as a major player in the crowded digital payments space and heralding a possible initial public offering.

November 28