Silicon Valley, New York, London and several of China’s largest cities are the world’s leading fintech hubs, but many other locales are gunning for their crown.

The emerging fintech hubs are tiny in comparison to the giants, but they’re rolling out the welcome mat to startups with innovative regulatory policies and incentives.

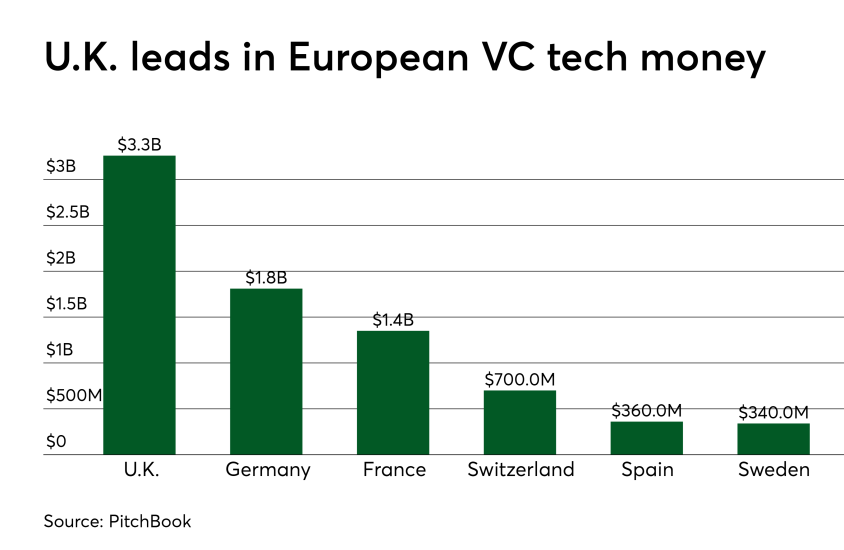

One reason fintechs might look to base their operations in emerging hubs is the high cost of doing business in tech centers like San Francisco and New York, along with the threat Brexit poses for London’s future. Here are some examples of fresh activity in new fintech zones, and a look at the fintech power the U.K. still controls.