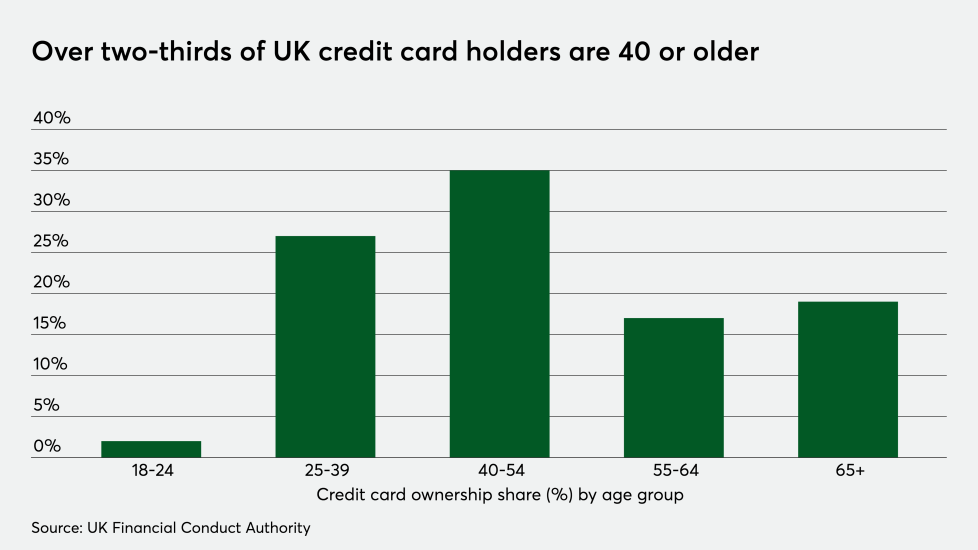

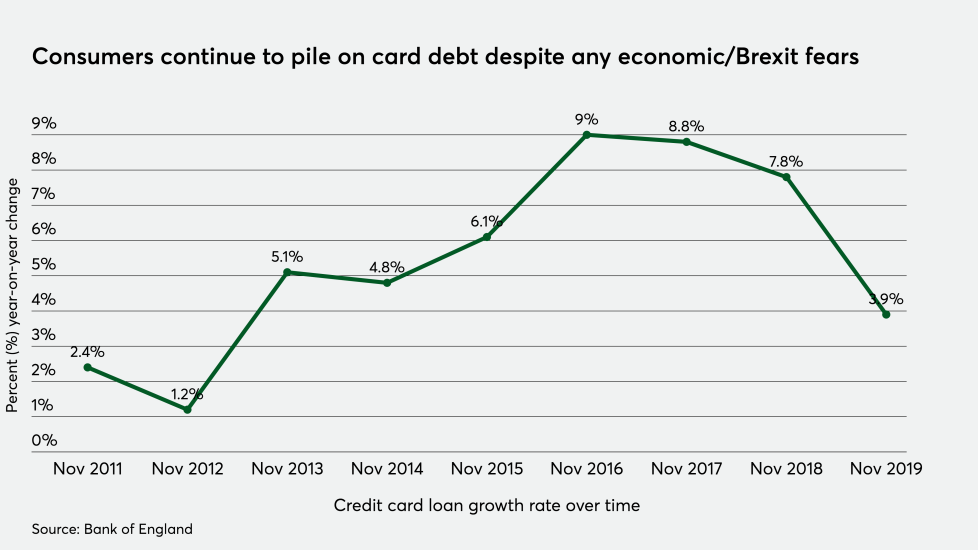

While not as large as the U.S. both in number of people and number of credit card owners, the U.K. remains a very lucrative market for issuing banks and card networks, as well as a host of alternative financial service providers catering to younger, underserved consumers.

In 2017 there were just over 32.3 million adult credit card owners possessing a total of roughly 60 million cards or about two different cards per owner, according to the

In comparison, according to the