-

Last year, the Raleigh, N.C.-based Integrated called off a deal to sell itself to MVB Financial after bank stocks took a hit in the aftermath of the regional bank failures. Capital hopes to expand its government-guaranteed lending with the transaction.

March 28 -

The banking giant has launched an online platform that links small-business owners and entrepreneurs in need of capital to community development financial institutions. The platform was developed in partnership with Community Reinvestment Fund USA.

March 27 -

Each spring during the rush of annual meetings, a handful of financial institutions take heat from shareholders who demand new strategies, management shakeups and, at times, even a sale of the company.

March 26 -

Wars in Ukraine and the Middle East. Fiercely polarized U.S. politics. Rapidly multiplying payments options on social media networks and elsewhere. Those factors and more are making it harder than ever for banks to combat illicit financial transactions.

March 25 -

In a simulation exercise hosted by the Global Resilience Federation on Tuesday, banks and credit unions tested their ability to withstand an industrywide wiperware attack.

March 20 -

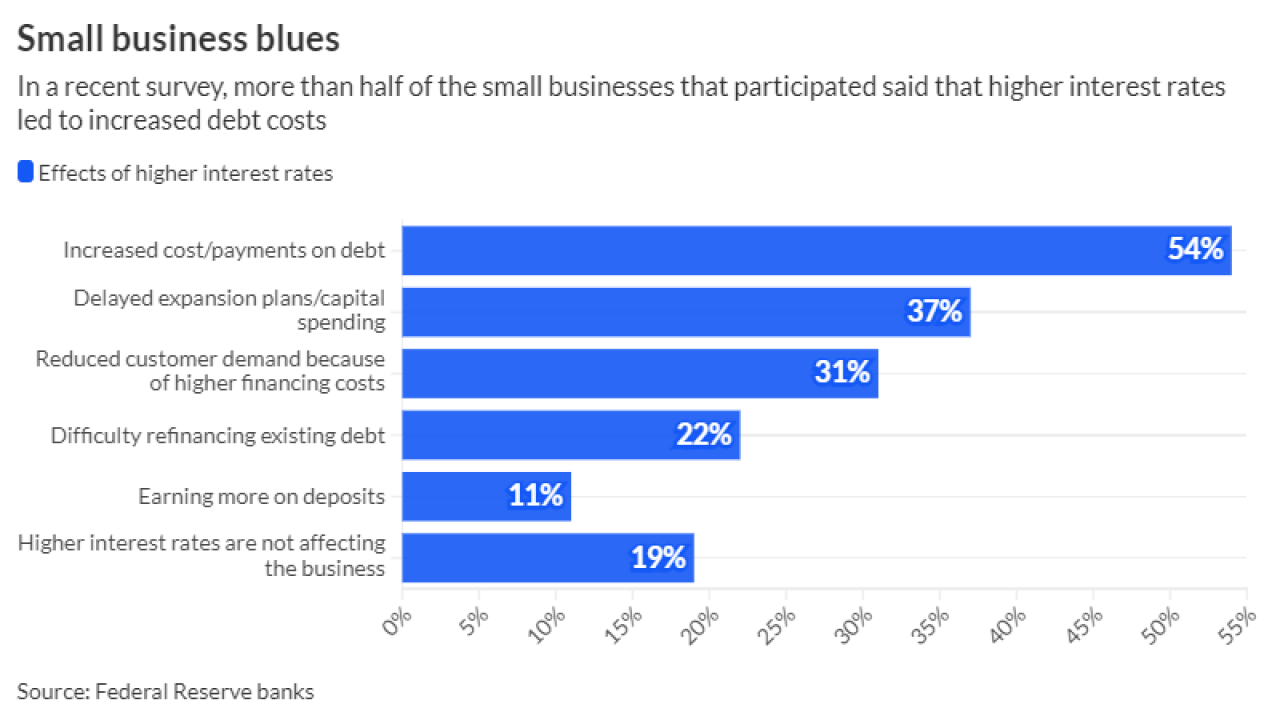

Some 54% of small businesses said in a recent survey that elevated rates had led to higher debt payments. And in a sign that loan demand remains soft, 37% reported delaying expansion plans or capital spending.

March 18 -

Larger banks are responsible for a special assessment to cover the costs of the failures of Silicon Valley Bank and Signature Bank. The price tag has ballooned by $4.1 billion, and trade groups are criticizing the FDIC's process, arguing that it lacks transparency.

March 13 -

The agency had intended to block access to tax data by most lenders on June 30 as part of a policy change that sought to protect taxpayer privacy. But drew broad opposition from the financial services industry.

March 12 -

The attack is one of three major incidents the lender has suffered in the past three years.

March 12 -

Bank of America, Citi and Navy Federal are among banks and credit unions to recently manage through unforeseen challenges.

March 11