As consumers are increasingly moving to mobile devices to conduct financial transactions, they are enticing fraudsters to follow them into the mobile channel, according to new research from TransUnion's iovation unit.

Mobile device usage as a percentage of all online transactions has increased from 28% in 2014 to 61% in 2019, according to iovation. A major driver of this shift has been consumers using their bank’s or issuer’s mobile app. Mobile app usage went from 15% in 2014 to 39% in 2019, while mobile web transactions went from 14% in 2014 to 22% in 2019. However, since 2017, the percentage of suspected fraudulent transactions increased by 138% — far outpacing overall mobile transactions, which grew only 30% in that time period.

“We found that 61% of the traffic is coming from mobile. It is important for businesses to consider the mobile-first approach to serving customers,” said Molly Hetz, product marketing manager at iovation.

The mobile-first mentality among banks and credit card issuers needs to be taken to heart, in particular as it means serving the latest generation of customers coming into the financial industry: Gen Z (born in 1996 and afterward). While millennials are often referred to as the online generation, Gen Z is the first truly mobile generation having been given mobile devices (often hand-me-downs from parents and siblings) at a very early age.

Despite the mobile-first mantra being espoused by iovation and others in financial services, a bigger challenge arises when it comes to authenticating existing users. While iovation reports that its repository of device knowledge can help issuers spot fraud, it doesn’t necessarily help consumers as they try to log into a financial account.

TransUnion acquired iovation last year to provide TransUnion and its clients with insight into nearly 5 billion unique devices such as smartphones and tablets across more than 50 countries.

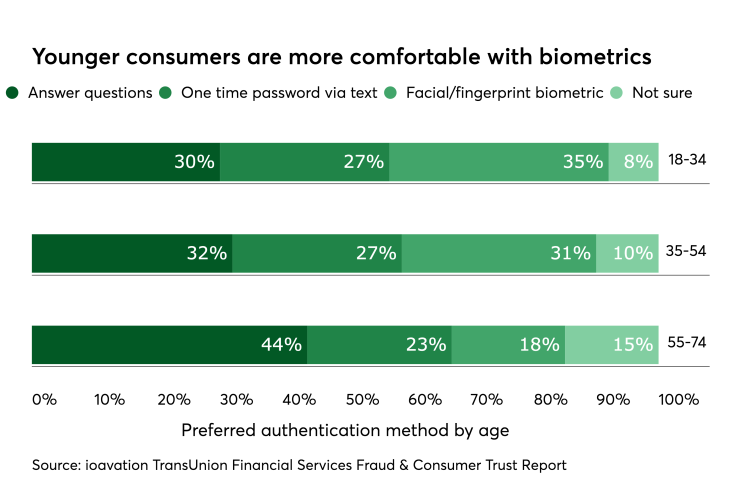

“The biggest takeaway for us was the security protection methods choice by age. Institutions need to service a diverse set of needs,” added Hetz.

While there was no single preferred method of authentication across all ages in iovation’s survey of 1,604 adults in the U.S. and U.K., there were some significant differences. Almost twice as many 18-34 year old consumers preferred using facial and fingerprint biometrics to authenticate themselves compared to consumers 55-74 years old, at 35% vs. 18%.

Older consumers (55-74) were more likely to prefer answering questions, e.g., knowledge-based authentication, to gain access to a financial account.

The iovation study found that income also had a major influence on preference for biometrics vs. questions which iovation reported is more likely due to familiarity based on ability to purchase the latest smartphones which use facial recognition.

About 36% of consumers earning $100,000 or more preferred biometric authentication compared to just 27% of consumers earning $50,000 or less. Roughly 39% of lower income consumers preferred answering questions in comparison to just 28% of $100,000+ earners.