Amazon's recent acquisition of

However, the human element plays a critical role in retail for a number of reasons, not least as a physical and psychological barrier to in-store product losses, or "shrink”. As self checkouts become increasingly pervasive in retail, and particularly at grocery stores, so does the opportunity for checkout fraud for consumers that see little chance in getting caught substituting a

There is clearly a trade-off between speed, convenience and security at the checkout. The question is, in the brave new world of automated checkouts and even automated stores, where is the point of equilibrium?

The increasingly time starved and demanding consumer

Societal expectations of real time everything are permeating all aspects of 21st Century living. As a result, brick and mortar retailers that can’t satisfy shopper’s ever more demanding requirements for shopping, bagging and paying may be met with literal cart abandonment.

A

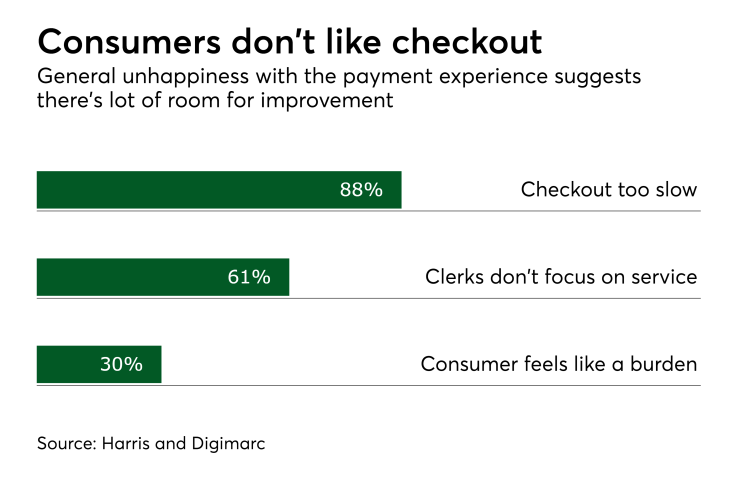

Given the last point of the customer experience in store is the checkout, a bad experience can also contribute to a retail hangover, with 50% of shoppers avoiding stores perceived to have long lines. Further evidence of the desire for faster and more efficient checkouts comes from a

The growth of shrinkage via self-checkouts

Retailers are reporting an increase in the levels of shrink, with groceries being one of the hardest hit areas. A

The retail industry therefore faces a trifecta conundrum: how to meet consumer demands, reduce costs and mitigate shrink at the checkout. A retailer can pick two of the following: Meeting consumer demands and mitigating shrink would require increased staff and / or technology, therefore negating cost reductions; Meeting consumer demands and reducing costs would probably require an increase in unattended checkouts, hence more shrink; Or reducing costs and mitigating shrink would result in a slower and more draconian approach to security, a scenario unlikely to meet consumer demands.

Hacking the human

There may be a solution, humanizing the non-human.

Extreme personalization. In Japan it is common to see the anthropomorphization of static objects to provoke an empathic human response, since objects frequently have "‘faces". While this may have mixed results in the U.S, humanization and personalization could tweak self checkout behavior. This could be as simple as having the checkout announce your name based on reading the store loyalty card or credit card on file. Personalization removes the perception of anonymity.

Moral triggers. Another technique is the “moral trigger," such as flashing announcements on checkout screens relating to the amount of donations made to a charity through the terminal. It doesn’t discourage theft directly, but it tugs on the moral compass of the shopper at the point that fraud may be committed to encourage a socially positive act.

Social proofing. It is common to see signs in hotel bathrooms requesting that guests place their towels on the drying rack to reduce the impact on the environment. Typically, a third of guests comply. However, a 2008 experiment where U.S. researchers changed the changed the signs to read that "75% of guests" chose to limit their towel washing, the number of guests who chose not to have their towels washed jumped to almost half. This technique, known as “social proofing” seems to prove that most of us want to be in a club. At the checkout, the message could be recalibrated to encourage shoppers to behave well.

The above measures make sense in adding a component of social responsibility and accountability to the self checkout experience, but these may be somewhat short lived as shoppers get wise to the technology and simply ignore these behavioral hacks. Nonetheless, innovation in this area is likely to continue as the industry evolves and needs to meet the demands of consumer and retailer.

It remains to be seen to what degree the human element can be removed from the retail experience before customers are turned off and the level of shrink outweighs the level of savings from automation. Amazon may well take us there.