Automatic payments have passed paper checks as the most popular method for reconciling recurring bills, the results of a new study by MasterCard International show.

The 2005 MasterCard Recurring Payments Awareness Study, released in October, found that 67% of households surveyed now pay some recurring bills automatically. Sixty-four percent of the responding households reported writing checks for some bills.

Among automatic bill payers, 38% of respondents said they pay recurring payments with credit cards, 31% with debit cards, 24% from checking accounts using the automated clearinghouse system, 14% through online banking and 9% directly from their paychecks.

The study also found that the number of bills paid automatically rose from an average of 3.1 bills per household per month in 2000 to 4.4 bills in 2005. During that five-year period, the number of checks written declined from 4.4 to 2.4 per month among the responding households.

The utilities and services for which surveyed consumers reported paying automatically most often include health club memberships, 56%: Internet services, 49%; life insurance, 47%; prepaid toll passes, 47%; wireless telephone service, 43%; automobile insurance, 41%; and cable or satellite service, 41%.

The consumers surveyed generally said they paid automatically because they found it convenient, easier than remembering to pay on time, quicker and cheaper because of the lack of late fees. They also said they liked being able to earn rewards points by paying their bills using debit or credit cards. Some felt more comfortable linking payments to cards because they believed biller mistakes are more easily corrected with card payments than with ACH payments from their checking accounts.

Among credit card recurring payment users, 67% said they would be more likely to cancel a credit card that is not linked to recurring payments than one that is. And 54% of debit card recurring payment users said they would be less likely to change banks because of their recurring payments setup.

"When somebody uses a debit or a credit card for automatic bill payment, they're less likely to change those cards," says Adrienne Chambers, MasterCard vice president of program development.

Despite such popularity, many consumers do not know they can link recurring payments to their credit and debit cards, Chambers says. "People just don't have knowledge that these service providers allow them to pay that way." She says issuers should analyze their portfolios to identify cardholders who are likely candidates for recurring card payments.

Then they should advertise accordingly, Chambers says, adding that issuers also can list utility and other service providers that allow card-based recurring payments on their Web sites or in mailers. "MasterCard also tries to help that along," she says. "We have a whole section on Mastercard.com that is a directory of service providers (that accept cards for recurring payments)."

The study, conducted in May and June, included in-person interviews with 762 consumers between the ages of 21 and 64. Those surveyed were responsible for paying most of their household's bills. Each person surveyed also held a personal credit card, debit card or both. Half were men and half were women, and respondents were from 25 geographically different markets.

METHODS OF AUTOMATIC BILL PAYMENT

Credit card 38%

Debit card 31

Checking account 24

Online banking 14

Paycheck 9

Source: MasterCard International. Percentage of household survey respondents who pay bills through automatic payments.

(c) 2005 Cards & Payments and SourceMedia, Inc. All Rights Reserved.

http://www.cardforum.com http://www.sourcemedia.com

-

PayPay is the latest international fintech to signal entry into the U.S. fintech investor market with an IPO that has been planned by SoftBank for years.

February 13 -

Attorneys from Holland & Knight warn that Treasury is targeting financial services companies in Minneapolis and at the southern border in an AML crackdown.

February 13 -

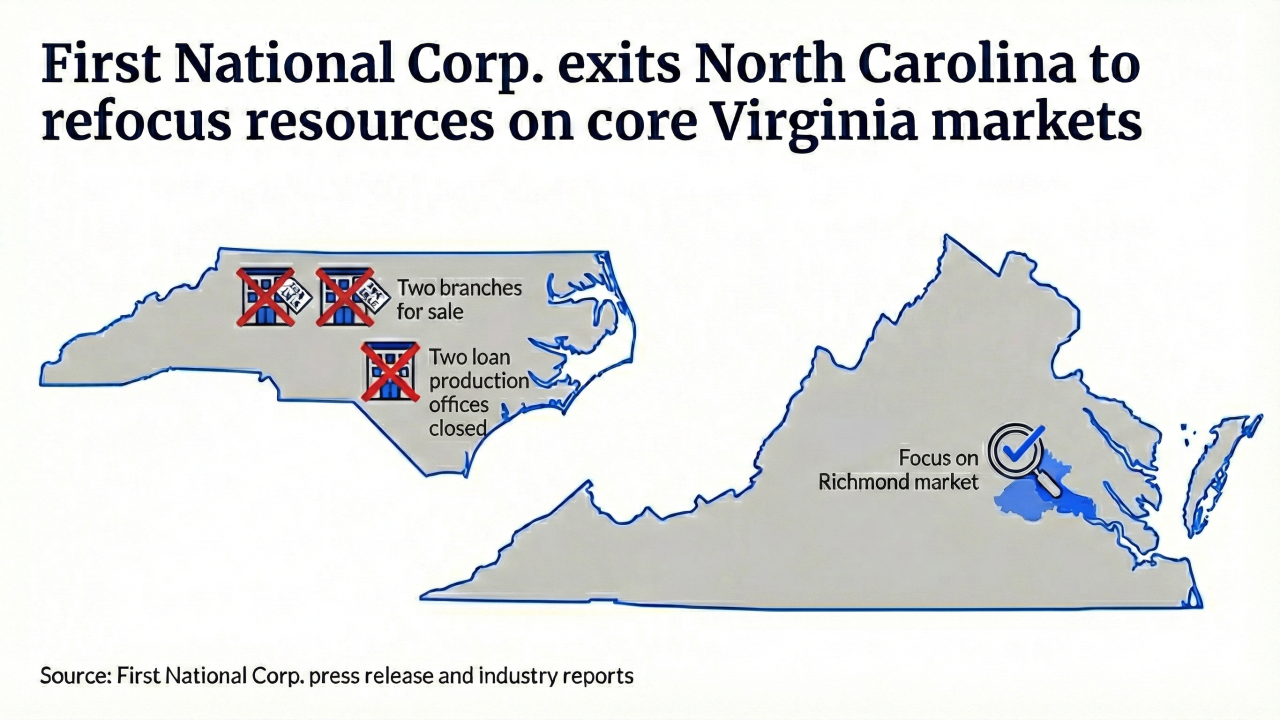

First National Corp. in Virginia announced the sale of its two North Carolina branches. Meanwhile, a number of larger competitors are laying plans for growth in the Carolinas.

February 13 -

After losing nearly $700 million in the fourth quarter as bitcoin's valuation tanked, Brian Armstrong stressed product diversification will help the company navigate the downturn.

February 13 -

The New York bank's technology leaders have been working to reengineer back-office work and give some of it to Anthropic's Claude generative AI model.

February 13 -

The Bureau of Labor Statistics released its January Consumer Price Index Friday, showing that inflation rose 0.2%, while the annual rate eased to 2.4% after holding at 2.7% for several months. The data reduces the likelihood that the Federal Reserve will cut interest rates in the near future.

February 13