More U.S. states are legalizing sports gambling, providing a huge opportunity for payments companies that have been fattened by multibillion-dollar mergers.

Sports betting is a prime revenue source, given its volume in the U.S. alone is expected to expand from $104 billion in 2017 to $155.5 billion 2024, according to

Both FIS and Fiserv hope to use acquired gaming technology from Worldpay and First Data, respectively, to navigate the complicated payment processing, risk and regulatory requirements of sports betting. Both of these deals closed in July, giving the combined companies free rein to move ahead with new strategies.

"If you own both legs of the stool for sports gambling, and can do issuing and the services off of the same platform, the value is tremendous," said Joe Pappano, the senior vice president of gaming at Worldpay, now part of FIS.

Both Worldpay and First Data bring gambling processing businesses and experience to their new owners. Worldpay has been processing sports betting payments in the U.K. for years, where it was legalized much earlier; while

"The legalization of online sports betting is bringing added diversity to the traditional brick and mortar world of gaming, first to the internet gaming side and more recently to the palm of our hands via mobile gaming experiences," said George Connors, who oversees gaming solutions at First Data, now part of Fiserv. "As the gaming industry embraces new technologies to meet the demands of a digitally oriented audience, ensuring payments technology evolves accordingly will be critical."

Two of Fiserv's services for gaming include an ACH warranty, which helps enable access to bank accounts for the casino guest and mitigate risks for gaming establishments accepting ACH payments. The company also offers digital disbursement capabilities, enabling clients to provide digital payouts to players in real time.

FIS' Pappano has worked in gaming payments for more than two decades, joining the former Vantiv in 1992 and focusing on casino, iGaming, lottery and social gaming, among other products. A series of acquisitions has brought the former Vantiv to FIS, culminating in FIS' $43 billion deal to acquire Worldpay.

Sports betting is an industry banks have traditionally shied away from, but as more states legalize the activity, technology companies will look to grab bank clients that are interested in expanding their revenues from gaming payments.

Ten states have

Pappano's team helps provide the compliance checks that validates legal betting, such as age verification and geolocation that demonstrates the payment is coming from a jurisdiction and venue that is legal. Since most sports betting is online — Pappano estimates as much as 80% comes from New Jersey, for example — the digital payments have to be tracked to a legal source.

"If it's from an online or mobile offering, it has to be tied to a land-based casino, state lottery or racetrack," Pappano said. "So you're leveraging AML and an ecosystem that we have used in other jurisdictions that we're bringing to the U.S. Payments is the heartbeat of gaming and now that it's becoming legal banks are going to want to know how the controls work."

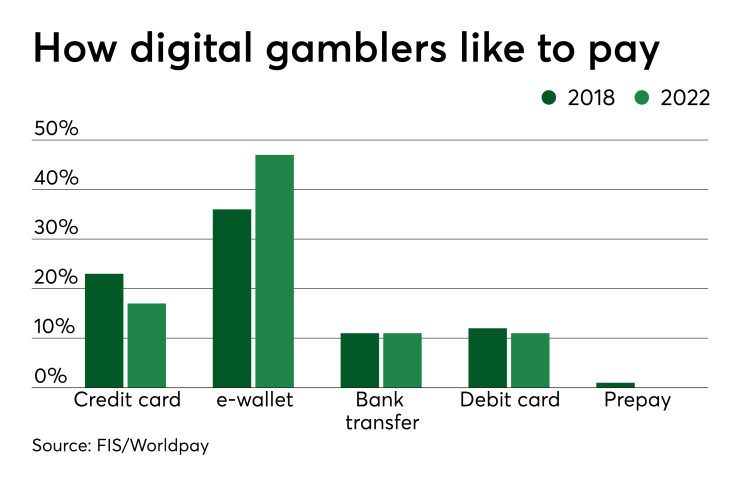

Beyond compliance, there is also a user experience challenge, such as ensuring integration between bank accounts and cards, digital wallets and other payment methods.

Sports gaming payments will likely be more complicated than other payment types, given the variety of wagers that are possible. Beyond results and point spreads, there is potential to bet on more real-time events, such as score by inning, and even pitch selection.

This has already spurred new niches, such as NBC Sports Washington's gambling telecast that supports wagering on in-game results. These niche-within-a-niche options will place a premium on compliance and real-time processing.

"The industry really boils down to finding simpler, faster, and more secure ways to move money," said Connors.