American Express' new blockchain technology could give the card issuer a trove of data on product purchases.

Amex has built a distributed ledger that merchants can use to tie card rewards to products they want to move off the shelf. For instance, if an auto insurance company wants to sell more policies or a coffee shop wants to serve more large coffees, it could offer American Express reward points for the featured items to make them more appealing. A merchant that wants to get people to download its app or join a program could offer the same enticement.

The blockchain lets merchants for the first time offer Amex rewards on their own channels, such as websites and apps, rather than through the card company’s channels.

But the real value of the company’s blockchain may be the purchase data it will record.

Product manufacturers want proof and an audit trail that show a promotion led to the purchase of a product, said consultant Richard Crone. Such product-specific information, referred to as "SKU-level data" because it includes the stock-keeping unit number on each product, is coveted.

“Card issuers have known this from the beginning,” he said. “They've been fighting for years to get SKU-level data. Retailers know this, and they guard that data judiciously.”

Using its new blockchain, American Express and its partners will be able to see and analyze such data.

“This is very disruptive technology,” Crone said. “You need a distributed ledger when everybody in the value chain needs to see what's going on, and [their records have] to be updated identically in real time.”

Users of the blockchain would be able to see what, when, where and how people bought things, and that could feed artificial intelligence programs that could present relevant offers, he said.

Though such a capability raises privacy questions, Crone said, “consumers have shown a very healthy appetite for trading data for relevant offers and services.”

Chris Cracchiolo, vice president of global membership rewards at American Express, said consumer privacy can be protected.

“The blockchain is designed to keep data passed on it very private, anonymized and secure, so there’s a level of trust in leveraging a blockchain," he said. "There’s no personal information shared and everything is tokenized."

The technology will also allow the company to share insights into promotions with merchants, Cracchiolo said.

“Leveraging blockchain gives us a level of detail that’s a bit unique, so we can track down to the point how and where points were awarded, the promotion they were awarded for, and that provides us with a lot of great insight,” he said. “It also gives the merchant insight into how customers are behaving that we can share back with them in reporting and a dashboard. Over time, they will have real-time access to the performance of these campaigns to be able to tweak things in real time.”

Crone said the new blockchain could be a threat to traditional proprietary database loyalty programs from players like Maritz, Affinion and FIS.

“It also could rattle and almost eliminate new entrants to this space like Cardlytics, which just went public, and Empyr,” he said.

John Ainsworth, CEO of CULedger and a former executive vice president of Mastercard, sees Amex’s effort as evolutionary rather than disruptive.

“This is a continuation of a trend of supporting distributed ledger as an emerging technology, not just in financial services but in retail and other industries,” he said.

CULedger offers Hyperledger-based blockchain technology to credit unions to manage digital identity, lending and cross-border payments.

“Blockchain technology is substantive, and it will be here for the long stay,” Ainsworth said.

One thing blockchains can do is connect businesses to one another and to consumers in a way that would have been difficult otherwise, he said.

“Because the technology is peer to peer, distributed ledger could enable those connections that would have been challenged before: retailer to manufacturer, manufacturer to consumer and so on,” he said. Additionally, the immutability and encryption of distributed ledger transactions offer protection to all parties.

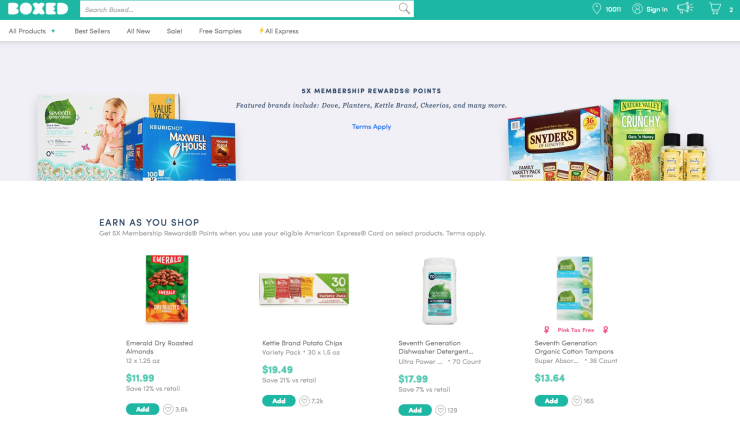

The first merchant using the program, Boxed, is an online bulk seller of goods like food, toiletries and paper products. Boxed has created a promotion in which it offers American Express cardholders five times the points they would normally receive on the purchase of about 100 products on its website. The points appear in the card member’s point bank within 24 hours.

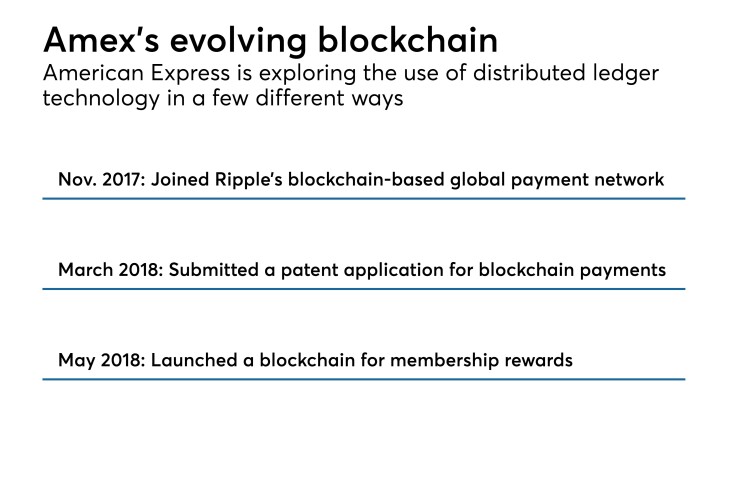

Building a blockchain

American Express used Hyperledger Fabric, the open-source distributed ledger technology that was originally based on software contributed by IBM and Digital Asset, to build its system.

The card company did not have to change Hyperledger Fabric much to make it work for this purpose, according to Cracchiolo.

"Making sure points [accrue] into [customer] accounts and that all that infrastructure works seamlessly and in real time is where the effort is,” Cracchiolo said in explaining the integration of the membership rewards program.

In American Express' iteration of Fabric, merchants create smart contracts to tie card rewards to sales of their products.

"The merchant is in the driver’s seat in terms of determining the value they want to give, to whom they want to give it, how they want to deploy that, and how they want to communicate that," said Cracchiolo. "It gives the merchant all the power in designing that offer to drive exactly the behavior they want to drive."

According to Cracchiolo, the blockchain technology provides speed to market — a new program can be deployed in a few weeks.

American Express is looking to expand the blockchain to other merchants in the near future.

“The value to American Express is that cardholders want to earn more points in more places, so we’re meeting a very important cardholder need,” Cracchiolo said. “The second piece is it deepens our relationships with merchants [and] allows them to leverage our currency in a powerful and unique way.”

Merchants are looking at creating their own blockchains to manage offer presentment, audit, accounting and transaction clearing on behalf of the brands they sell, Crone said.

“American Express is wise to dip their toes in here,” he said. “The traditional players that provide this today are all databases. Blockchain is an open, distributed ledger. Databases can do this but they use an [application programming interface] that it takes months to integrate with.”

If this concept takes off, are we all going to be flooded with exponentially more offers based on our recent purchases?

“It depends on who you enrolled with and what the user interface is you're using,” Crone said. “If you're a member of membership rewards, and you opted in to targeted offers at selected retailers, theoretically you should get more relevant, actionable offers and you wouldn't be bombarded. But how does that overlap from one retailer to another?”

Editor at Large Penny Crosman welcomes feedback at