Sensing a profitable opportunity in an underserved market, a variety of companies — ranging from traditional banks to fintech startups and even Amazon — are rushing into selling secured credit cards and other products designed for consumers with poor or thin credit.

The market for secured credit cards, which require a deposit and set a relatively low spending limit, generally ebbs and flows with the economy. It shrinks during recessions and grows when times are good; and given the current economy, the secured card sector is booming.

Because secured cards are designed for consumers with subprime credit, they are riskier for banks to offer due to a higher potential of default. Overall more than one in three (34.8%) U.S. consumers is considered a subprime credit, according to

“The problem with our credit system is that it punishes people for a very long time for any financial mistakes made that could have been the result of a situation beyond their control, such as an illness or job loss. It creates a huge market of people who need access to credit but are not being served by banks and it’s only getting bigger,” said Tim Coltrell, chairman and CEO of CARD, a prepaid card firm that's expanding to serve subprime credit markets.

The total addressable market is 53% of the U.S. adult population, when adding both subprime credit-scored consumers and a group named the “credit invisibles” by the

While the sheer number of people may be enough to compel some banks and fintechs to serve this market, the numbers alone don’t explain the gold rush. However, when examining who makes up the subprime and credit invisible categories, the opportunity becomes clear.

The CARD Act

This trend has its beginnings 10 years ago, with the passage of the CARD Act of 2009.

The act largely forbids issuing credit cards to consumers under 21, unless co-signed by a parent or guardian, and severely restricts credit card marketing on college campuses has cut off a traditional credit onboarding process for many consumers. Today most college students graduate without a credit card and a mountain of student debt — a toxic mix for most banks.

Millennials (ages 22 to 38) make up the single largest generation in the subprime market at a 37% share, followed by Gen Xers who represented 33% of subprime consumers in the fourth quarter of 2018. According to

“Millennials have some challenges in credit cards, without having the college cards that their parents had because of limitations mandated by the CARD Act of 2009,” said Brian Riley, director of the Credit Advisory Service at Mercator Advisory Group.

Other contributing factors include the heavy use of debit cards and the growth of installment lending by companies such as Affirm.

The CARD Act also changed the profit model of subprime cards, making it less attractive to banks, and added a compliance hurdle. The CARD Act eliminated universal default, retroactive interest rates and fee harvester cards, which were tactics used by banks to more profitably serve subprime consumers.

The act also required banks to make sure that a consumer has the “ability to pay,” or ATP, for a credit card line being offered. Banks that provide credit lines that are too generous could run afoul of ATP rules under the CARD Act. When it comes to low-income consumers with small credit lines, the margin of ATP error is magnified. After the 2008-2010 recession, many banks moved their marketing dollars to serving up reward cards for prime consumers.

The rising use of debit cards and the preference for installment loans for online purchases means that the adoption of credit cards is occurring much later in the lives of millennials and Gen Z.

Pushed out of prime

By 2019, prime consumers have been flooded with marketing for premium reward cards — such as the

“Subprime has some potential, but it is a niche. Other sectors such as mass affluent are highly saturated by card issuers,” said Brian Riley, director of the Credit Advisory Service at Mercator Advisory Group.

It may appear that banks have been sleeping on the opportunity to serve subprime consumers, but reaching a market with poor, limited and even no credit history requires a strong ability to innovate and a willingness to take risk. Banks are traditionally reluctant in both areas.

“The regulatory framework under which banks operate makes it difficult to innovate. It’s easier for them to buy an innovator. Also, when it comes to risk, banks have to answer to shareholders. Startups can take that risk because it’s in their DNA and their investors are VCs who are used to risk,” said David Girouard, CEO of Upstart, an online lending platform that uses nontraditional variables to predict the creditworthiness of loan applicants.

The launch of Amazon’s Credit Builder Card will enable consumers with poor or thin credit to put down a security deposit to shop online, while earning rewards on par with those offered to mainstream cardholders.

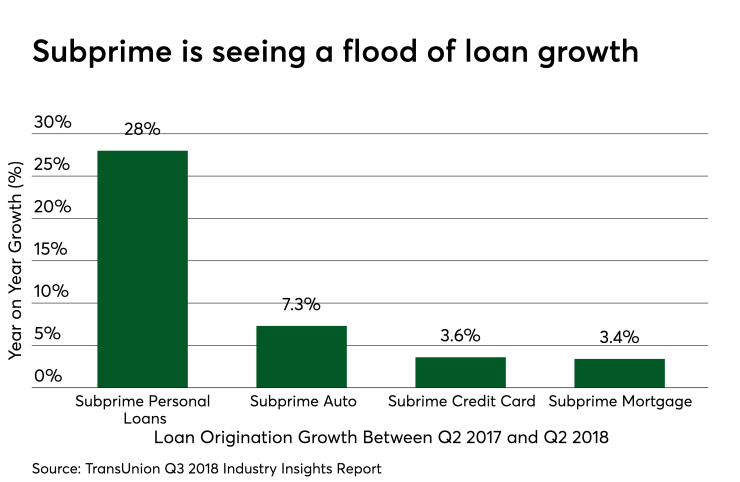

And it’s not just secured credit card that’s growing, but the entire subprime market overall. According to

For the full year of 2018,

“The future is bright as new technology is being applied to meet consumer financial needs. Companies such as Apple and Amazon will do something that will force traditional banks out of their comfort zones,” Salam Syed, vice president of business development at Marqeta, said at the SourceMedia Digital Banking conference in Austin, Texas.

Banks vs. startups

Given that new companies, as well as traditional banks, are rushing to serve a traditionally underserved segment of the market, there is a change being implemented in how companies are examining potential risk of subprime consumers that includes using artificial intelligence, and nontraditional credit variables such as rent payments. The

The reliance on using FICO scores to extend credit card loans is putting banks at a major disadvantage to the startups using AI, social media and nontraditional variables to score prospective customers.

“When FICO came out in 1989 it was quite novel and readily adopted by banks, mortgage lenders and the credit bureaus. Thirty years later, it has not evolved," said Girouard. "In fact, the FICO-centric model is archaic since it has not adapted with changing consumer spending and borrowing habits. It has created a massive underserved population with only about 45% of Americans having access to prime bank credit."

Similar to Amazon's approach, some banks are offering secured cards that give a line of credit based on the size of the security deposit placed with the bank.

However, the reach of secured cards is limited by the fact that banks are asking consumers to shell out a considerable amount of money for a security deposit when many don’t have the funds to do so. The

Justin Zeidman, head of credit card products at Navy Federal Credit Union, said his company took a renewed interest in secured credit cards after seeing fintechs encroach on that market. To make its secured credit card more appealing, Navy Federal lowered the secured credit line to a $200 deposit — and saw acquisitions nearly double.

"I know it's no secret secured credit isn't the most profitable place to play, but when you think about the lifetime value of being the first issuer to lend to someone — and then the value of that loyalty over the course of years and years — for us it made a lot of sense," Zeidman said at the SourceMedia Card Forum.

Venture capitalists have also taken notice and are putting billions of dollars into fintechs catering to this underserved market. According to Crunchbase, a website that tracks investments into private companies,

“In the credit card space, most issuers make their decisions based on consumers’ past credit histories, believing it’s a good indicator of future performance. However, by using artificial intelligence to observe current financial behaviors, an issuer can have a stronger view of potential risk, meaning a better approach to underwriting,” stated Anirudh Shah, co-founder and CEO of Habitual.AI, an AI-powered fintech based in India.

The truth may actually be that the current rush of new subprime cardholders are actually creditworthy. It could simply be that they have been forced into the subprime category because they lack any appreciable credit history.

If serving up secured cards is the only way banks believe they can tap this underserved market that includes 53% of U.S. adults, they may be missing out on the gold rush being mined by the likes of Petal Card, Deserve Card, LendUp, Affirm, and other fintechs.