In this age of diminishing brand loyalty, survival hinges on two things: the ability to differentiate and to exceed consumer expectations.

Data holds the key to both. Thanks to the increasing variety of available information and data sources, payment companies and lenders can now go much further, generating customer insights that open the door to enhanced services and cross-selling, while powering product diversification and opening new markets.

With data such a valuable commodity, lenders should welcome the news that consumers are increasingly willing to share it. Our research report into U.K. attitudes toward unsecured credit found that only 18% of credit applicants still think that a loan application asks too many personal questions. Consumer confidence is also growing in how lenders use data, and where they collect it from. Half of all consumers, for example, don't mind if a lender consults their social media channels to help inform a credit decision, a factor that rises to 58% for the millennial generation.

Put simply: the new data-driven lending economy is a big opportunity for lenders to make better decisions, attract more customers and broaden their base.

Where data collection is concerned, however, just because you can doesn’t always mean you should. While consumers might be willing to offer more, lenders need to evaluate carefully whether requesting new information will add tangible benefits. Social media, for example, is a window into a consumer’s personal lifestyle — their job history, likes and interests. This could be indicative of financial stability and responsibility, but equally it might not.

This example poses broader questions: Is social media data a genuine and reliable representation of an applicant? If not, should it be used as a factor in credit decisions? While half of those we surveyed said they would be happy for social media data to be integrated into credit applications, over a third of the market remains resistant. This suggests that lenders need to tread carefully; merely posing questions could turn applicants away.

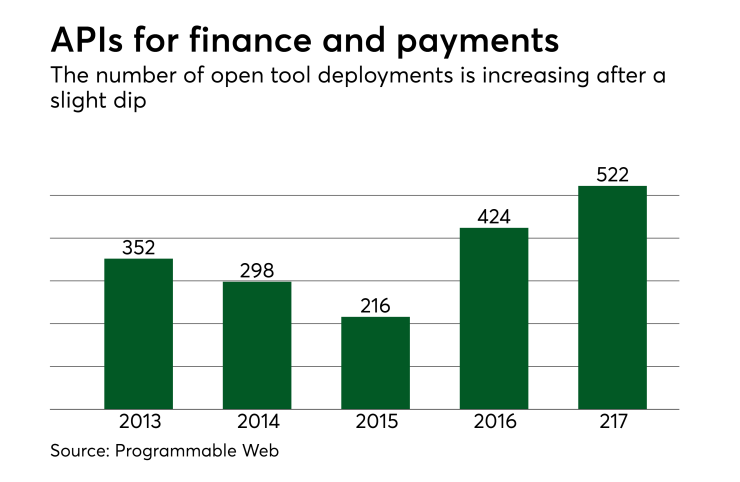

Making smarter use of more conventional data sources is a safer bet. Through open banking APIs, for example, lenders can now access (with consent) an applicant’s detailed payment history (including utility and rental payments, for example) — data that is likely to be far more valuable for assessing ability and willingness to repay.

It’s important also to note that an open data culture doesn’t equate to a free-for-all for lenders — consumers expect a reward in return. The "you scratch my back, I’ll scratch yours" sentiment has been successfully embodied by other financial markets — "black box" telematic devices have revolutionized segments of the car insurance market, for example, where policy holders consent to the collection of driving data in return for lower premiums.

Identifying gaps where more data is needed, and incentivizing consumers to help lenders plug them, is also important. But creating real value comes as much from the analysis and interpretation as the collection.

The ability to identify trends and generate insights that can be used to achieve differentiation and deliver better customer experiences is the key to success in an increasingly overcrowded marketplace. While this is a resource-intensive task for lenders, automated technologies and APIs are already making life easier, for example, by matching an applicant’s data with a marketwide panel of loan scorecards to match them to the best product for their financial circumstances. Having a lendtech infrastructure like this in place, one that delivers the technical agility and tools needed to integrate with new data sources as they become available, is crucial to freeing up lenders’ time so that they can focus on using data insights to create the products that strike the right balance for their businesses and their customers.