-

The data aggregator is recruiting partners such as Railsbank, Silicon Valley Bank and Marqeta for a project designed to make certain digital transactions easier to complete.

November 10 -

The company, whose software is used by four of the top five U.S. banks, says it will use the money to improve its identity verification and fraud detection technology.

November 9 -

After vowing for months to crack down on ransomware, the Biden administration and allied countries unleashed a string of actions Monday against one of the most prolific hacking groups and also issued sanctions against cryptocurrency entities that allegedly enable such attacks.

November 8 -

The bank is partnering with Anthemis to match investors with female entrepreneurs, who according to Findexable research attract just 1.5% of investment in the sector.

November 8 -

Northern Hills Federal Credit Union in South Dakota is one of several institutions testing tools that can deliver faster loan decisions, an edge they need against digital upstarts.

November 8 -

Citigroup, BNY Mellon, JPMorgan Chase and PNC are each working to enable wireless providers, public utilities and other companies to instantly receive funds from the consumers they bill.

November 5 -

Hispanic adults are underbanked compared with their white counterparts, according to the Federal Reserve. Challenger banks such as Tend and Viva First are reaching out to this population with bilingual services and low-cost money transfers.

November 4 -

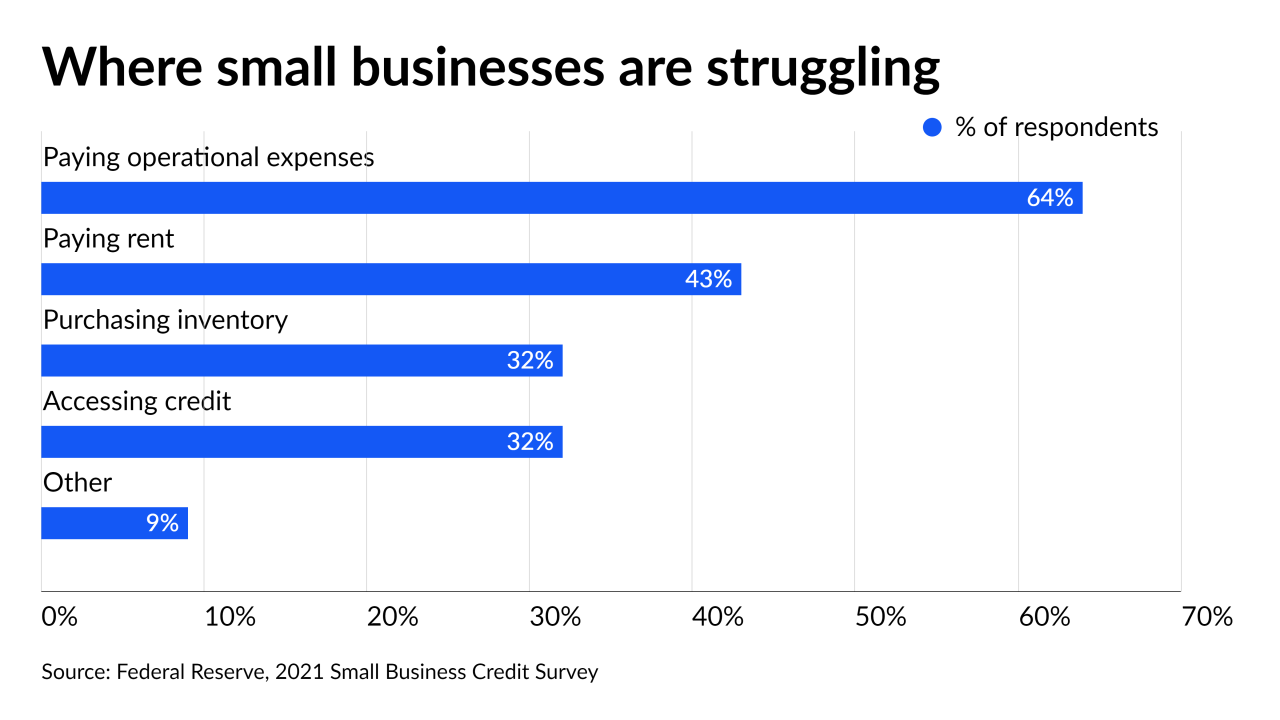

Digital upstarts like Square, Stripe and PayPal are invading community banks' turf by appealing to local merchants with a mix of electronic payments and lending. Small banks are fighting back by leaning into digital services while maintaining their personal touch.

November 3 -

With today’s generation of home buyers so rooted in a digital world, how will the financial services industry need to change to meet their needs? What new consumer technology will they need to adopt to meet consumers where they are? How will those approaches differ from how things have been done historically in the industry? Join us in a discussion with Blend’s Founder, Nima Ghamsari as we chat through how banks and financial institutions need to think through these questions.

-

If law enforcement concludes that the company's devices were used in a cyberattack on U.S. companies, banks may need to change the way they choose, test and monitor point-of-sale equipment.

October 29