-

At a House Financial Services Committee hearing, lawmakers on both sides of the aisle questioned the widespread practice of screen scraping and agreed that consumers should have a more direct say over how their financial data is handled.

September 21 -

The company's new app bundles banking services such as payments, buy now/pay later and direct deposit. But the company plans to add features that could include stock trading, a popular offering from tech startups.

September 21 -

JPMorgan Chase bought the college financial-planning platform Frank, the latest in a string of acquisitions the largest U.S. bank has made this year to compete with both big technology firms and fintech upstarts.

September 21 -

The companies each recently rolled out new contactless checkout technology as they attempt to turn Amazon Prime and Square Cash into platforms that let consumers pay for goods, save money, take out loans at the point of sale and conduct other financial services all in one place.

September 20 -

Vendors including Akoya, Plaid and MX are trying to help banks manage and view their application programming interfaces through data portals as an alternative to scraping consumers’ login credentials.

September 20 -

The U.S. subsidiary of Japanese banking giant Mitsubishi UFJ Financial Group has entered into a consent order with the Office of the Comptroller of the Currency that requires it to improve its information security protocols, hire more IT staff and create a board-level committee to monitor its progress.

September 20 -

President Biden urged a group of chief executive officers to help improve cybersecurity across the nation’s critical infrastructure and economy, citing a lack of trained professionals to adequately protect the U.S.

September 17 -

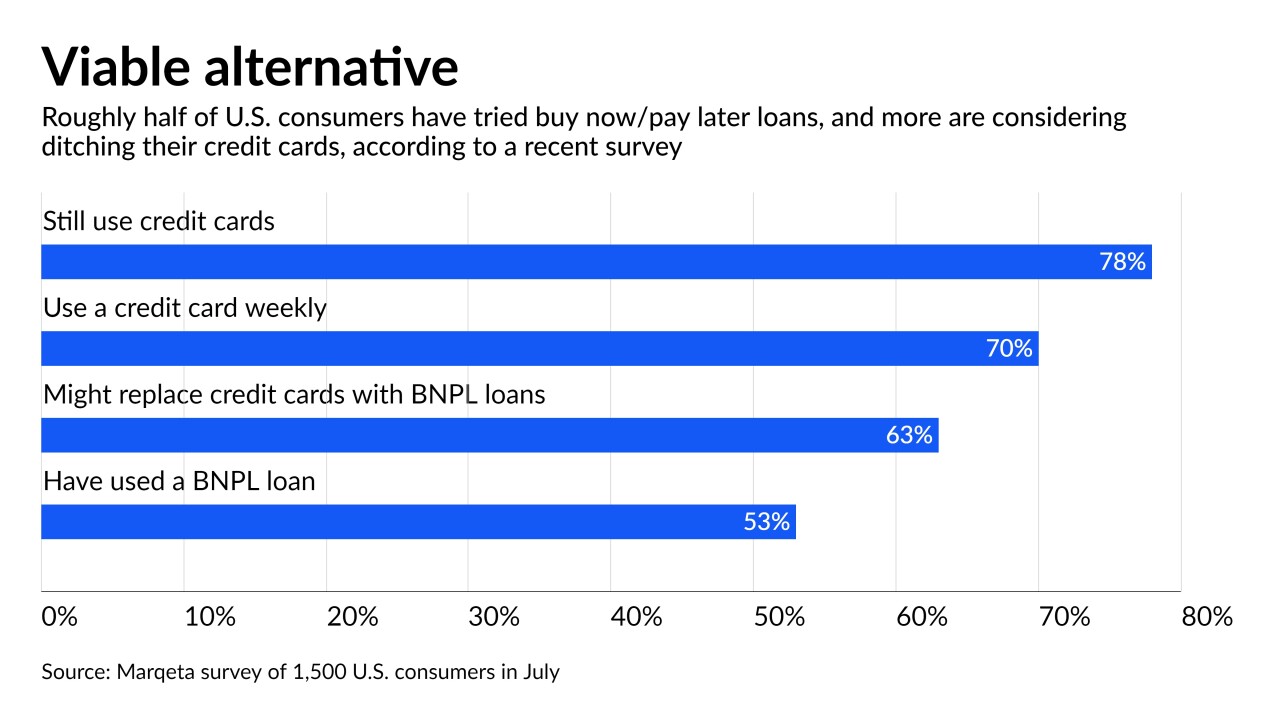

More than a third of installment borrowers are delinquent, according to new research. Fintechs and the banks that are following them into the market are willing to tolerate the credit risk — for now — because of BNPL’s rapid growth and the fee income from merchants.

September 17 -

Already in 2021, the nation's largest bank by assets has purchased more than 30 companies, including both fintechs and firms that are more removed from the financial industry. Here's a look at eight of those deals and the thinking behind them.

September 17 -

A long to-do list — from developing mortgage servicing requirements to revisiting payday lending rules — awaits Rohit Chopra, the administration’s choice to lead the consumer bureau. But it's still anyone's guess when the Senate will confirm him.

September 16