-

The lender traps consumers in an "exploitative cycle of debt," Brandon Scott said.

January 2 -

As artificial intelligence is integrated into more and more core banking operations, bank boards of directors need to make sure business continuity plans account for the possibility of AI system failures.

January 2

-

Articles about the AI deployments of big banks and of scammers generated clicks from American Banker readers.

January 1 -

Fintechs sought to acquire the rights and privileges of bank charters in various ways this year, from de novo applications to buying up banks.

December 31 -

The year was marked with six state regulations, new entrants, product and market expansion from existing EWA providers and buy-in from investors.

December 30 -

The fintech IPO drought ended this year with several large public exits by firms such as Chime, Klarna and Circle.

December 30 -

There is a narrow window of opportunity for banks to position tokenized deposits as an alternative to stablecoins for customers seeking the convenience of cheap, blockchain-enabled payments.

December 30

-

As stablecoins become an increasingly prominent feature of the financial landscape, Noelle Acheson gives us her top five trends to watch out for.

December 30 -

Stories about data breaches, fraud and one neobank were reader favorites this year.

December 29 -

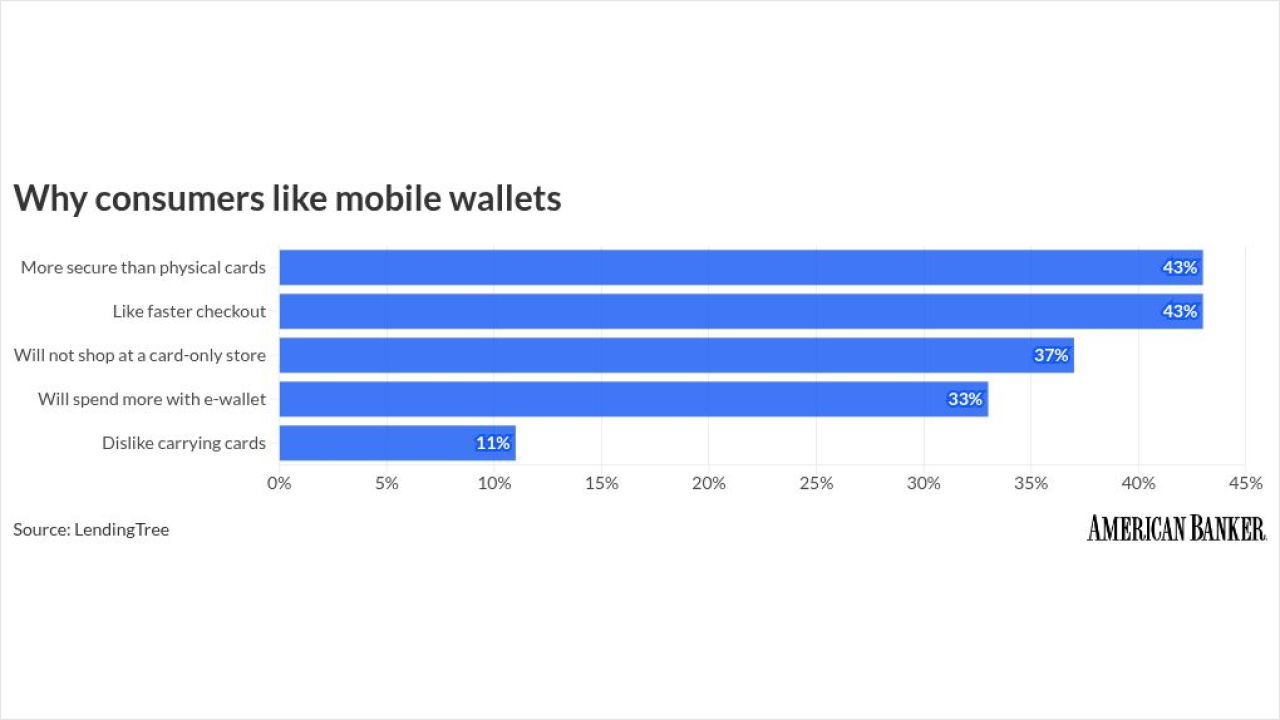

Consumer appetite for mobile wallets is growing, challenging banks to innovate to stay ahead.

December 29