-

President Donald Trump's plans to deregulate the financial services industry still lack detail, though Mastercard is betting on a more favorable legal environment in the future.

January 31 -

President Trump's order to eliminate two regulations for every new one does not apply to financial institution regulators, but may affect banks and credit unions in other ways.

January 30 -

The largest U.S. banks are treading lightly in response to President Trump's executive order banning travel to the U.S. by refugees and others from certain Muslim nations. Corporate statements emphasize the need for diversity while stopping short of outright opposition.

January 30 -

Mastercard CEO Ajay Banga was among the financial services, payment and technology executives to express worry or opposition to President Trump's travel ban for certain Middle Eastern countries.

January 30 -

After initially declining this weekend to weigh in on President Trump’s travel ban regarding refugees and others traveling from seven nations, Citigroup said Monday that it is worried about the order’s impact on its employees and customers.

January 30 -

Despite their global reach, the largest U.S. banks mostly stayed quiet in response to President Trump’s ban stopping nationals from certain Muslim countries from entering the United States.

January 29 -

If underwriting standards at other lenders begin to fall, how will CUs respond?

January 27 -

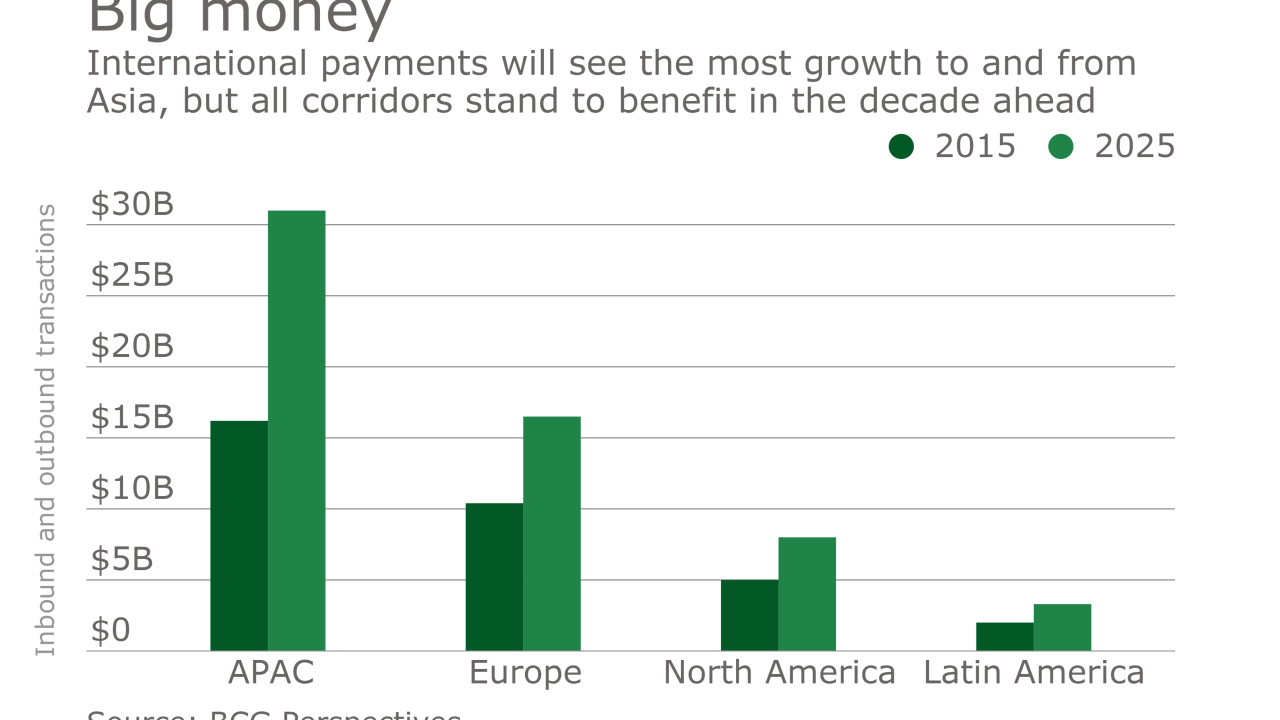

The U.S.-to-China payments corridor is one of the biggest in the world, according to the most recent World Bank data. It is dwarfed only by the U.S.-to-Mexico corridor, which the Trump campaign targeted as part of its border wall plan.

January 27 -

A new director of the consumer bureau must focus on how a still-relatively-young agency matures while maintaining a positive consumer protection agenda.

January 26 MWWPR

MWWPR -

A new director of the consumer bureau must focus on how a still-relatively-young agency matures while maintaining a positive consumer protection agenda.

January 26 MWWPR

MWWPR