-

Sen. Elizabeth Warren, the founder of the Consumer Financial Protection Bureau, said Thursday she would fight back against congressional efforts to delay or revamp the agency's payday lending proposal even while she acknowledged the plan could have been tougher.

June 2 -

Federal Reserve Board Gov. Daniel Tarullo said Thursday that he anticipates the agency will eliminate the qualitative requirements in the annual stress testing program for most midsize banks as early as next year.

June 2 -

The Consumer Financial Protection Bureau's long-awaited proposal to establish the first federal rules for payday, auto title and high-cost installment loans did not include a provision that banks had planned would allow them to compete by offering small-dollar installment loans.

June 2 -

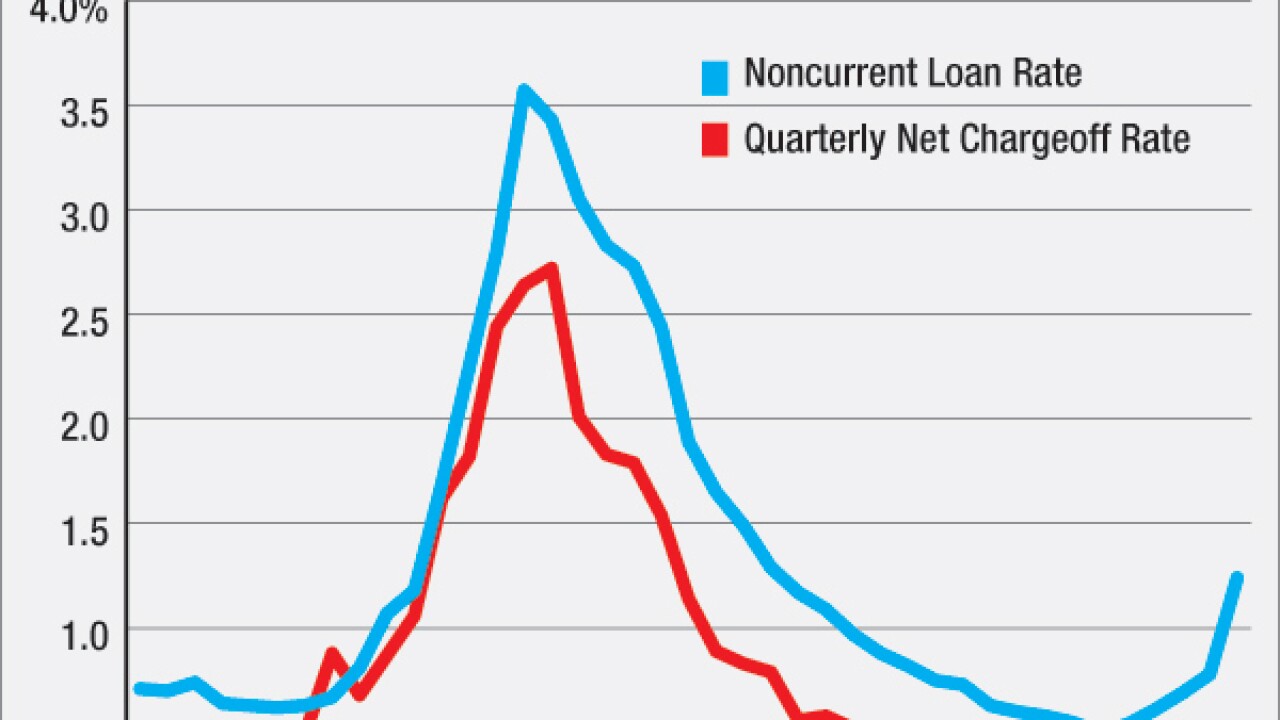

While there were positive signals like loan growth and improved interest margins in the Federal Deposit Insurance Corp.'s first-quarter report card, there were also signs of trouble for the future, including larger institutions' ongoing exposure to the energy sector.

June 1 -

The Independent Community Bankers of America said that it agrees with the Office of the Comptroller of the Currencys support for responsible innovation in fintech but that it worries marketplace lenders have a regulatory advantage.

June 1 -

We need to adopt a more nuanced view of credit that considers not only the cost of credit, but also the cost of default and the cost of having no credit.

June 1

-

The drumbeat of news about hackers stealing millions of dollars by gaming the Swift interbank messaging system should have been a wake-up call for banking executives, but it's unclear how many of them answered it. Is it too late for them to shore up their defenses?

June 1 -

While existing state laws show that payday lending curbs lead to positive outcomes, those laws will still benefit from a strong Consumer Financial Protection Bureau rule.

June 1

-

The Federal Reserve detected more than 50 breaches of its computer systems from 2011 to 2015, Reuters reported, adding to signs that the central bank may be vulnerable to hackers or spies.

June 1 -

Ties to the energy sector hurt the banking industry in the first quarter as earnings fell 1.9% to $39.1 billion compared with a year earlier, the Federal Deposit Insurance Corp. said Wednesday.

June 1