-

Policymakers signaled more reductions lie ahead, a development that could curb lenders' net interest income in the near term but support economic growth and credit quality.

September 18 -

Only two de novo banks have opened in 2024, while more than 100 launched annually prior to the 2008 financial crisis. Experts don't agree on how to solve the problem.

September 18 -

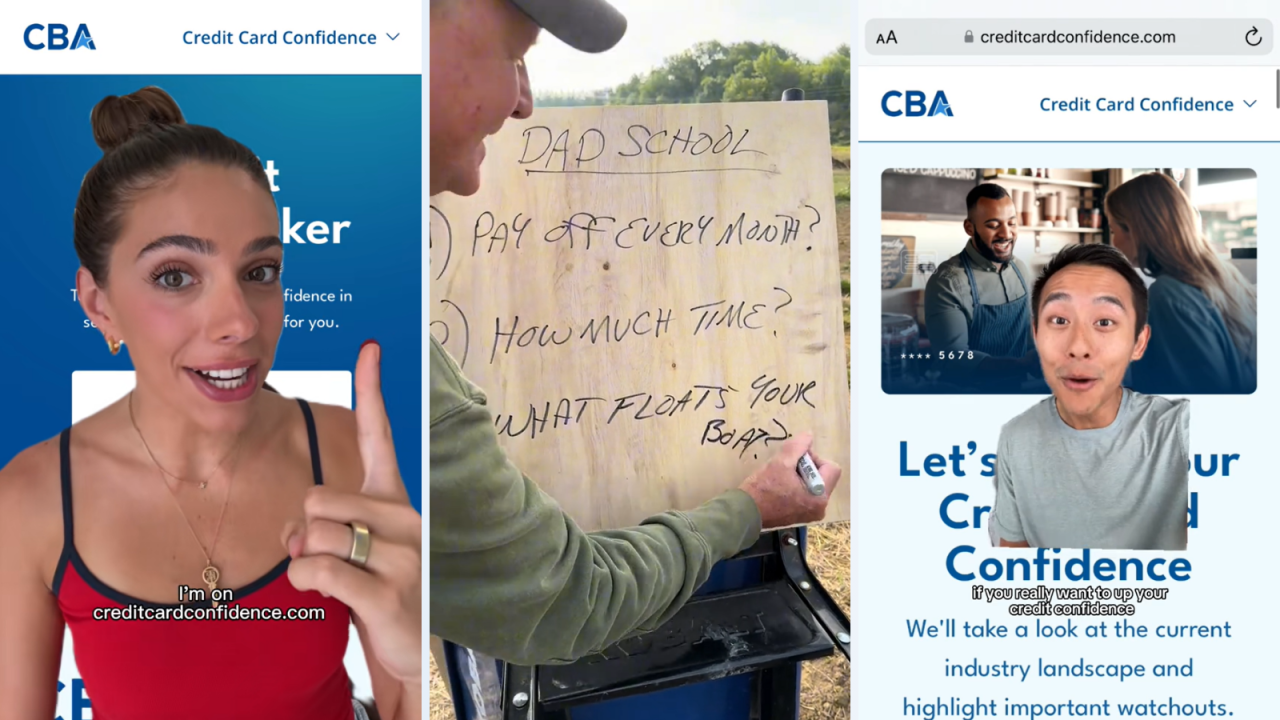

The Consumer Bankers Association launched its first campaign using social media influencers to promote credit card education, experimenting with a mix of personalities and refraining from specific card recommendations.

September 18 -

As the commercial real estate industry sputters along, lenders, investors and analysts are putting less stock in loan-to-value ratios, a longtime bellwether of risk.

September 17 -

CEO Colin Walsh believes his company is positioned to benefit from consumers that prize the convenience of technology opting for the safety of a "real bank."

September 17 -

The Consumer Financial Protection Bureau issued guidance reminding banks that they must be able to prove that consumers have opted in to overdraft services in order to charge overdraft fees.

September 17 -

Donald Felix, who has previously worked at JPMorgan Chase and Citi, will become Carver's president and CEO on Nov. 1. He succeeds interim CEO Craig MacKay, who's been running the unprofitable bank for the past year.

September 17 -

The Federal Deposit Insurance Corp.'s proposed rule aims to improve record keeping for custodial accounts, while the merger policy would increase regulatory scrutiny for combinations involving the largest banks.

September 17 -

The New York community bank cited the contribution of BaaS to its core financial results, evolving regulatory expectations, and the cost of talent and technology needed to scale as factors in this decision.

September 17 -

St. Mary's Bank in New Hampshire tries to serve members as it has for 116 years, while dealing with today's cybersecurity and fraud concerns.

September 16