Beth Mooney, KeyCorp

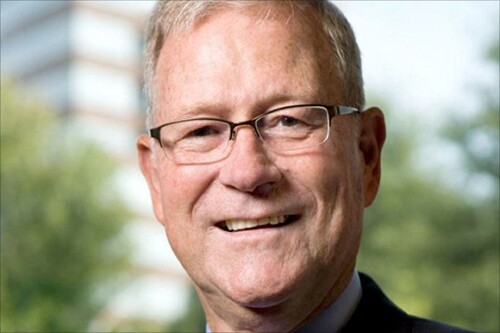

Greg Carmichael, Fifth Third Bancorp

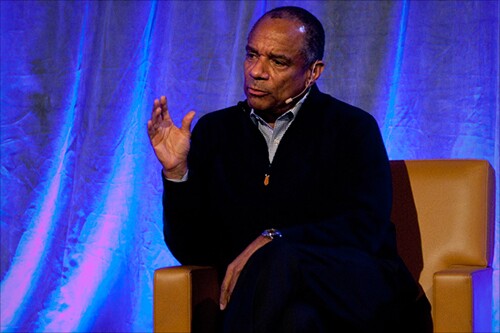

Kenneth Chenault, American Express

Ellen Alemany, CIT Group

Alemany's primary job will be leading CIT's transition from specialty lender to mainstream commercial bank. That means shedding noncore assets CIT recently put its commercial air business, as well as lending operations in China and Canada up for sale and increasing CIT's focus on middle-market and small-business customers in the U.S. It's a tall order, but Vice Admiral John Ryan, CIT's lead director, has great confidence in Alemany's ability to execute. "As an experienced and well-respected leader in the commercial banking sector, she is well-suited to assume these responsibilities and lead CIT forward," he said.

Jeffrey Brown, Diane Morais, Ally Financial

Craig Dahl, TCF Financial

Phillip Green, Cullen/Frost Bankers

Niti Badarinath, BMO Financial

Gene Taylor, Capital Bank Financial