Deposits: The hottest topic in 2Q

Corporate deposits are on the move

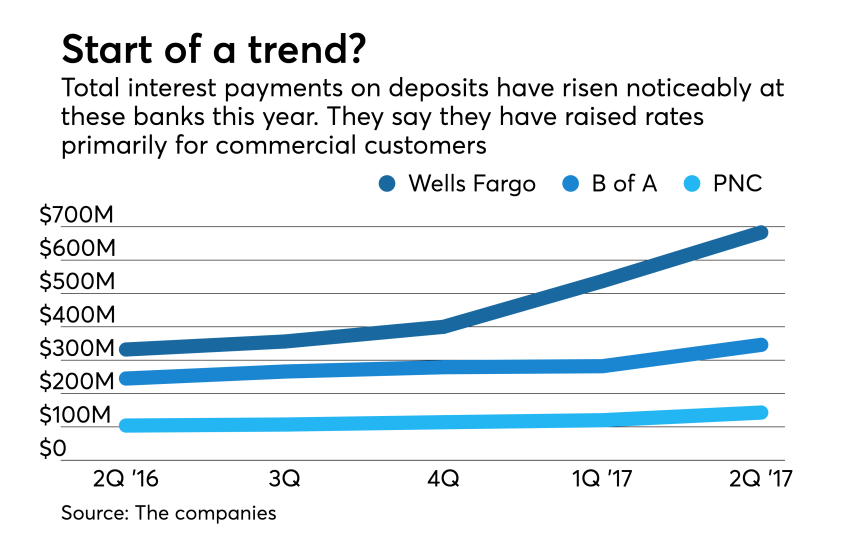

During the second quarter, Wells Fargo paid $683 million in interest on deposits, more than double its outlay from a year earlier. The San Francisco company has "implemented some incremental commercial deposit pricing in line with the market," Chief Financial Officer John Shrewsberry told analysts.

Deposit prices on the consumer side, however, have remained mostly flat industrywide.

"It's a tale of two cities," said Marianne Lake, chief financial officer at JPMorgan Chase during the company's call last week.

Smaller banks have started paying up

"We've held off for a long time, but the demand is now that we need deposits," CEO Ed Wehmer said. "So we're going to start paying up a little bit, as I reference, and try to do it on a spot basis."

What's the magic number for consumer deposit rates?

Deposit prices on standard checking and savings accounts have remained low, even as the Federal Reserve has hiked short-term rates to around 1% through four 25-basis-point rate hikes over the past two years.

So far the increases haven't been a strong enough incentive for consumers to chase higher yields, but bankers say they are watching the market closely.

"I think when rates start to get at 2%, consumers may begin to change their preferences and start to take the extra effort to move some money around," said Kevin Blair, chief financial officer at Synovus.

Banks bracing for the unwinding of the Fed balance sheet

"We've never had QE like this before, and we've never had unwinding like this before,"

But during second-quarter calls, national and regional bank executives projected an image of calm. Speaking to analysts, U.S. Bancorp Chief Financial Officer Terry Dolan said that the Fed has been transparent about its plans, and that he expects the pace of redemptions to be gradual.

"I think that will cause any impacts of it to be very manageable on the banking industry, and as the market adjusts," Dolan said.

Still, bankers cautioned that the Fed's move could result in a reduction in commercial deposits over time as institutional clients step up their purchase of Treasury securities.

Going big on mobile deposits

The transition to mobile among B of A's customer base will help the company save money over time, according to Moynihan.

"That's equivalent of what a thousand financial centers do," Moynihan said. "That's important for client satisfaction. It is also important because those cost one-tenth of what it costs to do it over the counter."

Draw-down in commercial deposits is a sign of future loan growth

It's often viewed as a precursor for loan growth. The theory is that clients are using their cash on hand to cover the cost of growth — and that credit line utilization, or demand for a commercial term loan, could be just around the corner.

"We believe that a lot of that reduction is an indicator that middle-market customers are using their excess deposits to invest in their business," said Ralph Babb, CEO at the Dallas-based Comerica.

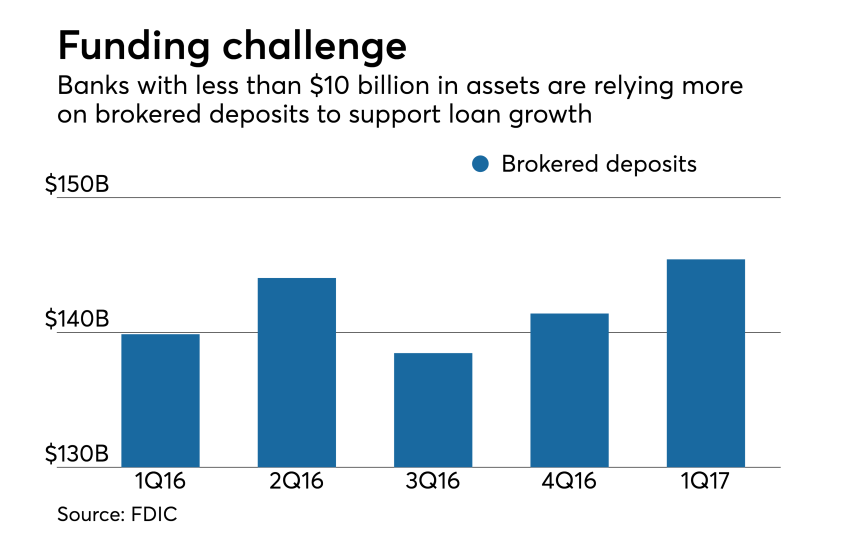

Brokered deposit worries

Community banks have been increasingly turning to brokered deposits in recent months. Such deposits topped $145 billion in the first quarter — their highest level in more than five years.

Banks that use brokered deposits to accelerate commercial real estate lending, for instance, should expect additional scrutiny in the months ahead.

"Liquidity risk is generally increasing for these institutions," George French, the FDIC's deputy director of risk management, said during a July 12 advisory committee meeting on community banking.