The year in fintech exits

Companies in the first phase focus more on revenue than on profit, as they race to build market share, and to position themselves to become one of a select few consolidators.

While the ebullient digital currency business is still in the first stage, other parts of the U.S. financial technology sector, including the online lending industry, have moved on to the second.

The industry’s maturation is illustrated in data from KPMG, which publishes a quarterly report on fintech investment.

KPMG found that 2015 was the peak year for venture capital investment in U.S. fintech firms, with roughly $7.5 billion having been invested that year. More recently, many early-stage investors have been looking to cash out.

Ideally that happens via an initial public offering or in a splashy acquisition by a bigger firm. In other cases, the rush to the exit is less graceful, as startups close up shop or sell themselves at sharply discounted prices.

Exit activity in the U.S. fintech sector will keep rising, KPMG predicts.

“Fintech M&A is set to continue as startups realize that in order to manage complex regulatory requirements and achieve scale, they need to partner with or be acquired by incumbents,” Anthony Rjeily, fintech practice lead for KPMG in the U.S., said in the firm’s most recent report.

What follows is a look at some of 2017’s more prominent fintech exits. The list includes both online lenders and mobile banking apps.

Swift Financial

Swift Financial offered small-business credit, and its employees have now joined PayPal's business financial solutions unit, which has extended more than $3 billion in funding to more than 115,000 small businesses.

The San Jose, Calif.-based payments giant has said that it plans to fully integrate Swift into PayPal by next fall.

Earnest

The deal, announced in October, was viewed as a disappointment because San Francisco-based Earnest had reportedly been valued two years earlier at around $375 million.

Earnest offers personal loans and refinanced student loans, and it continues to operate as a standalone brand. Navient CEO Jack Remondi has said that the Wilmington, Del.-based company, which separated from SLM Corp. in 2014, wants to become a big player in the student loan refinancing business.

Pave

At the time, Pave CEO Oren Bass (pictured) attributed the company's troubles to difficulties in accessing debt capital at affordable rates.

The online consumer lender had been through a few different incarnations. It was founded in 2012 as a way to invest in a share of the future earnings of young adults who needed immediate cash.

Two years later, Pave restructured as a marketplace lender, while still focusing on millennials in need of money. Later, the company became something more akin to a balance-sheet lender.

Bond Street

The four-year-old company had offered one-year to three-year term loans to small businesses. But it

A number of Bond Street employees, including CEO David Haber, were hired by Goldman Sachs. The fabled New York investment bank has been building its own online lending business, which is known as Marcus.

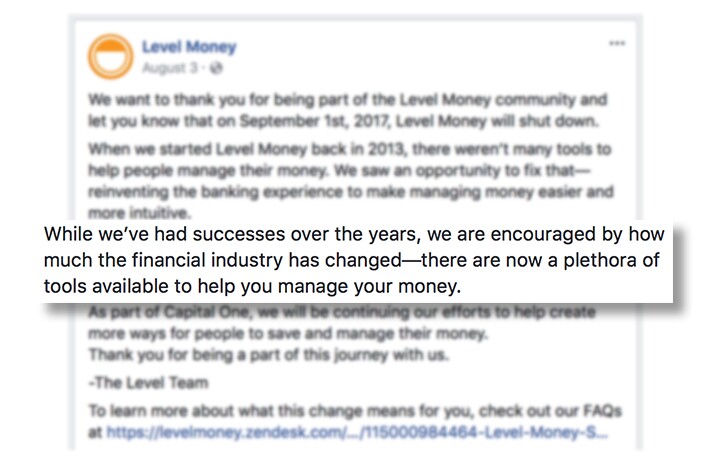

Level Money

One example is Level Money, the maker of a personal financial management app that was bought by Capital One Financial in 2015.

Before it was shut down, the four-year-old app faced new competition from the likes of Digit and Clarity Money.

"While we've had successes over the years," the managers of Level Money wrote over the summer in a blog post, "we are encouraged by how much the financial industry has changed. There are now a plethora of tools available to help you manage your money."

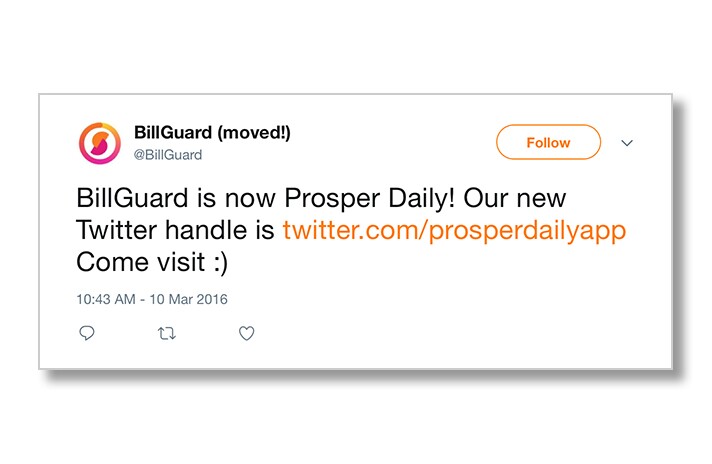

BillGuard

San Francisco-based Prosper initially envisioned BillGuard as a lynchpin in its efforts to build a broader relationship with the consumers who use its loans. The app, which provided identity protection and also allowed users to monitor their credit scores, was relaunched as Prosper Daily in 2016.

Prosper, which has lost $210 million over the last two years,

Zenbanx

Zenbanx was started in 2012 by Arkadi Kuhlmann (pictured), the onetime founder of the online bank ING Direct. The app allowed users to transfer money quickly between nine currencies, including the dollar, the euro and the Japanese yen.

SoFi, an online consumer lender,

But SoFi has proceeded down that track in fits and starts — first pulling the plug on Zenbanx, and later withdrawing its application for a banking charter after CEO Mike Cagney left the company amid scandal.

SoFi's interim CEO, Tom Hutton, said last month in a letter to investors that the San Francisco-based company still plans to offer deposit accounts, debit cards and credit cards by early next year.