How Wells Fargo is exploring the future of digital banking

(Full story

Citizens makes big mortgage move with $500M acquisition

(Full story

Has Amex found a data gold mine with its rewards blockchain?

(Full story

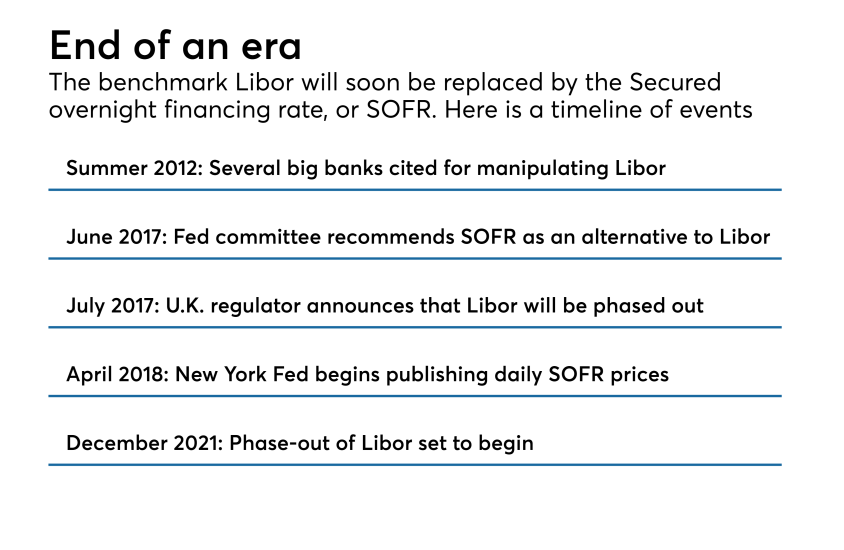

Uneasy transition: Banks prepare for Libor's demise

(Full story

Facing up to bias in facial recognition

(Full story

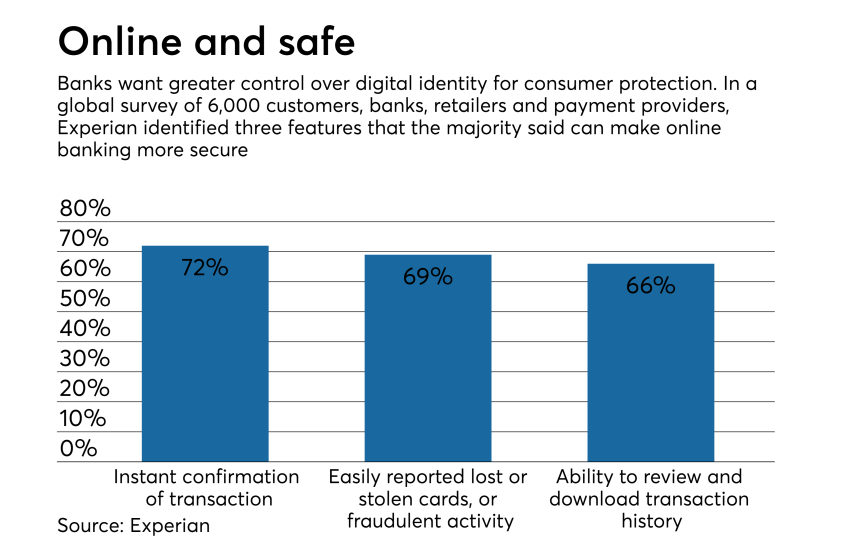

How Capital One sees digital identity as a business opportunity

(Full story

CFPB's Mulvaney plots HMDA rollback, but it may not matter

(Full story

Sloan addresses Wells Fargo's AML snafu, but big questions remain

(Full story

No, regulators did not gut the Volcker Rule

(Full story

CFPB looking to hop on fintech sandbox bandwagon

(Full story