-

On Dec. 31, 2017. Dollars in thousands, except for average loan amount.

March 26 -

Only North Dakota has its own state-owned bank, but policymakers in other states say more public banks are necessary to fully meet society's needs. Among those who proponents say would benefit the most: small-business owners and legal marijuana suppliers and distributors.

March 25 -

The e-commerce giant is muscling its way into a number of businesses that banks have long dominated.

March 18 -

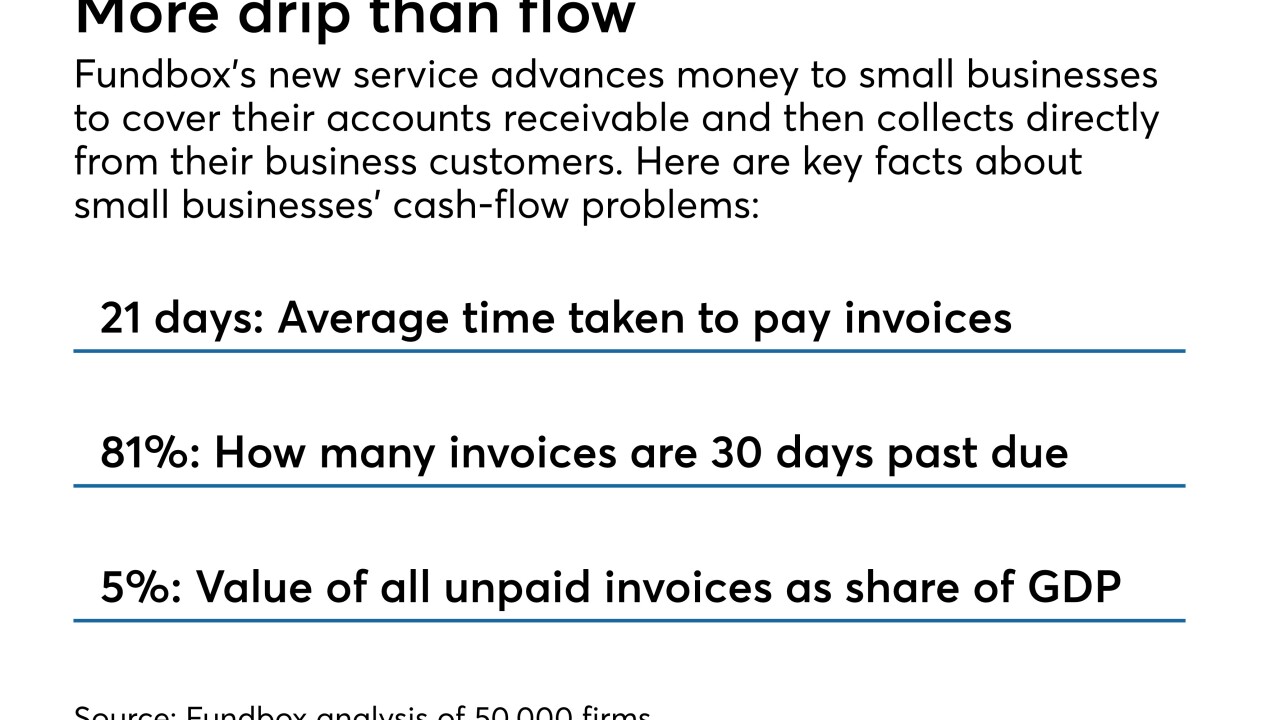

Fundbox is testing a payments and credit network for small businesses and their business clients that may offer an alternative to traditional lenders, credit card issuers and supplier financing.

March 14 -

The online lender is hiring Kenneth Brause, a CIT Group executive, to succeed CFO Howard Katzenberg.

March 13 -

Amazon.com is planning to offer a credit card to U.S. small-business customers, furthering its push to supply companies with everything from reams of paper to factory parts, according to people with knowledge of the matter.

March 12 -

Franklin Synergy and MidFirst both plan to deploy the online lending platform, which according to its creator can render loan decisions in just under three minutes.

March 12 -

Deposit prices are starting to rise, deposit growth is slowing, commercial loan growth remains tepid (with some exceptions) and concerns are mounting about the economic toll of U.S. trade policy, bank executives said just a few weeks ahead of the end of the quarter.

March 6 -

The Charlotte, N.C., company will open 500 new branches and hire 5,400 employees as it continues to expand in midsize cities across the country.

February 26 -

On Sep. 30, 2017. Dollars in thousands.

February 26 -

Since stepping down as CEO of Webster Bank last month, James Smith has spent much of his time co-chairing a panel tasked with solving his home state’s fiscal and economic woes. Banks, and perhaps even fintechs, could be a part of its comeback story, he says.

February 26 -

A community group has secured a grant from the W.K. Kellogg Foundation to probe banks’ small-business lending practices. It follows a 2017 pilot study in which the group found that white shoppers posing as business owners were three times more likely to be invited for follow-up appointments than their black counterparts and twice as likely to be offered help in completing loan applications.

February 21 -

It’s too soon to gauge the true impact of recent tax cuts on loan demand, but anecdotes from bankers suggest that, after months of stagnation, pipelines are filling up again.

February 14 -

The online small-business lender is enjoying a payoff from its year-old push to cut costs and tighten underwriting standards. It is also set to announce another lending agreement with a major bank this year, its CEO said Tuesday.

February 13 -

Neptune Financial plans to use technology to improve the efficiency in making loans to companies with $10 million to $100 million in annual revenue.

February 13 -

Marquette Bank is proof that community banks don't have to be the fastest or flashiest to compete with online lenders. Instead, the Chicago bank closely mirrored fintech offerings while promoting personal service to set itself apart.

February 8 -

Patriot National in Connecticut planned to build a regional small-business lending operation on its own — until it had a chance to buy a national platform.

February 7 -

Patriot National in Connecticut would become the latest community bank to ramp up small-business lending with its $81 million deal to acquire Hana Financial's much larger SBA lending unit.

February 6 -

Its small, locally owned banks were as decimated after the crisis as in any big city. But community bankers say changes to the economy and their lending practices offer them a shot at challenging the big banks that dominate their market.

February 6 -

Credit standards for commercial loans to medium and large firms showed some signs of easing over the last three months of 2017, even though demand stayed relatively unchanged.

February 5