-

Isabel Casillas Guzman, administrator of the Small Business Administration, wants the agency to get involved in direct lending, a practice that was discontinued during the Clinton administration. Congress has not embraced the idea, to put it mildly.

April 29 -

Republicans on the House and Senate Small Business committees are accusing the SBA of being irresponsible in granting Funding Circle permission to participate in its flagship loan-guarantee program.

April 24 -

The decision to approve the fintech's application to make 7(a) loans came nearly a month after Funding Circle's U.K.-based CEO hinted it is considering a sale of its U.S. operations, alarming some members of Congress.

April 4 -

The Congressional Budget Office report on the Home Loan banks illustrates the ways the nearly 100-year-old system is integral to the U.S. economy, and its benefits for American consumers.

April 1

-

Last year, the Raleigh, N.C.-based Integrated called off a deal to sell itself to MVB Financial after bank stocks took a hit in the aftermath of the regional bank failures. Capital hopes to expand its government-guaranteed lending with the transaction.

March 28 -

The banking giant has launched an online platform that links small-business owners and entrepreneurs in need of capital to community development financial institutions. The platform was developed in partnership with Community Reinvestment Fund USA.

March 27 -

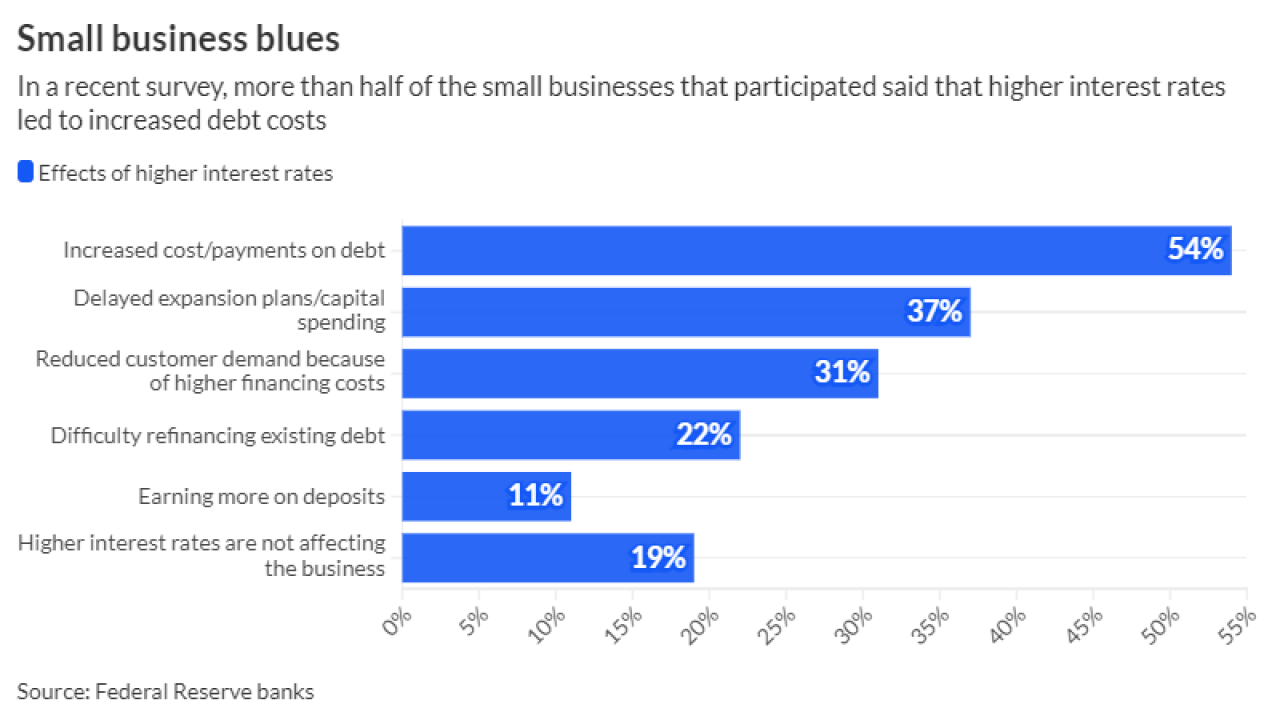

Some 54% of small businesses said in a recent survey that elevated rates had led to higher debt payments. And in a sign that loan demand remains soft, 37% reported delaying expansion plans or capital spending.

March 18 -

The agency had intended to block access to tax data by most lenders on June 30 as part of a policy change that sought to protect taxpayer privacy. But drew broad opposition from the financial services industry.

March 12 -

Data as of Dec. 31, 2023. Dollars in thousands.

March 7 -

The proposed implementing rule will squeeze credit for entrepreneurs and small businesses, adding more barriers to their success in an already-tight lending environment.

February 15 Ethel’s Baking Co.

Ethel’s Baking Co. -

Experts predict the number of small businesses turning to an employee-ownership model will accelerate in the coming years. The would mean opportunities for banks that advise on such transitions.

January 30 -

The Senate on Wednesday fell short of the two-thirds majority needed to override President Biden's veto in December of a Republican-led resolution to gut the small-business data collection rule using the Congressional Review Act.

January 11 -

The agency plans to restrict access to a system that provides borrower tax returns to mortgage lenders beginning June 30. Left out of the loop, small-business lenders say getting credit to borrowers will become more difficult as a result.

January 10 -

The legislation is the latest step in California's effort to crack down on high-cost small-business loans.

January 8 -

Many banks, especially smaller ones, will have to rethink how they lend to small businesses and automate manual processes.

December 20 -

The Fed's Basel endgame draft rule would restrict access to capital and credit on Main Street.

December 18 Alabama

Alabama -

Banks are perfectly willing to comply with a reasonable data collection standard. The problem is that the Consumer Financial Protection Bureau's final rule makes demands far in excess of what the law requires.

December 15 Consumer Bankers Association

Consumer Bankers Association -

The passage of a Congressional Review Act resolution to rescind the Consumer Financial Protection Bureau's small-business data collection rule may be only symbolic, but the rule is designed to detect and stop discrimination — something everyone should support.

December 5 American Banker

American Banker -

Rep. Maxine Waters pressed executives from City National Bank, PNC Financial Services and Wells Fargo on opening branches in her California district and upholding promises made from recent merger agreements or consent orders.

December 3 -

Republicans and a handful of Democrats in the House and Senate, which already had passed an identical bill, say the data-collection rule would be too onerous for lenders and small-business borrowers. President Biden is expected to veto the legislation.

December 1

![DSC_0142[1].JPG](https://arizent.brightspotcdn.com/dims4/default/4315a9c/2147483647/strip/true/crop/6000x3375+0+454/resize/1280x720!/quality/90/?url=https%3A%2F%2Fsource-media-brightspot.s3.us-east-1.amazonaws.com%2F2c%2F3e%2F785d353e4320a75ce6e3f29895a2%2Fdsc-01421.JPG)