-

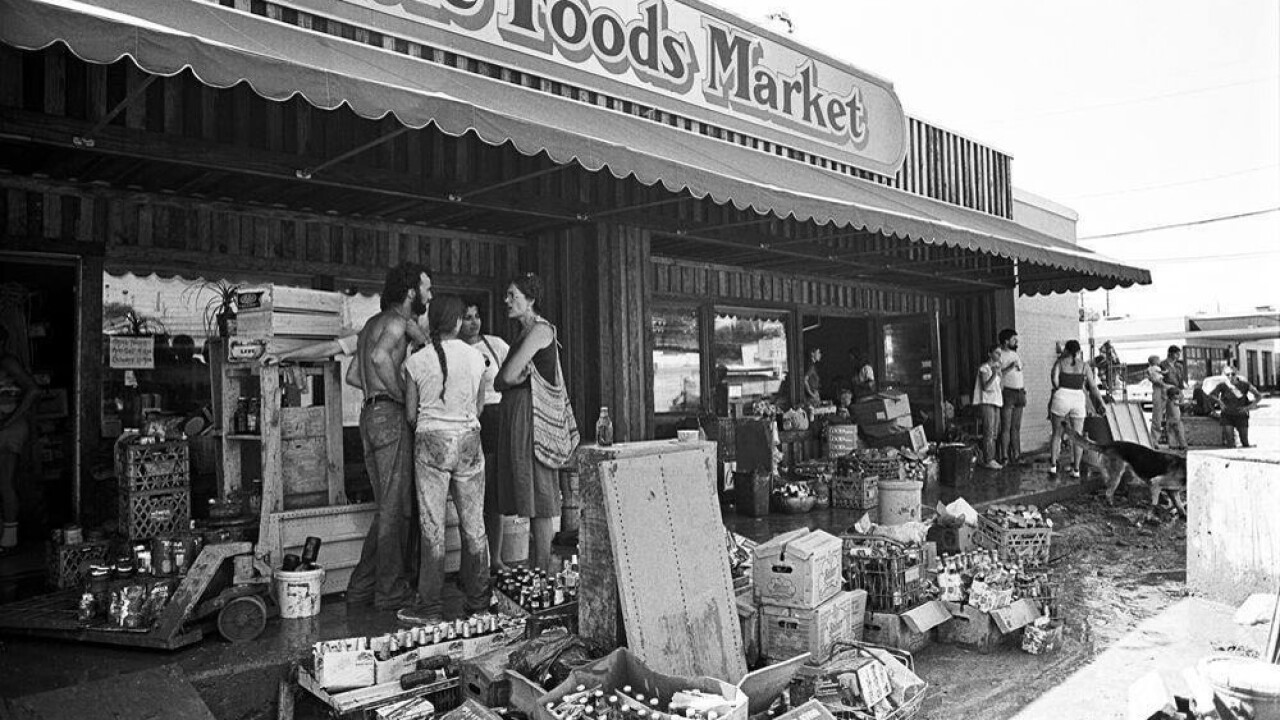

Former employees of the Austin-based City National Bank still recall the 1981 flood that deluged the city and Whole Foods, and they take pride in the lender's role in rescuing what was then a fledgling health food store.

July 3 -

Funding Circle US fought to win a coveted license to make SBA 7(a) loans only to see its London-based parent company agree to a sale before it could make its first government-guaranteed loan

June 25 -

The Consumer Financial Protection Bureau extended the deadline for lenders with the highest volume of small-business loans to July 18, 2025, and will not assess penalties for reporting errors for a year.

June 25 -

The Canadian institution will offer cross-border banking services, financing, wealth management and more with its new TD Innovation Partners platform.

June 18 -

Rather than fueling uncertainty, the Consumer Financial Protection Bureau should be devising strategies that facilitate clearer policies that bring more certainty to lending markets.

June 6

-

While the $800 billion in PPP loans has largely self-liquidated through the forgiveness process, SBA continues to service the longer-duration EIDL portfolio and will likely be doing so for years to come after opting to hold on to the loans.

May 22 -

The small business lender's bankrupt shell has agreed to pay up to $120 million in connection with allegations that its verification processes for Paycheck Protection Program loan applications were faulty. The government argued that Kabbage reaped larger fees by enabling fraudulently inflated loans.

May 14 -

Bank stocks are up this year as interest rates have leveled off and there are hopes that pressure on lenders' profits could moderate.

May 8 -

Banks maintain lists of consulting firms that they trust to help troubled commercial borrowers to fix their businesses. These specialists say they're getting more calls, especially in areas such as multifamily and CRE, from business owners who need help.

May 2 -

Isabel Casillas Guzman, administrator of the Small Business Administration, wants the agency to get involved in direct lending, a practice that was discontinued during the Clinton administration. Congress has not embraced the idea, to put it mildly.

April 29 -

Republicans on the House and Senate Small Business committees are accusing the SBA of being irresponsible in granting Funding Circle permission to participate in its flagship loan-guarantee program.

April 24 -

The decision to approve the fintech's application to make 7(a) loans came nearly a month after Funding Circle's U.K.-based CEO hinted it is considering a sale of its U.S. operations, alarming some members of Congress.

April 4 -

The Congressional Budget Office report on the Home Loan banks illustrates the ways the nearly 100-year-old system is integral to the U.S. economy, and its benefits for American consumers.

April 1

-

Last year, the Raleigh, N.C.-based Integrated called off a deal to sell itself to MVB Financial after bank stocks took a hit in the aftermath of the regional bank failures. Capital hopes to expand its government-guaranteed lending with the transaction.

March 28 -

The banking giant has launched an online platform that links small-business owners and entrepreneurs in need of capital to community development financial institutions. The platform was developed in partnership with Community Reinvestment Fund USA.

March 27 -

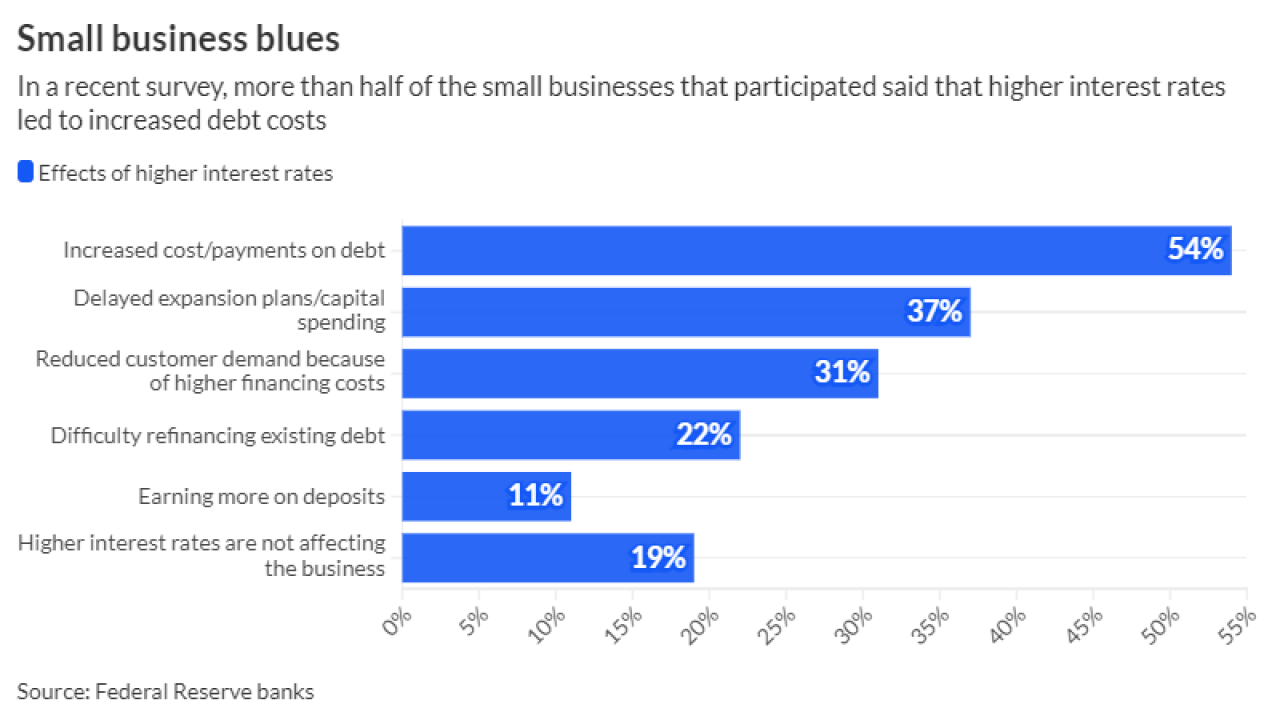

Some 54% of small businesses said in a recent survey that elevated rates had led to higher debt payments. And in a sign that loan demand remains soft, 37% reported delaying expansion plans or capital spending.

March 18 -

The agency had intended to block access to tax data by most lenders on June 30 as part of a policy change that sought to protect taxpayer privacy. But drew broad opposition from the financial services industry.

March 12 -

Data as of Dec. 31, 2023. Dollars in thousands.

March 7 -

The proposed implementing rule will squeeze credit for entrepreneurs and small businesses, adding more barriers to their success in an already-tight lending environment.

February 15 Ethel’s Baking Co.

Ethel’s Baking Co. -

Experts predict the number of small businesses turning to an employee-ownership model will accelerate in the coming years. The would mean opportunities for banks that advise on such transitions.

January 30

![DSC_0142[1].JPG](https://arizent.brightspotcdn.com/dims4/default/4315a9c/2147483647/strip/true/crop/6000x3375+0+454/resize/1280x720!/quality/90/?url=https%3A%2F%2Fsource-media-brightspot.s3.us-east-1.amazonaws.com%2F2c%2F3e%2F785d353e4320a75ce6e3f29895a2%2Fdsc-01421.JPG)