-

Bank merger and acquisition activity rebounded this year, led by Fifth Third's $10.9 billion proposed purchase of Comerica. Huntington, PNC and Columbia were involved in some of the other biggest deals announced in 2025.

December 26 -

Articles about stablecoins, scams, fintechs, premium credit cards and open banking were just some of the topics that struck a chord with American Banker subscribers in 2025.

December 26 -

From credit bureaus to software providers, 2025 saw attackers bypass bank defenses by targeting the supply chain and using social engineering.

December 26 -

Banks are beginning to engage with decentralized financial infrastructure. But until lawmakers create a foundation for allowing legally recognized entities like LLCs and nonprofits to govern these networks, compliance burdens will hinder full adoption.

December 26

-

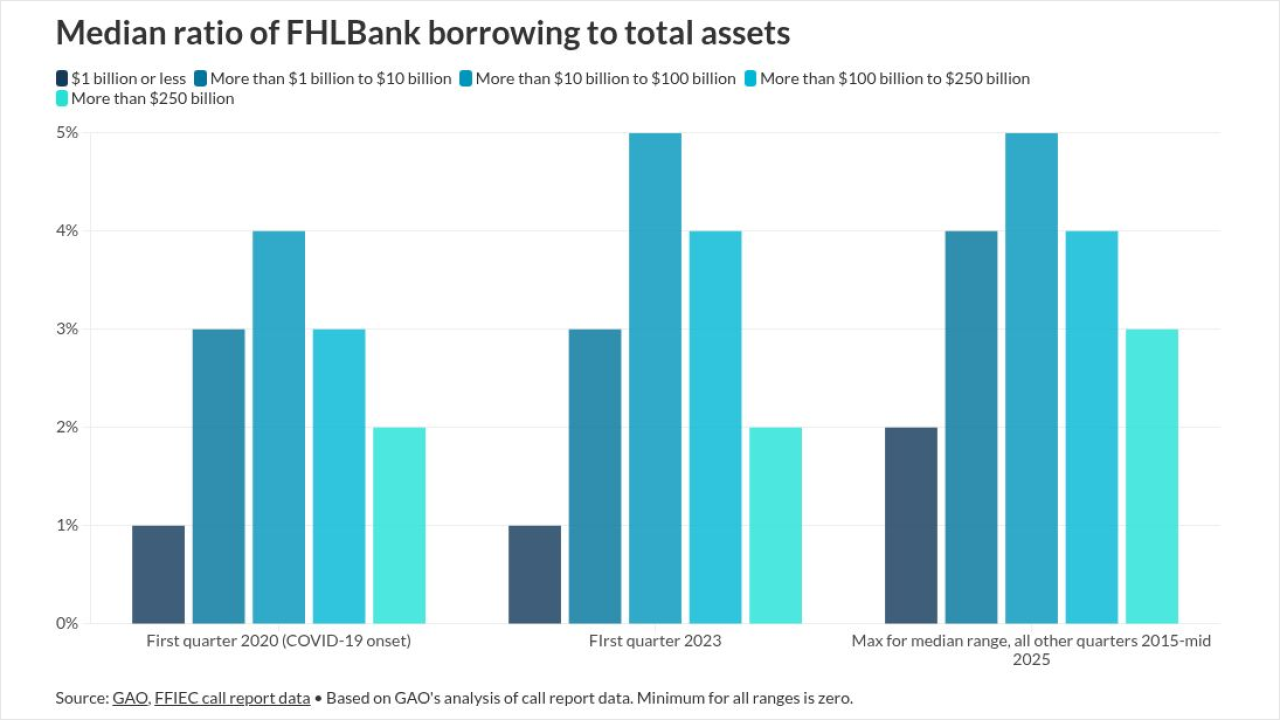

Fewer than 1% of members reported surges relative to total assets outside the normal range, making Silvergate's experience unusual, according to the GAO.

December 26 -

Banks typically prefer to steer clear of politics. But in 2025, politics would not steer clear of banks

December 25 -

CodeBoxx Academy is filling a void for banks and other companies that desperately need AI experts. Peret's time behind bars uniquely informed how he runs the school, he says.

December 25 -

The Consumer Financial Protection Bureau will face an existential crisis in 2026 between the Trump administration's efforts to shut down the agency and the employee union and consumer advocates who want to stop them.

December 25 -

Monetary policy remains the key to the markets. The Federal Open Market Committee predicts one rate cut in 2026, but the panel will get a lot of data before

-

The Federal Deposit Insurance Corp. has made big changes in 2025, including cutting headcount, walking back Biden-era rules and guidance and resetting the agency's approach to emerging technologies and crypto.

December 24 -

The Treasury Department issued guidance on how merchants can round cash transactions to the nearest nickel. Banks and retailers have been calling for more clarity from the government amid a penny shortage that stems from the Trump administration's abrupt decision to halt production of the one-cent coins.

December 24 -

The bank regulator is proposing to strengthen national preemption in the wake of conflicting decisions in related court cases.

December 24 -

The card network and bank technology seller partnered to expand AI protocols, while British payment companies face tougher fee disclosures but looser rules for contactless transactions. That and more in the American Banker global payments and fintech roundup.

December 24 -

-

-

The former chief national bank examiner for the Office of the Comptroller of the Currency sees welcome changes in the structure of federal banking supervision, but warns against the dangers of complacency.

December 24

-

Cockroaches, crazy work and shots in the butt: Here are some of the most quotable bank CEOs of 2025.

December 24 -

-

Michigan State University Federal Credit Union avoided $2.57 million in fraud exposure through blocking AI deepfake fraud calls with Pindrop products.

December 23 -

The bank is betting on demand from resource-challenged companies.

December 23