-

Tom Marano, a former Bear Stearns banker, was apparently well compensated following the housing crisis for heading up ResCap and Ditech, both of which went into bankruptcy.

November 11 -

Gordon Sondland, the U.S. ambassador to the European Union, is often described as a hotelier from the Pacific Northwest. But he has also had a long and sometimes controversial career in finance.

October 18 -

Mission Lane, which was spun off from LendUp in December, said Monday that Shane Holdaway took the helm in August after roughly a year serving as CEO of Barclays' U.S. consumer bank. The upstart lender also announced that it has raised $200 million in equity funding.

September 16 -

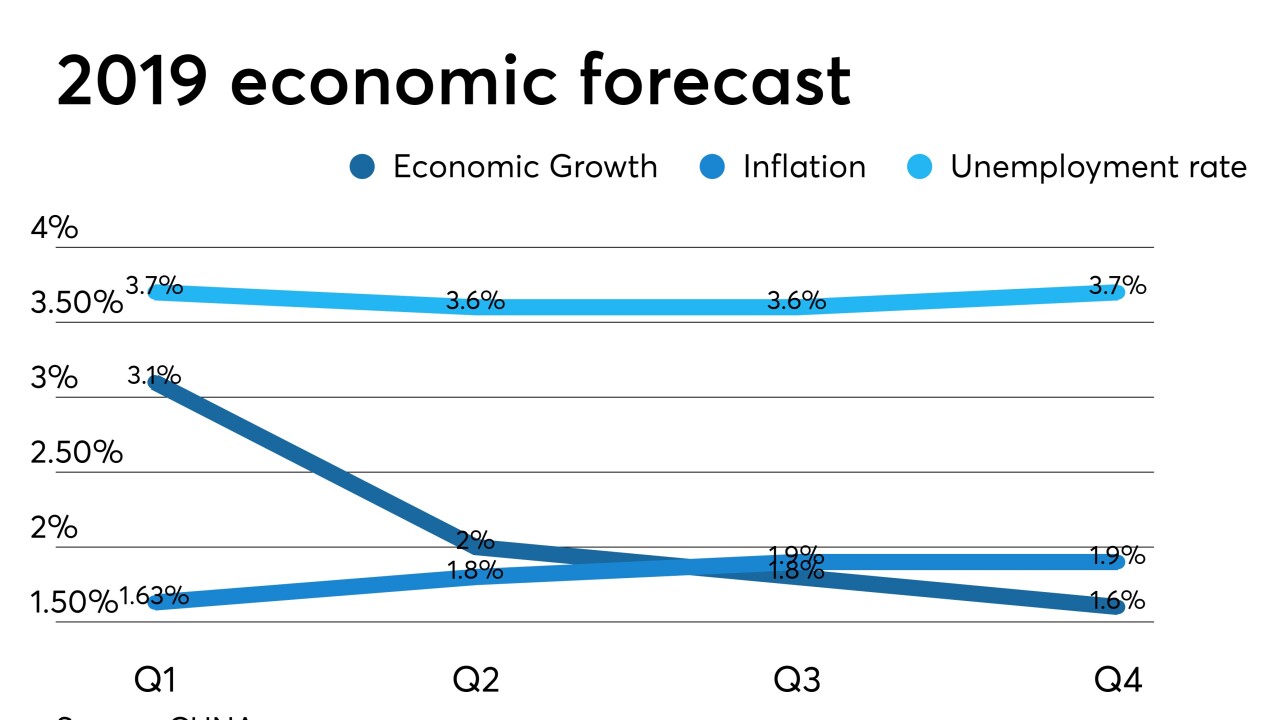

Some industry economists say this yield curve inversion is not as reliable an indicator as it has been for past recessions, but credit unions should still start preparing for an eventual economic downturn.

September 10 -

The FDIC and the OCC relax the rule restricting proprietary trading; home buyers with bad credit, lots of debt, or employment issues are again getting loans.

August 21 -

Sensing a profitable opportunity in an underserved market, a variety of companies — ranging from traditional banks to fintech startups and even Amazon — are rushing into selling secured credit cards and other products designed for consumers with poor or thin credit.

July 9 -

Offering secured credit cards can help a credit union build loyalty with members but this product line can be difficult to successfully manage.

June 26 -

Aura is one of the few fintechs in the nation to have a community development financial institution designation from the Treasury Department.

June 25 -

New York lawmakers took steps to prevent predatory lenders from using the state's court system to seize the assets of small businesses nationwide.

June 21 -

Santander Bank and Santander Consumer USA have put many problems behind them in recent years under CEO Scott Powell, but he still has a Federal Reserve enforcement action to resolve and is negotiating with Fiat Chrysler to preserve a crucial auto lending relationship.

June 3 -

Uber Technologies Inc. is going nationwide with a program that helps those without a car — or the financial means to get one — drive for the ride-hailing giant.

May 30 -

Borrowers with poor credit make up less than 15% of the industry's total auto loan portfolio. That has shielded CUs from some delinquency issues, but some say it raises questions about whether the movement is reaching the consumers it was chartered to serve.

May 28 -

The Federal Trade Commission accused the online lender of numerous violations in connection with its loan servicing practices. In one example, Avant allegedly informed customers that they could make payments by credit card or debit card but then refused to accept such payments.

April 15 -

Seven years after James Gutierrez left Oportun Financial and started a competitor, the acrimony sparked by the divorce is coming into public view.

March 14 -

Credit unions haven't dipped into subprime lending as much as other lenders, which has helped protect the industry – but there could still be major speed bumps ahead.

March 4 -

New research from the New York Fed found that banks with more than $50 billion of assets originate more subprime car loans than small banks and credit unions do.

February 12 -

Bankers weigh their options in mortgage and CRE lending as implementation of a new accounting standard nears.

February 4 -

Executives from Ally Financial and Santander Consumer USA gave rosy outlooks about 2019 consumer trends, while other banks that rely less heavily on car lending offered more cautious appraisals.

February 1 -

The subprime online lender said Thursday that it will spin off its credit card business into a new entity, Mission Lane. It also named a new CEO to replace its founder, Sasha Orloff.

January 10 -

The agency alleges the subprime auto lender violated consumer finance laws by misrepresenting the level of guaranteed insurance protection.

November 20