-

Square Inc. reported earnings that exceeded analysts’ expectations and raised its full-year forecast, bolstered by larger merchants that are increasingly using its platform for payment transactions and buying business software services.

November 8 -

In the crowded small-business payment technology market, Fattmerchant is taking a different approach to revenue.

October 26 -

Online sales and software development are two of the most dynamic categories in the payments processing market, and First Data's acquisition of BluePay will give it inroads into both.

October 20 -

By turning itself into a pseudo payment facilitator as part of a new program, Elavon says it is in a better position to grow by offering services in a fast-growing sector.

October 18 -

JPMorgan Chase has made several investments in financial technology startups, but its plan to buy WePay will give its 4 million small-business clients a much more direct way to adopt digital payments.

October 17 -

While the EMV fraud liability shift for most companies passed nearly two years ago, there are still pockets of stores that haven't switched over — and they can be particularly prone to the kind of fraud chip cards are designed to thwart.

September 13 -

Online payments and services provider Secure Trading will partner with payments marketplace COMO Global S.A. to make its gateway and acquiring services available to more providers and merchants worldwide.

September 5 -

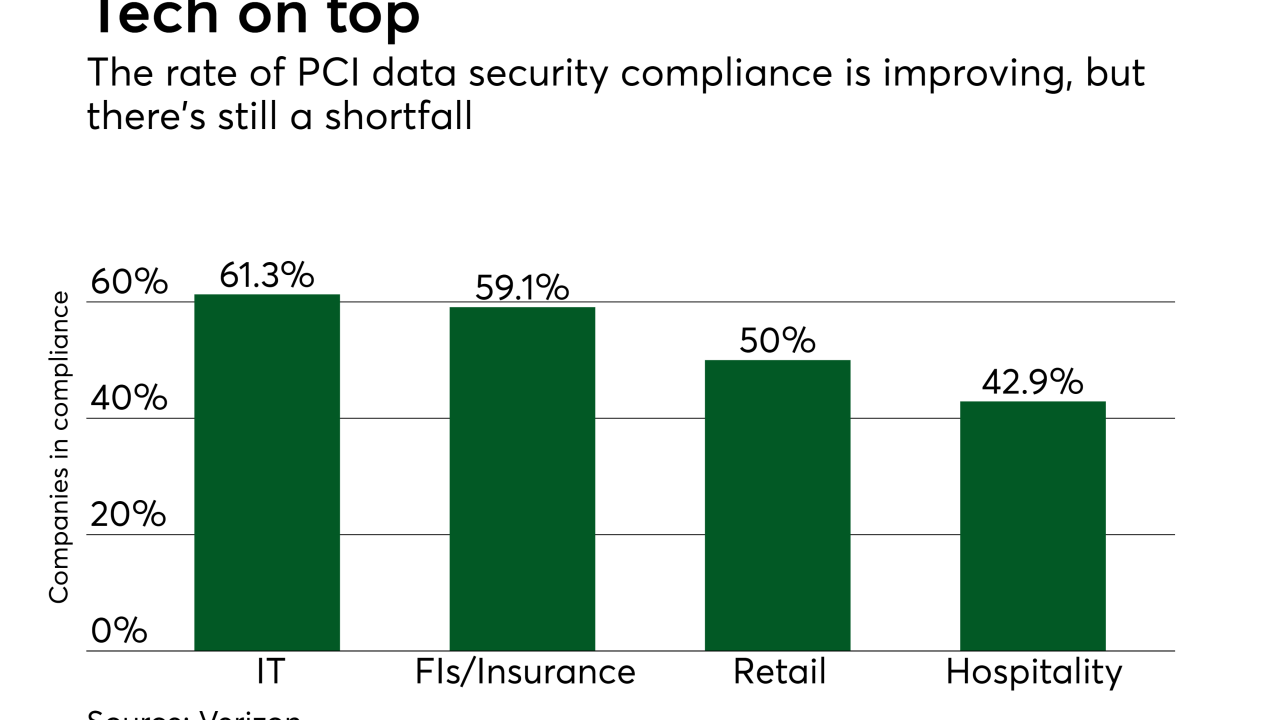

Compliance is improving, but more than 40% of companies still have work to do, according to a new Verizon report.

August 31 -

Using good, old-fashioned customer service and consultation to cut down on merchant attrition has been part of the acquiring playbook for years. But that playbook is long overdue for an update.

August 16 -

Payments processor iPayment Inc. is getting back into the merchant cash advance business.

August 15 -

Revenue growth in its merchant payments business is expected to be tepid in the foreseeable future. The Minneapolis company says it is looking to ramp up innovation to stay competitive in a business that has been upended by fintech firms and online shopping.

July 19 -

Payments services provider Worldline has agreed to acquire the Digital River World Payments unit of Digital River Inc. to bolster its online payments offerings to large merchant clients.

July 17 -

Both Vantiv and JPMorgan have a strong merchant acquiring business in the U.S., while Worldpay has a large market in Europe.

July 4 -

Processors are investing billions of dollars to build huge menus of tools for retailers that may no longer have the time to work with multiple vendors. These transformations are years in the making, and each investment or acquisition has the potential to dramatically change the competitive landscape.

May 30 -

For years, William Shatner plugged Priceline, an online portal to take costs out of travel by pitting hotels and airlines against their rivals. A similar idea is taking shape in the market for payment providers.

May 18 -

Payment and marketing company Harland Clarke Holdings has agreed to buy the popular online coupon site RetailMeNot for an equity value of $630 million, a deal that would add digital discount technology to Harland's existing merchant services.

April 10 -

The U.S. merchant acquirer-processor arena is so mature that the only dramatic gains typically come from consolidation, leading to even more formidable combinations that make the next phase of growth even tougher. But there are also opportunities for companies that know how to specialize.

April 5 -

Philip McHugh, a top-ranking executive with Barclaycard, will join the processor Total System Services Inc. as its senior executive vice president and president of merchant solutions, effective May 1.

January 27 -

Merchant acquirers say the industry has worked over the course of decades to improve its ethics. But some acquirers report that deceptive practices and dubious tactics still exist, and that the card brands could do a better job at enforcing their own rules.

December 21 -

Just weeks after it shook up its executive ranks and suspended efforts to pursue new customers, the New York-based business lender confirmed Friday that it is eliminating dozens of jobs.

December 16