-

On Jun. 30, 2021. Dollars in thousands.

September 7 -

Community banks support legislation that would exempt them from paying tax on interest earned from farmland loans, arguing it would make them more competitive with government-backed lenders and expand access to credit in rural areas.

July 2 -

On Mar. 31, 2021. Dollars in thousands.

June 7 -

Under a plan signed into law in March, the agency will first target direct loans that it has made to socially disadvantaged farmers. Guidance that will affect small banks that have made government-backed agricultural loans is due in 120 days.

May 21 -

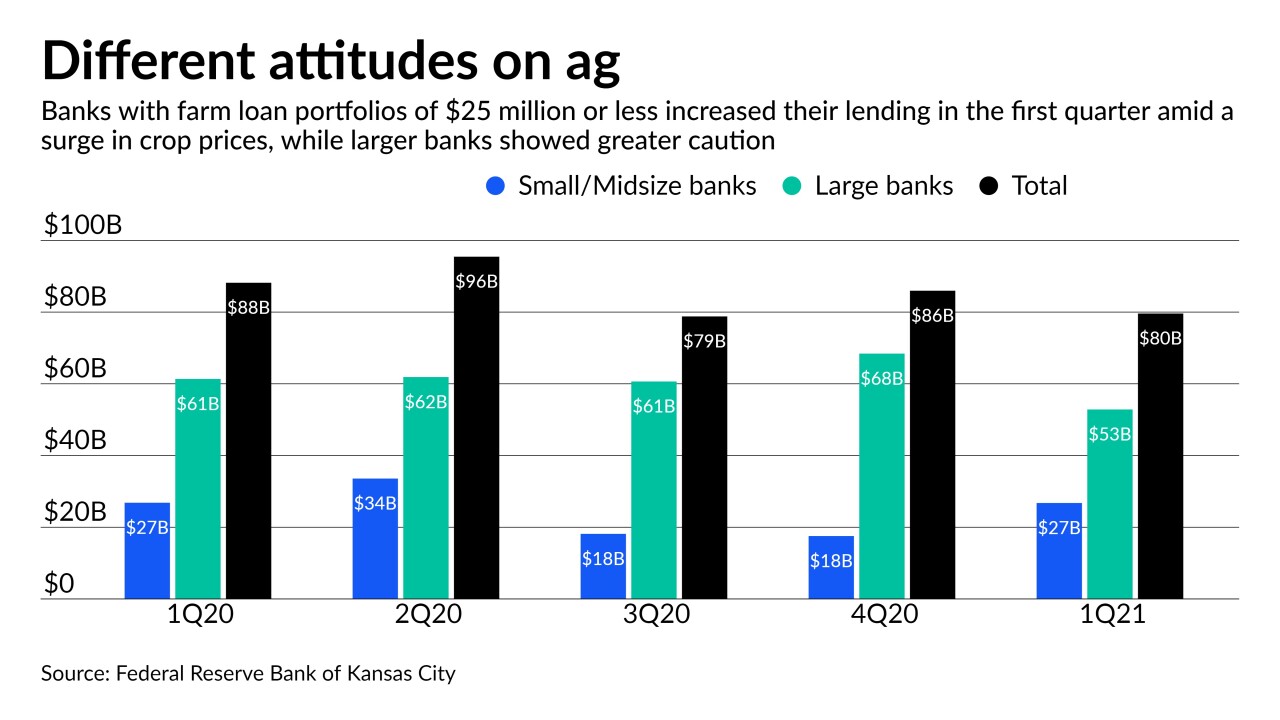

Smaller lenders have proved more aggressive than their larger rivals in making new loans during the farm country rebound. Market watchers warn that the price boom may not last.

May 5 -

On Dec. 31, 2020. Dollars in thousands.

March 8 -

A rule change that allows farms with just one employee tap the Paycheck Protection Program means more pandemic relief funds are flowing into such states as Nebraska, Oklahoma, Wyoming and North Dakota.

January 29 -

The Amarillo company is buying First National Bank of Tahoka, continuing the industry’s consolidation in the state.

December 14 -

On Sep. 30, 2020. Dollars in thousands.

December 7 -

On Jun. 30, 2020. Dollars in thousands.

September 14 -

Why banks want in on Google checking accounts; readying new tech tools to tackle anticipated rise in delinquencies; more institutions opt to sell PPP loans as heavy lifting nears; and more from this week’s most-read stories.

August 7 -

On Mar. 31, 2020. Dollars in thousands.

June 15 -

On Dec. 31, 2019. Dollars in thousands.

March 23 -

Members of the House Small Business Committee expressed concerns to SBA Administrator Jovita Carranza that the rule could harm poultry farmers.

February 26 -

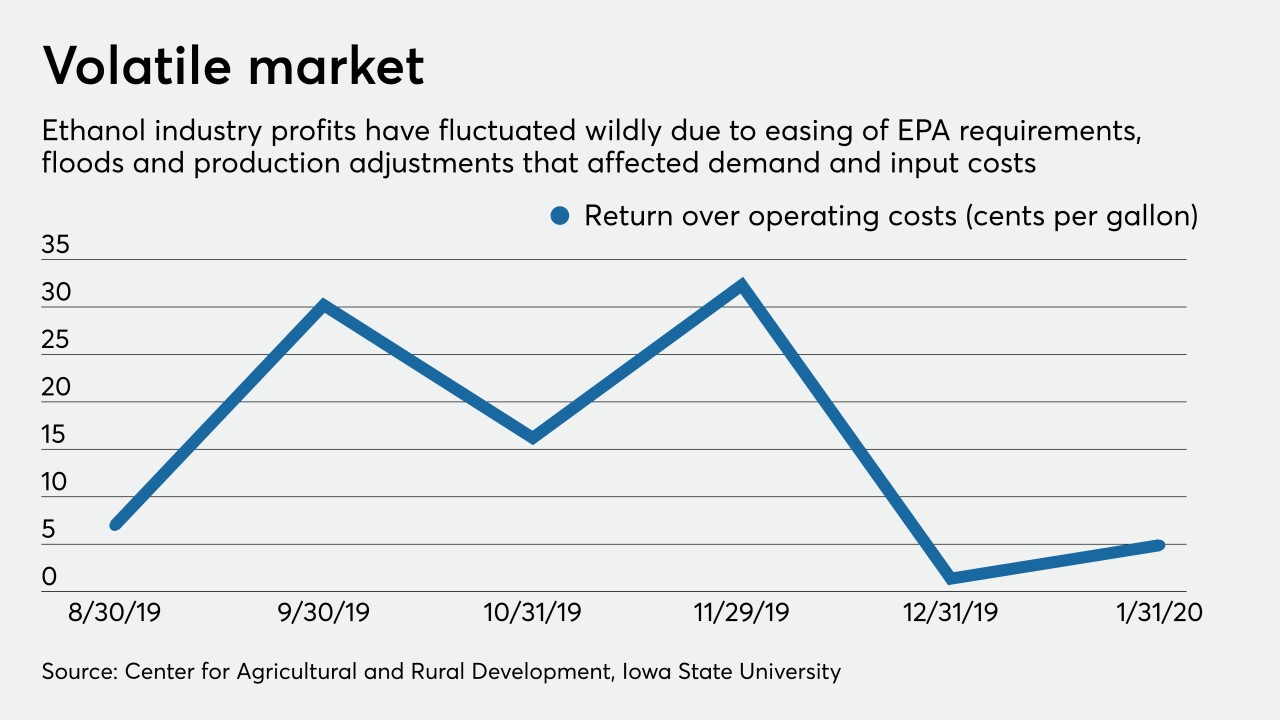

Ag lenders say the Trump administration’s waivers for oil refineries threaten another source of revenue for corn growers and ethanol makers.

February 12 -

Ken Karels will be succeeded by Mark Borrecco, who had been CEO of Rabobank's U.S. bank.

February 11 -

To guard against headwinds in the agricultural sector, the Federal Deposit Insurance Corp. recommended that institutions consider the “overall financial status” of farm loan borrowers.

January 28 -

On Sep. 30, 2019. Dollars in thousands.

December 16 -

The percentage of farm lenders losing money hit a six-year high in the third quarter, according to the FDIC.

December 5 -

So far farm loans are holding up well, but bankers gathered at an industry conference this week said they are growing increasingly concerned that credit quality will weaken if the U.S. and China don’t reach a deal soon.

November 12